by scott.gillum | Aug 5, 2014 | 2014, Sales

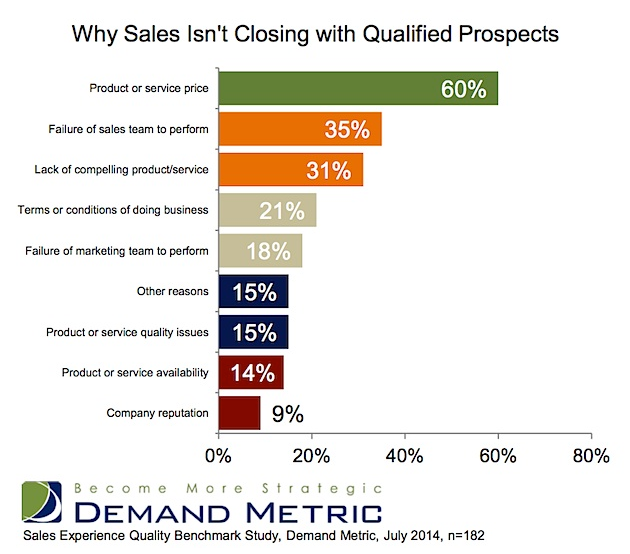

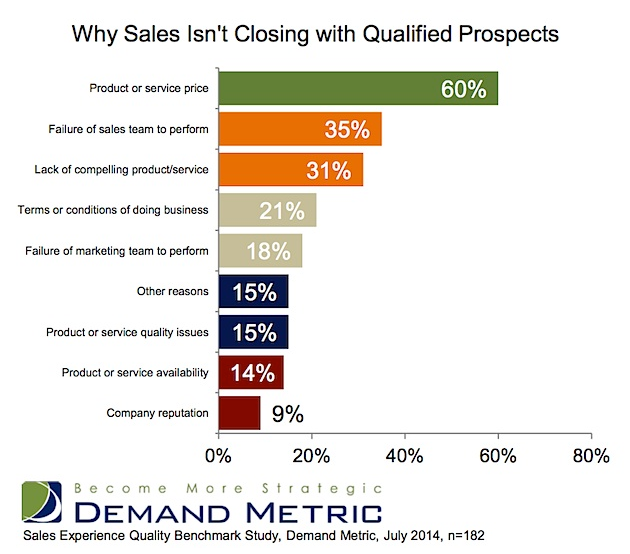

The team killed it. The presentation was flawless. The proposal was outstanding. You covered all of the bases, but you lost. Searching for answers, the only thing you can think of is that the other guy must of “bought the deal,” right? In the article entitled; Why B2B Sales Leads Don’t Convert (and Who Is to Blame) Marketing Profs.com highlights a recent survey of close to 200 marketers, sales professionals, and president/CEOs on their thoughts on why deals were “lost.” Not surprisingly, 60% said that “price” was the main reason, but what may surprise you is that percentage is wrong.

To truly understand why deals are lost, you have to get feedback from buyers. Having conducted numerous post mortem analysis of lost deals, and buyer behavior research, here’s what I have learned. Roughly one third of all buyers consider price as one of, or the main driver of a purchase decision. Pure price buyers represent about 5-10% of all decision makers. The remaining portion (20-25%) are value buyers who may, but don’t always, buy the lowest priced product or service. Using those numbers, the research overstates “price” as the reason for a loss by a factor of 2X. What accounts for the remaining thirty percent? Here are three common reasons for losing a deal, that doesn’t involve price.

- Low investment in the relationship – deals are not solely rationally made purchase transactions, especially as price and product complexity increases. Selling bigger ticket items involves a degree of trust built between a vendor and a buyer. Recent research by Fortune and gyro found that 65% of executives believe subjective factors that can’t be quantified (like a company’s culture and values) make a difference when evaluating competing proposals. Even more executives (70%) said that a company’s reputation was a critical consideration in the decision making process. Investing in relationship building with buyers takes time but as the research shows, it’s worth it. If buyers say that the only time they hear from a rep is when he/she wants to sell them something…that investment is not being made.

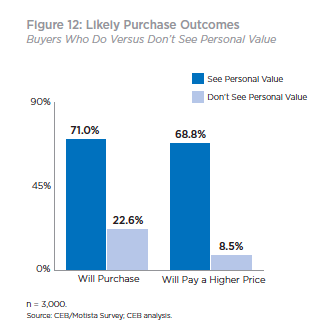

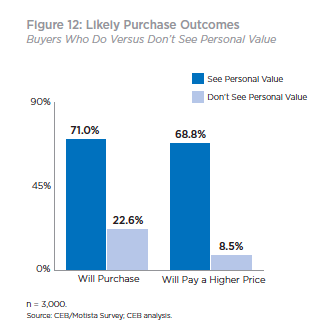

- Focusing on the wrong message – focusing on only selling the business value (functional benefits, business outcomes) of a product limits sales ability to make the case for a higher price. Connecting the value the product delivers to the buyer, on a personal level, helps reps broaden the conversation. According to CEB research, not only are you twice as likely to win the deal by focusing on personal value drivers

(professional and personal benefits, like a promotion, admiration from peers, etc.), but also, buyers are eight times more willing pay a premium. To do this effectively sales people need to be able to put themselves in the shoes of decision mak ers. They need to understand their buyers’ situation, role, relationships, etc., and sell the value of the product or service to those unique needs. If reps only know how to sell “feature functionality” the conversation will all too often come back to price.

(professional and personal benefits, like a promotion, admiration from peers, etc.), but also, buyers are eight times more willing pay a premium. To do this effectively sales people need to be able to put themselves in the shoes of decision mak ers. They need to understand their buyers’ situation, role, relationships, etc., and sell the value of the product or service to those unique needs. If reps only know how to sell “feature functionality” the conversation will all too often come back to price.

- Missing the real buyer – there is no guarantee that past buyers will be key decision makers in future purchase decisions, or on other types of products. Years ago, I did a post mortem analysis for a medical equipment company on an innovative new product. Sales said they were losing deals because it was priced too high. The analysis proved that they were both right, and wrong. The traditional buyer, did in fact, believe that the product was priced too high compared to others in the market. But a new set of users who had become the primary decision makers had emerged. This group was using the innovative technology as a revenue generating procedure. As a result, they valued the product differently and were willing to pay a premium. Deals were lost because the company didn’t understand how buyers intended to use the product, and as a result, they missed the key decision maker.

The simple answer is that deals are lost because the case for the value of the product or service has not been adequately expressed to meet the needs (professional, personal or both) of the key decision maker. Blaming “price” is a convenient crutch that shifts accountability to the product or pricing team, and away from sales and marketing. Finger pointing may make us feel better about our role, but it doesn’t fix the problem. If you are truly intent on increasing win rates dig deeper into understand why, I can guarantee you won’t find that it is “price” 6 out of 10 times.

by scott.gillum | May 12, 2013 | 2013, Sales

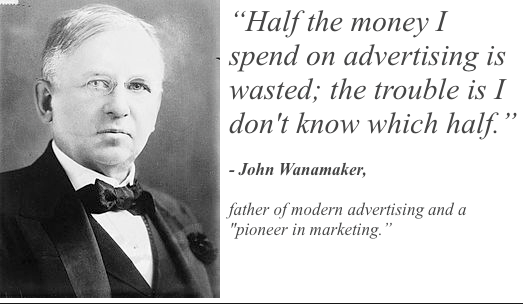

John Wanamaker was an innovator, a merchandising, and advertising genius. But when he made the statement; “Half the money I spend on advertising is wasted, the trouble is wasted, the trouble is I don’t know which half.” He left legacy that has haunted marketers ever since.

New research from CSO Insights suggests that the day may have come for sales. In their annual Sales Performance Optimization study of over 1500 companies across multiple industries, CSO found that the accuracy of sales forecasting fell to a near all-time low of 46.5%. Or as John Wanamaker might say; “Half of your sales efforts are wasted, you just don’t know which half. “

And since the forecast, defined in the study as near-term (30, 60 and 90 day), is an output of the sales pipeline, one could also conclude that half (or more) of the pipeline is “junk.”

With the wide spread adoption and utilization of CRM (84% of the firms surveyed), marketing automation, and analytical forecasting tools, the question is how can this be?

Here are some thoughts on why this might be happening, and five tips to help you improve your forecast.

Reasons for poor forecasting:

- Impurities in the System – let’s go after the big one first. “Garbage in, garbage out”…as they say. There’s a laundry list of things to look for — from reps putting leads in the system right before they close, to not updating opportunity consistently, and leaving in dead leads too long.

- Sales Optimism – yes, the economy seems to be recovering but it may not be moving at the “speed of sales.” Sales folks are an optimistic bunch; they want to believe things are better than they may be in reality. For example, the average length of the sales cycle. In a report earlier this year by BtoB Magazine, 43% of marketers reported that the sales cycle had increased over the last 3 years. Which is consistent with the CSO Insights report where 42% of Chief Sales Officers stated that the sales cycle had lengthened, in particular with new acquisitions.

- Incentives & Goals – take a look at how reps are being incented, and/or their sales goals. You may find the reason why reps leave opportunities in the pipeline too long, and/or are over optimistic with their forecast. Pressure to build and maintain pipeline can sometimes cause counter productive behaviors.

- Gut Feel – even if the troops in the trenches are putting in accurate and timely data, the generals may change it to fit the political environment and/or their own personal bias.

- Changing Buyer Behavior – recent research has shown that the buyer’s journey, and the typical sales process are not aligned. Buyers frequently start and stop the journey, or will cycle at a stage, and even move backward in the process. CRM systems are typically designed in a linear approach, progressing from a lead to a close. It’s an internal view, and increasingly out of alignment with buyers’ preferences.

How to improve:

- Active Pipeline Management – The pipeline and forecast will never be 100% accurate. That said, you should have a feel for how far off it is, and what is needed to improve. For example, do you have an inspection process to keep the pipeline current? If so, consider doing it more frequently. Move quarterly reviews to monthly. Also, if everyone is responsible for updating the pipeline, then no one is responsible. Consolidate the “maintenance and hygiene” of the pipeline to one person. Others may be responsible for providing updates, but one person needs to police the system.

- Discount Probability and Value – conduct a post-mortem on past forecasts over last year or two. Assess the difference between forecasted and actual results. Create discounted probabilities based on that delta for: lead movement (from stage to stage), and lead value. If implemented, evaluate the accuracy of your “pre-set” discounts. It should help bring forecasts more in-line and ground “sales optimism” in a bit of reality.

- Govern the Process – to improve the accuracy of “output”, focus on implementing and managing a standard process. Accenture’s Connecting the Dots on Sales Performance found inconsistencies among reps in using their company’s defined process and methodologies to selling. A quarter of Chief Sales Officers surveyed stated that sales reps used their sales methodologies 50% of the time, 31% said it was used 75% of the time.

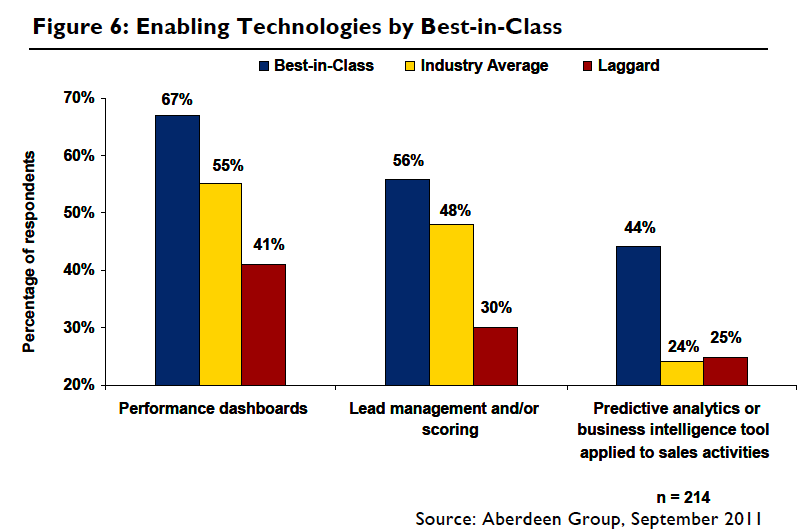

- Leverage Marketing – close the feedback loop with marketing to improve the quality of leads from campaigns and activities. In a report on Sales & Marketing Alignment by the Aberdeen Group, marketing accounted for 47% of the sales forecasted pipeline in the Top 20% of companies studied, compared to only 5% of laggard organizations (bottom 20%).

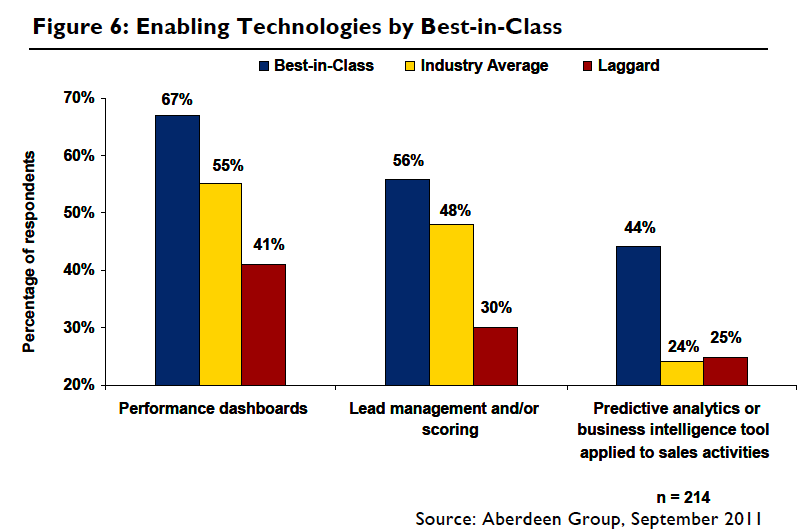

- Utilize Business Intelligence Tools – high penetration rates of CRM may equate to high visibility, but doesn’t automatically mean that it provides the best insight. Despite high adoption rates of performance dashboard, few companies are using business intelligence or analytics tools according to the Aberdeen Group report on sales forecasting. However, the report found that 44% of the highest performing sales organizations were using predictive analytics to reduce “gut feel” in the forecast.

Of all the options, perhaps the best lever for impacting accuracy is the rep. As Ashish Vazirani, a Principal in the Hi-Tech practice of the sales consultancy, ZS Associates says; “A sales person needs to be coached, or apprenticed on how to discern and input the right information for accurate forecasting. Technology can make us lazy and reliant on the tools to do the thinking, we need to emphasize the importance coaching plays in keeping the garbage out of the system. ”

Helping the troops become better soldiers through coaching should help improve the accuracy of the forecast. As well as, implementing the tips mentioned above. But you may still find that half of the pipeline is wasted, but hopefully, unlike Mr. Wanamaker, you’ll understand which half.

by scott.gillum | Jan 2, 2013 | 2013, Sales

Twenty-five years ago, I was a snot-nosed kid out of college who suddenly decided that law school was not in the future. With a recession on, and needing to pay the rent, I took the first job offered and went into sales.

Having learned nothing about the profession in college, I picked up a copy of Miller Heiman’s Strategic Selling — still have a dog-eared copy on my bookshelf. I learned everything I could about the buyer types, account management, and the sales process. “Know the process work the process,” as my first sales manager used to say.

Typically, that process came down to 5-to-7 steps that generally covered the following areas below.

Over the years, I found that working the process helped give you sense of control. It came down to the numbers; calls, leads, transaction sizes or conversion rate. Call on X number of qualified prospects to get Y amount of proposals, at Z close rate, and you made bonus.

But, research from Google and CEB entitled The Digital Evolution in B2B Marketing provides new insight into buyer behavior, and it challenges the conventional wisdom. According to the study, customers reported to being nearly 60% through the sales process before engaging a sales rep, regardless of price point. More accurately, 57% of the sales process just disappeared.

What are buyers doing if they’re not talking to sales? Well, they’re surfing corporate websites to identify and qualify vendors, instead of the sales forces qualifying them. They are engaging peers in social media to learn more about their needs, potential solutions, and providers. And they’re reading, listening to, and watching free digital content that is available to them at the click of a mouse. No longer is the sales force the sole source of information.

What does this mean for sales and marketing?

The study recommends focusing efforts in three areas; 1) improve marketing communication integration, 2) develop and activate a content strategy, and 3) strengthen multichannel analytics. Nothing new or breakthrough here, but the study provides good examples of how companies are executing against each point.

However, I found a number of other points to take from the research.

- It is not all bad news – for products or services with low price points and/or margins, having customers self direct themselves through the sales process can help reduce the cost of sale and/or create leverage for the sales force. In fact, in certain situations an organization will want to encourage and/or incent this behavior. The research also found that some customers felt comfortable going through 70% of the process before making contact.

- Changing buying behavior – an old manager used to say that technology changes fastest, then consumer buyer behavior, and eventually, organizations. The “57%” stated in the research makes for a good sound bite; the fact is, that number will vary, greatly by customers, transaction, industry, etc. The point is that change is a constant; the question is how far ahead or behind is your sales and marketing efforts? Are you keeping pace? The second question is, how would you know?

- Content Distribution – as the study notes, the sales force is still the most effective and important communication channel. When developing the content strategy ensure that the best and/or most valuable content is not in the public domain, reserve it for the sales force.

- Time to Take Social Media Seriously – with well-informed prospects, sales reps have to quickly learn what buyers know or perceive about the organization, products/services and competitors. Social media can help them better understand what is motivating buyers to take action, what buyers believe to be true, and perhaps most importantly, who they believe.

The Future

Business decision makers will continue to drive their buyer process deeper into the sales process. As a result, relevant content will continue to escalate in value, especially content related to consideration and purchase drivers, and the business application of the product or service.

Social media and monitoring has helped many marketing organizations understand this trend and to make the transition from being content “dictators” to information “facilitators.”

For sales, the research may be an epiphany. No longer can it be successful focusing solely on an inwardly directed process intended for reporting and planning purposes.

With ever-increasing knowledgeable buyers waiting longer to engage, sales has to transition from being a “product pusher” following a process, to an insight “provider” adding value to the buyers business. As the study states, sales must deliver “pointed insights and evidence that seek to challenge an entrenched point of view among potential customers.”

Finally, it is time to recognize that we’re not in control, and perhaps we never were. The traditional sales process is now obsolete; it is now time to follow the buyers’ journey.

by scott.gillum | Nov 26, 2012 | 2011, Sales

Original Post Date 9/22/11

Even if you believe in love at first sight, the likelihood of a marriage proposal on the first date is highly unlikely. Committing yourself to someone without getting to know him or her first is a ridiculous idea. Yet far too often companies are asking audiences to “commit” at the hint of an interaction despite knowing little about each other.

Why?

In the tech industry and according to author Tom Grant, Ph.D, companies desire early commitment, due to the industry’s “voracious appetite for leads.” As Grant explains in his report, Tech Marketers Pursue Antiquated Marketing Strategies, the “high-speed innovation” rate drives a hyperfocus on product marketing and lead generation compared to other industries.

In fact, only 22 percent of marketers in the technology industry said that customer relationship management was one of the two most important priorities. Contrast that with 52 percent of marketers in non-tech companies. The focus is obviously on producing a measurable outcome that drives the product P&L: leads.

Developing a relationship with an audience takes time and resources, and it can be perceived as a distraction to the task of finding “ready to marry” prospects. This inward-out view of marketing ignores audience needs and assumes that all audiences are the same, and that all searches must indicate intent.

However, the key to driving demand and lead generation in today’s economy is not being more aggressive and pushing harder, but rather, taking time to develop and nurture relationships. Audiences, like dates, can sense desperation. Perhaps the way to go faster is to slow down and shift the focal point from the conversion to the conversation.

We have long known that relevancy drives conversion and that conversion drives revenue. Getting to relevancy requires us to engage with the audience to understand their unique needs and motivations. As a result, our role changes from dictating to facilitating and understanding that it’s now on the buyer’s time frame, not ours.

New technologies such as Bizo enable us to know who the audience is at the first interaction. We also know where they’ve been for 30 days (who they’ve been dating, so to speak) before the conversion point, via Google Analytics’ new Multichannel Funnels.

We can serve up custom content through retargeting based on audience profiles, adapt for whatever device they are using, and deepen engagement by providing specific product or brand messages that align with their journey.

We can serve up custom content through retargeting based on audience profiles, adapt for whatever device they are using, and deepen engagement by providing specific product or brand messages that align with their journey.

95% of prospects on your website are not yet ready to talk with a sales rep.” Source: 2011 MECLABS research

We no longer have to interrupt a buyer’s journey to gauge the interest level. We no longer have to call a prospect to qualify him or her. When a company offers something of value (i.e., relevant and personal), buyers are more likely to share their interests, desires and needs, but only if we listen, nurture and respect the relationship. According to Forrester, this intimate information is critical to creating real opportunity (leads) for the sales force.

In the Technology Buyer Insight Study, Forrester found that although tech has done a good job of equipping its sales force to discuss company products, it had failed to provide reps with insight into the buyer’s roles and responsibilities. Only 29 percent of CIOs said that sales reps could “relate to their role”; less than a quarter (24 percent) of business leaders said that reps were “knowledgeable about their business.”

Still too touchy-feely for you? Consider Harte Hanks’ report, Mapping the Technology Buyer’s Journey, which states that the relationship with the vendor is still a top five consideration driver. The first and second most important drivers are what you’d expect: (1) Meets all needs and (2) cost.

Competitors can match your price, but they can’t necessarily match your understanding of the buyer’s need or the relationship developed through that journey.

by scott.gillum | Aug 28, 2012 | 2010, Sales

Originally posted on August 11, 2010

Social Relationship Management and Social CRM are terms that are now being thrown around for new technology platforms that are enabling multichannel execution. Companies like Lithium Technologies have created platforms that allow companies to run hosted communities, listen across a variety of social media channels, and manage content to and from social networks in one integrate tool.

While marketing has steadily evolved from “one to many”, to “one to one“, Social CRM is now creating the opportunity for “many to one.” For example, a customer tweets a question about a product (e.g. is it worth the money) on Twitter, a customer advocate brings that comment into the company’s online forum. Customers response to the question by sharing their experiences with the product, those comments (most likely only the positive ones) are then tweeted by the company to promote the product.

The promise of Web 2.0 has always been about customers selling to customers. New Social CRM tools are now enabling that by consolidating platforms. But this has the potential to raise issues over who gets credit for the sale. If the true ROI on social media is revenue, which many research studies are now suggesting, then who should gets credit for a sale closed by a customer advocate?

Customer references and testimonials have always been critical for closing deals. What happens when customer advocates volunteer their support for the brand and/or endorsement of a product? Does marketing get credit for providing platforms for enabling customer advocates? And what about the customer/s who’s comments help push the prospect over the goal line…do they need to be rewarded, and if so?

One thing is certain: social media is blurring the line between sales and marketing interactions and dialogues. Given that, we may have to rethink our traditional views of customer coverage and relationship management. Perhaps in the future, marketing will be responsible for managing customers online relationships, and sales for the offline experience.

Someone call HR and give them the heads up. Territory planning, revenue crediting, roles and responsibilities might need a refresh soon.

by scott.gillum | Jul 20, 2012 | 2009, Sales

Original post date March 24, 2009

In August 1999, Selling Power magazine ran an article featuring our firm and the work we’ve done helping clients, like IBM, build new sales channels and increase sales productivity. A few months later, we received a call from the head of a division within NCR asking us to meet with them to see if we could help them with something similar.

The senior executive with whom we met said if we could help IBM we should be able to do this project for them. Excited about the prospect of helping them build a new channel, we agreed and they laid out the challenge:

- A well-known consulting firm had been previously engaged but had failed

- …which left only 41 working days to get the new sales channel up and running

- An internal NCR tele organization was competing for this…which, we would later learn, tried to sabotage the effort…and us

- And finally, we were entering the holiday season…good luck

After collecting the previous project work we quickly went to work on assessing what had gone wrong. It took us a while, but we finally discovered “IT”. Once found, this insight became the key to unlocking success.

Almost ten years later I’ve seen this scenario play out over and over in B2B companies. This is what we discovered.

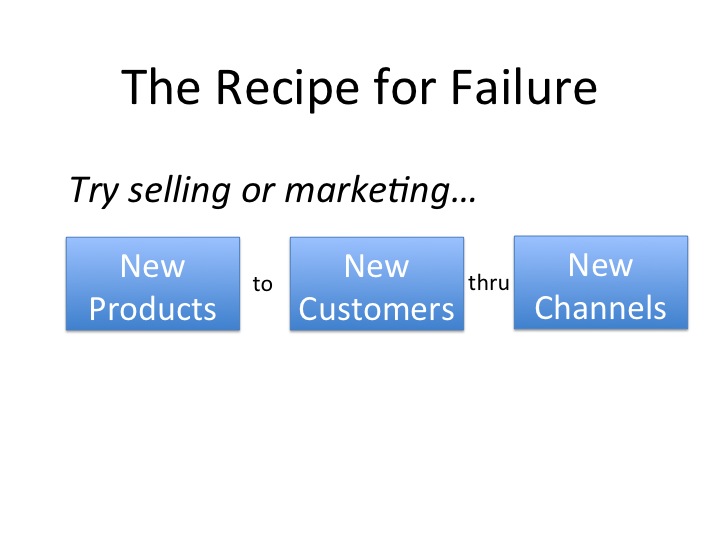

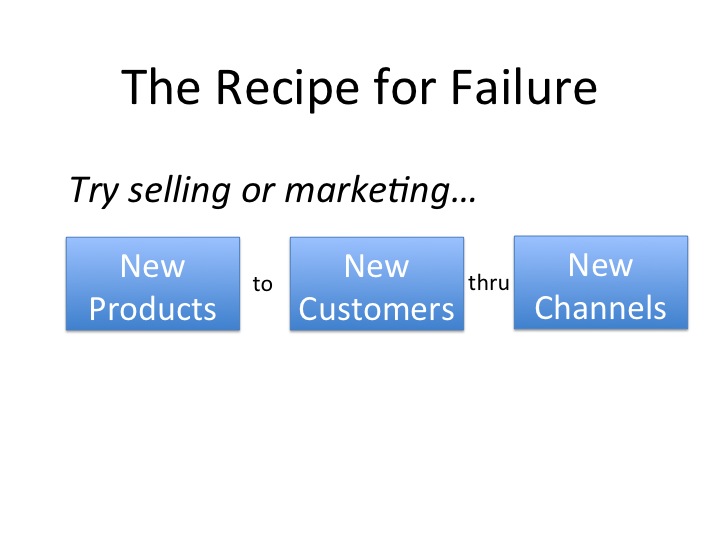

The secret recipe for failure

This simple equation is just as true today as it was a decade ago when we discovered it. Oh, you may find one or two exceptions but the majority of the time when we do post mordem on failed programs you find this equation is at the heart of the problem. When combined with a few related pieces, like a lack of time in the market and/or funding, the initiative is doomed. The degree of “newness” in these three areas will directly impact the likelihood of success or failure.

Sales Channels

- Why they fail – new sales channels fail because companies aim new channels at the wrong targets — new customers/markets. An investment in a new sales channel means that it is competing with existing channels for funding. If it does not hit expectations/goals quickly, it will be robbed of the necessary funding and/or resources needed to make it successful.

- How to improve the chances for success – The most successful way to build a new sale channel is to do exactly the opposite of what is described above. Shift coverage of existing customers or products to the new channel and use your existing channels to go after the “new.” Shift dormant or flat growth customers to the new channel to give it revenue immediately and free up your existing most knowledgeable, best trained sales folks to go after new opportunity.

Marketing Campaigns

- Why they fail – new marketing campaigns promoting new products aimed at new customers typically fail because of reasons listed above…they take too long to produce and/or aren’t given the time. Here’s another common problem, agencies will tell you the problem is the “creative” or “value prop”…maybe, but they also could telling you this because they make money on creative and production. “New” works with their business model.

- How to improve the chances for success – build less individual campaigns and invest more in one or two long term programs with many integrated tactics. Keep the programs in the market longer, closely monitor them and modify tactics based on performance. You don’t need a new campaign every month, you need a program that produces…and with tight budgets this will help you be cost effective/efficient. Years ago we did an assessment of campaign performance at IBM. We found that the highest performing campaigns had at least 7 integrated tactics and stayed in the market for at least 6 months. Use this as a starting point to design your campaigns and programs.

- New to New thru New – level set expectations and invest for the long haul. You will need time and commitment to make it successful. Companies have short-term horizons that are getting shorter every day. If you’re going to lead this effort get everyone to agree on what defines success and stick with your timeline.

- New Product/Service/Solution – try to leverage existing channels, customers or both to start…then migrate to new. This way you can learn if you have the right value prop, messaging, pricing, etc. We like to take existing reps, for example, and use them to help launch a new sales channel, like Tele. We like to use existing customers to test new products, etc.

We got the NCR teleaccount program up and running in 41 days. We transitioned existing field account managers to TeleAccount managers and built their territories around their customers. We then began to backfill them with new lower cost resources over time. You’ll be happy to now that the manager of the group that tried to sabotage the effort got fired.

The program hit our first year sales targets, reduced the expense to revenue ratio from 13% to 6% and grew sales productivity from $1.7M to $3.1M per rep. As a result, NCR then built a full-scale tele channel with close to 80 reps.

Then they killed it. It’s a long story but the bottom line was the company has a strong field sales tradition and culture. Mark Hurd, now CEO of HP, became the CEO of NCR, and decided to shut the channel down, redirecting the resources to the field.

Remember my comment about competing for resources. Mark’s an operations guy and a fan of face to face selling.

Culture runs deep, and can also kill channels and programs. Maybe I should update the “recipe” to include the forth “New”…new leadership.

(professional and personal benefits, like a promotion, admiration from peers, etc.), but also, buyers are eight times more willing pay a premium. To do this effectively sales people need to be able to put themselves in the shoes of decision mak ers. They need to understand their buyers’ situation, role, relationships, etc., and sell the value of the product or service to those unique needs. If reps only know how to sell “feature functionality” the conversation will all too often come back to price.

(professional and personal benefits, like a promotion, admiration from peers, etc.), but also, buyers are eight times more willing pay a premium. To do this effectively sales people need to be able to put themselves in the shoes of decision mak ers. They need to understand their buyers’ situation, role, relationships, etc., and sell the value of the product or service to those unique needs. If reps only know how to sell “feature functionality” the conversation will all too often come back to price.