by scott.gillum | Jul 19, 2012 | 2012, Sales

Large companies have long recognized the opportunity to address the needs of small business (26 million firms <99 FTE’s). Over the years, companies like IBM, American Express and Google have spent millions to try to understand the segment and convince business owners that they have the products and services they need.

Yet, they still struggle to capture of the opportunity in this segment, for a number of reasons. Despite their best efforts, they often fall back into their “big company” ways. They speak the wrong language, have a hard time creating compelling offers, and/or reinforce perception that they’re too big to serve small businesses.

Whether you’re a Fortune 500 company or an INC 500 firm, here are 10 key points to keep in mind when selling to the Small Business segment. All Insights below are taken from various research reports produced by the Executive Council on Small Business.

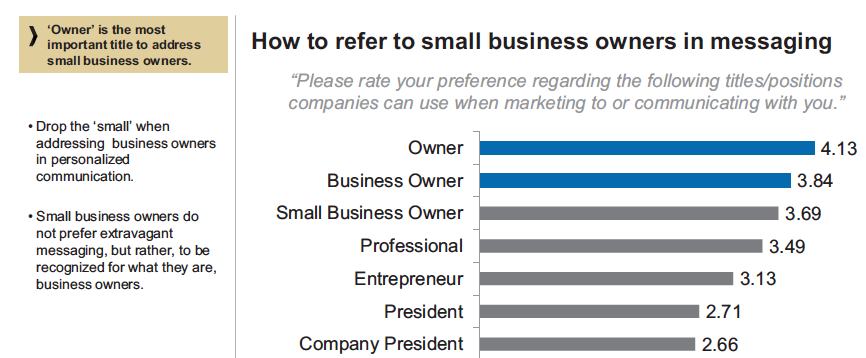

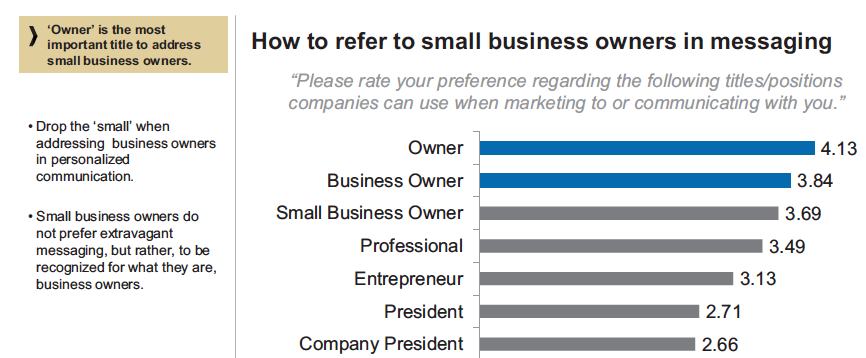

1. Don’t call them Small Businesses – despite this becoming common knowledge for many selling to this segment, companies still make the mistake. Despite the fact that 60% of small businesses, as defined by the U.S Census Bureau 2008, have less than 5 employees, don’t call them a small business.

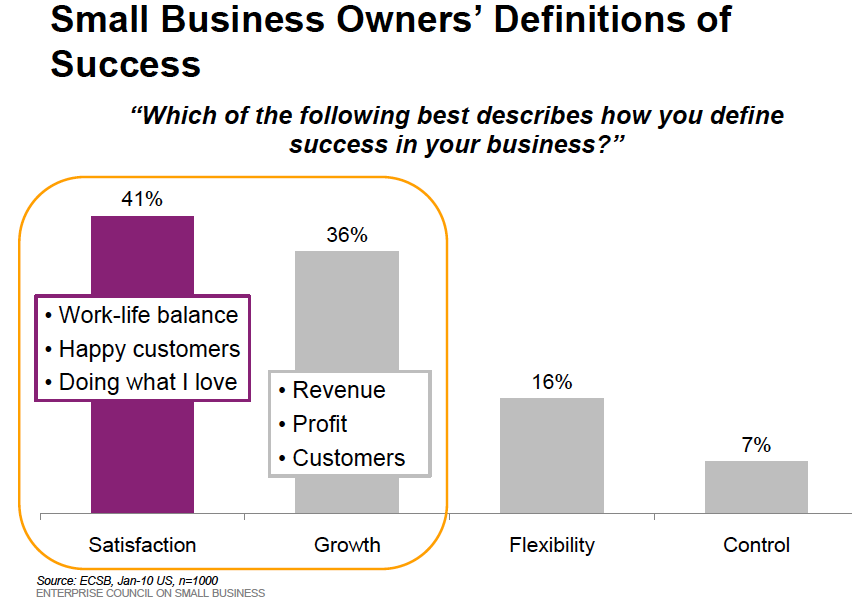

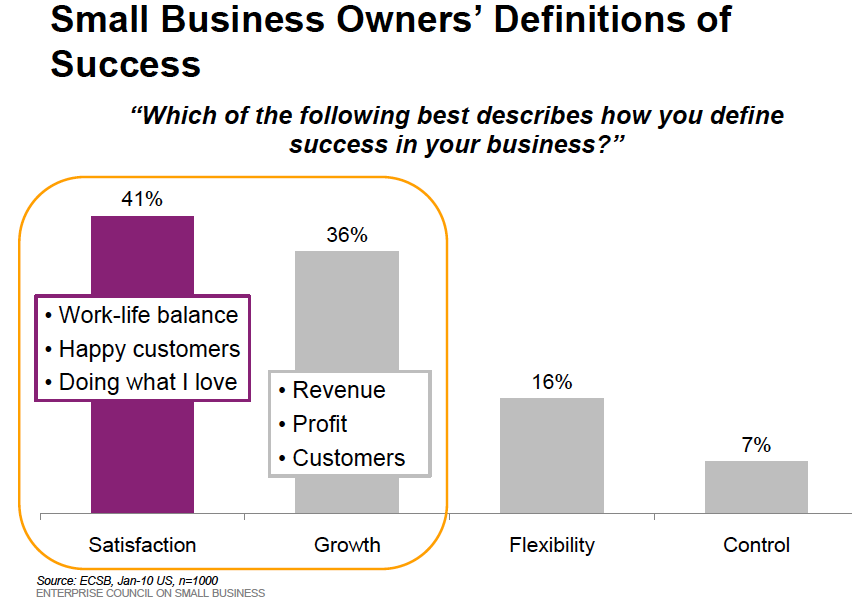

2. There are 2 different types of business owners – one type of owner is focused on growing their business, the other surprisingly, is not. Know the difference when targeting this segment. “Satisfaction owners” know also as “lifestyle owners” are older (>46) and more likely to have higher revenue businesses. They are in it because they love what they do and enjoy the work-life balance ownership present. “Growth” owners are more likely to be in retail, and more likely to have owned or own more than one business (serial entrepreneurs).

3. They are in the Service Business – for the most part small businesses are focused on providing services. 60% of small business are; professional services or other services (dry-cleaning, florist, cleaning service, etc.).

4. Speak THEIR language – As you might have already picked up, this will be a reoccurring theme in the post. 3X as many business owners find a sales person more trustworthy if he/she discusses savings in dollars rather than percentages. To be credible give them specific details, contact information and testimonials for other business owners (Top 3 Indicators of Credibility).

5. Small things are a BIG Deal – according to the research, a major purchase decision starts at $500. Cash flow is the lifeblood of small business don’t under estimate your need to prove value or ROI on what you would consider small transactions. If you’re talking about cost savings, express it in monthly terms rather than annual. 2X as many owners expressed seeing savings monthly rather than yearly.

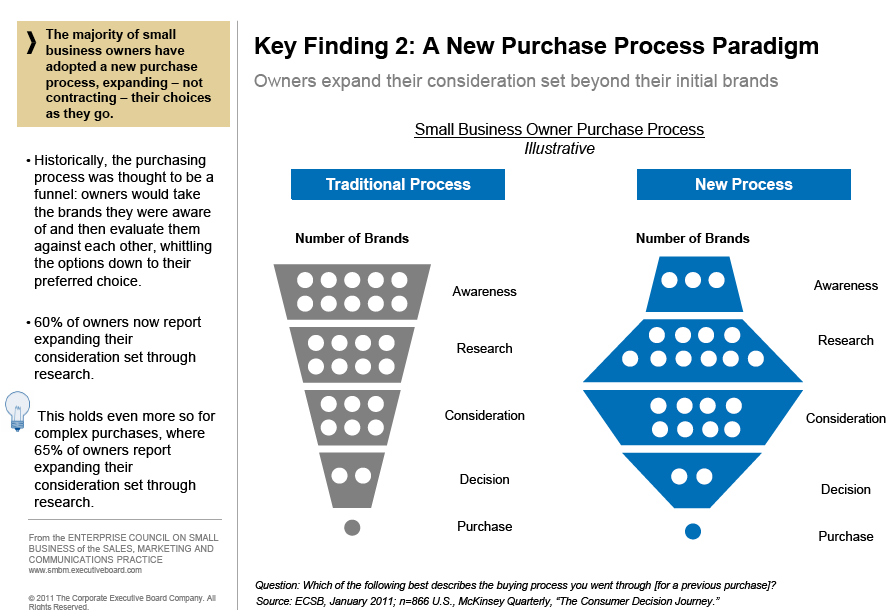

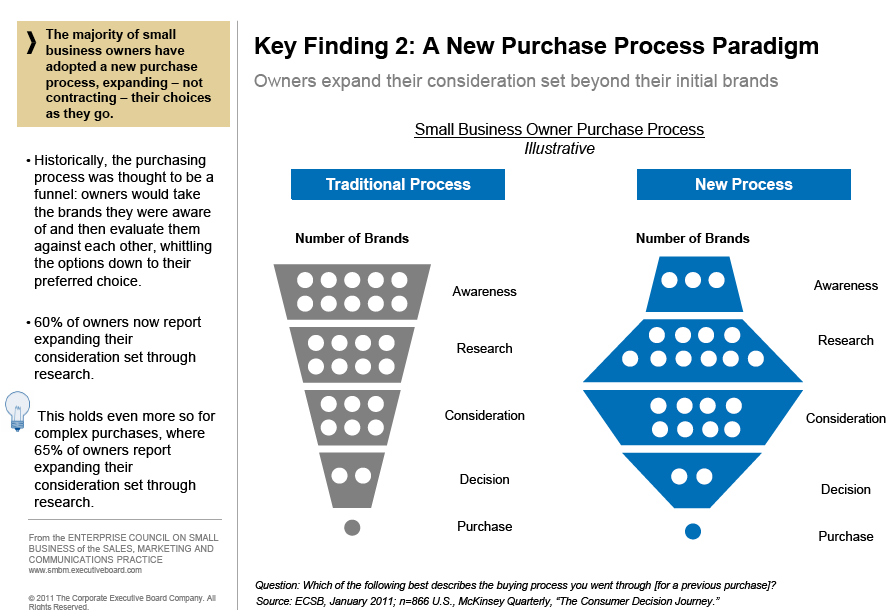

6. Resources and Time are Tight – owners now make a purchase decision in less than a week for complex and simple products. 43% said that it now takes them less time to make a decision than it did 5 years ago. They search online, visit your website, and then call to confirm what they’ve learned. SEO is critical if you’re going to play in this segment, as you will see below.

7. They Love to Search – Business owners purchase patterns have changed, instead of contracting it’s now expanding. Rather than narrowing their list of vendors, 60% of owners now report expanding their consideration set through research.

8. And it’s Local – business owners search for a product or services by name, not a brand, and they include their local area (e.g. “internet providers in St Louis”). They don’t include “small business.”

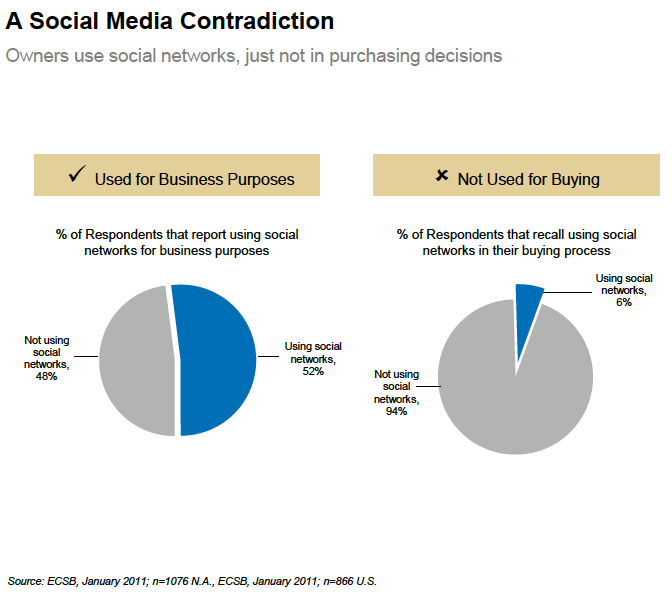

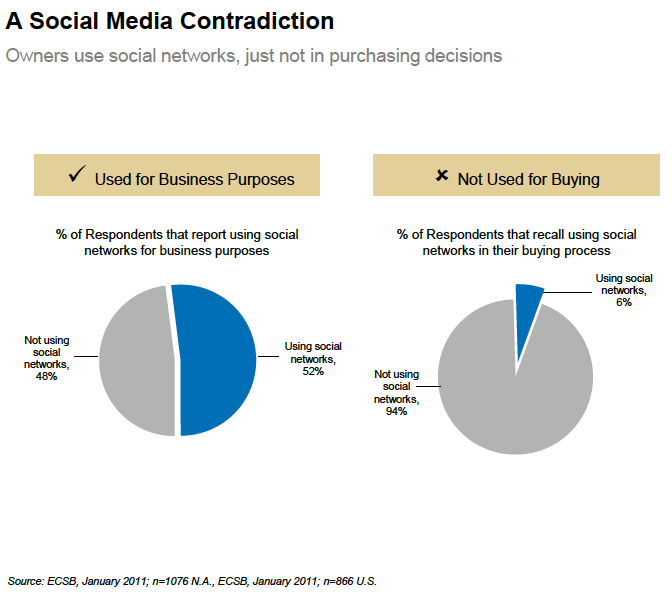

9. Search is Important, but Social Isn’t – as you saw in the previous examples Search is critical for being considered, but interesting enough, Social Media is not. The reason – small business owners view social media as a channel to speak about their businesses, rather than hear what suppliers have to say.

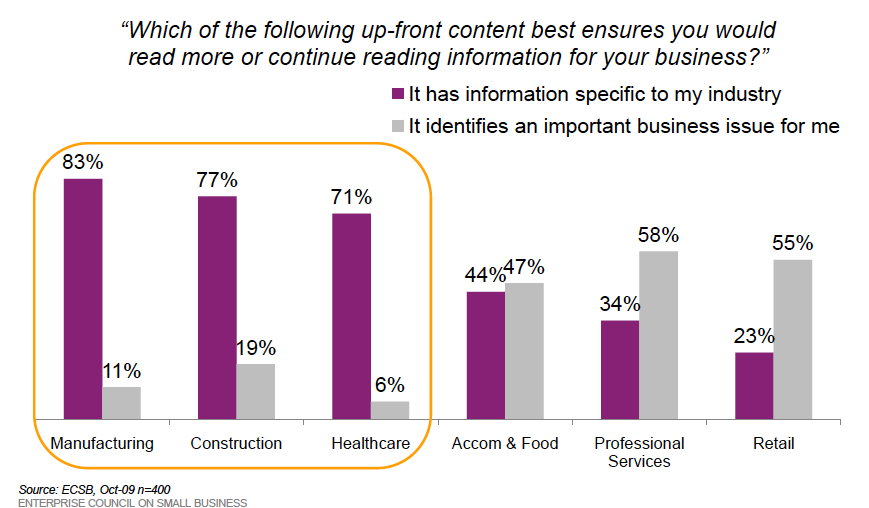

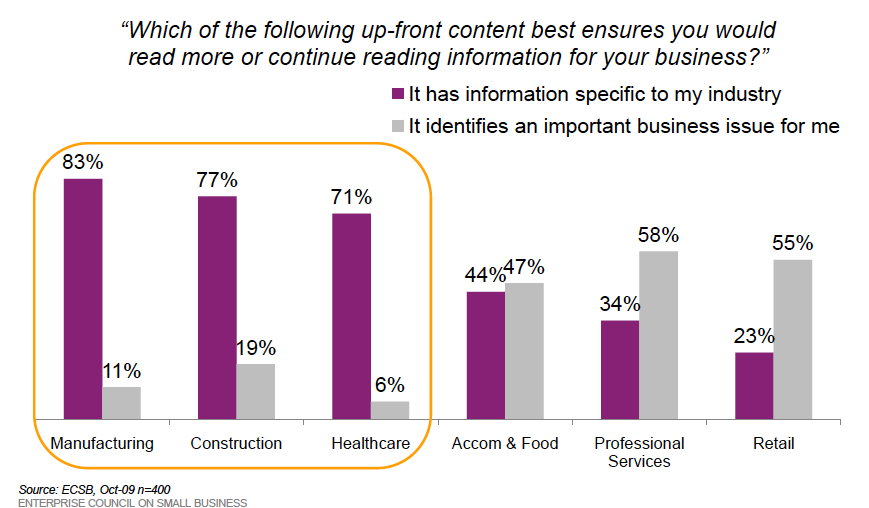

10. If You’re Not Relevant…You’re Not Relevant. In today’s marketplace to resonate with audience content must be personalized. A recent Forrester report showed that most sales forces very capable of discussing products and solution, and even the industry issues, but when it came down understanding the buyer’s role or situation they failed.

Business owners in healthcare, construction and manufacturing want information specific to their industries. Owners of professional services or retail want information specific to them.

Satisfaction owners are looking for products and services that save them time savings and strengthen their relationship with customers. With Growth Oriented owners talk ROI, and time to payback.

Summary – it’s OK to categorize your services or products as small business solutions, but don’t call the buyers small business owners. Recognize that there are two different types business owners focused on two different goals – lifestyle vs. growth. Both groups are interested in hearing your value proposition in terms of real dollars on a monthly basis, not over the year.

Business owners are heavy users of search for researching vendors, and they use social media to promote their business, but not for buying from vendors. To be relevant your content must speak to their industry or similar size businesses.

If you talk to them like you know them, show them you are committed to building a lasting relationship this dynamic market can power your organizations growth.

by scott.gillum | Jul 18, 2012 | 2009, Sales

Original post date Feburay 21, 2009

This post was recently featured in an article on MarketingProf’s

Pipeline slowed to a trickle? Opportunities backing up, lead-to-close time seem like forever…yea, welcome to the recession. With customers delaying and/or postponing decisions altogether the ol’ pipeline ain’t what it used to be.

Here are 7 Pipeline Management Best Practice tips taken from leading companies that might help:

- Weekly Pipeline Meetings with Sales AND Marketing – yes weekly…and with Marketing, do it in country and at the region level. You may also do it at the corporate level with the CEO , like IBM.

- Apply BANT – CRM is great at increasing visibility into opportunities but it tells you nothing about why opportunities aren’t advancing. BANT will. By qualifying and re-qualifying opportunities based on Budget, Authority, Need and Time you will get to the bottom line on why leads are not advancing. Reps will say that it’s “B” but I wouldn’t assume that. Companies are still spending (not as much) but now it takes a C-Level to approve (is your sales force getting to “A)? Budgets have moved higher in the organization and have been centralized. Also, business cases are required for EVERYTHING so if you aren’t submitting one with every proposal you’re not address “N”. Timing (T) of course, things are slow so you need to find out as much as you can about when budgets might get released and then check again, then again…

- 90 day Movement Limit – this is one of my personal favorites. If a lead (that is truly a lead) does not advance within a 90 day window it moves back to the previous stage in pipeline or is killed. Given that lead cycle times have lengthened…considerably, you may want to make the window 120 days. Up or Out…learn it, live it, love it.

- Define a lead and stick to it – look, it’s going to be difficult road but be honest with yourself on what is truly a lead. A response to a campaign offering a free gift card, or a download of a white paper off the website, aren’t leads…they’re responses and should be treated that way. Leads are defined by meeting a BANT criteria…see above. People will want to get fast and loose with the facts to satisfy the sales force or make marketing targets but don’t let them…stay firm, you’ll thank me when the recovery starts.

- Response Management – so now that you’ve removed the “junk” out of the pipeline it’s time to do something with it. In reality responses aren’t “junk” (well, some are), they’re potential leads that just need to be nurtured…for a long time in today’s environment. Don’t disregard them, I’ve seen too many companies do nothing with this group. In the good times most of them would be leads. How to find them? Simple, ask this question during you pipeline call; “who owns responses that aren’t qualified leads…” wait for the silence. Bingo, there’s your answer. Take the last 6 months of campaign response and start digging.

- Lead Gen to Sales Enablement – it’s time to move marketing down the pipeline. Lead generation aimed at acquiring new opportunities is a waste of money in a recession. The cost of a qualified lead has skyrocketed…don’t believe me go do the analysis you will be surprised and in some cases shocked. So it’s time to invest against sales enablement and helping the sales force move opportunities already in the pipeline. Here’s another fact for you…B2B sales channels create 80-85% of all leads so cutting lead generation programs will not hurt you…I’ll say it again, redirecting investments away for lead gen activities will not hurt the pipeline.

What is sales enablement, and how does it help the sales force? Well, it’s things like business tools that can prove a ROI, sales presentations loaded with proof points (case studies) on your value, and a robust customer reference program (see the graph above). By aligning marketing activities to moving the BANT levers you will be investing marketing dollars were they can have the greatest return…and your sales force will thank you for it.

What is sales enablement, and how does it help the sales force? Well, it’s things like business tools that can prove a ROI, sales presentations loaded with proof points (case studies) on your value, and a robust customer reference program (see the graph above). By aligning marketing activities to moving the BANT levers you will be investing marketing dollars were they can have the greatest return…and your sales force will thank you for it.

- Comp on or Emphasize Customer Meetings – if you build comp plans based on revenue and lead targets/production you may want to consider over emphasizing face time in front of the customer for the first half of the year. You’re probably saying to yourself, “but Scott, why would I do that if customers aren’t buying?” Right, but they can tell you why, when things might loosen, and who you need to get to (see my rant on BANT in bullet #2). It’s during these times that you need to have your reps in front of customers so they can collect the information needed to provide you with update during the weekly pipeline call. Use your sales enablement team (see paragraph above) to provide them with high value material to share with customers in order to get those meetings. See how it all connects?

I hope this helps. Unfortunately, it looks like we’re going to be stuck in this situation for all of 2009. Be strong…the bad times, just like the good times, don’t last forever.

by scott.gillum | Jul 18, 2012 | 2009, Sales

Original post date January 12, 2009

Last week I had the pleasure…to my surprise…of hearing my 6th grader work the phone selling Girl Scout cookies. She’s been a Girl Scout for a number of years and has achieved “Cookie Diva” (Cookie VIP this year) status numerous times by selling more than 150 boxes of cookies. Although I had helped her over the years by selling some cookies at work, I never actually got to hear her sales pitch, until last night.Sure, it’s hard to resist a Girl Scout selling cookies, but as a sales and marketing consultant for the last 12 years, I was struck by how well a simple, honest approach to selling worked. It was an interesting and enlightening 30 minutes.

Here are some of things I heard:

- Niceties/Pleasantries – started every conversation with “happy new year”, and talked about their holiday, children, etc. She invested the time in catching up with them even though she had limited time to make calls between homework and bedtime. She didn’t jump to “getting the order.” It made me think about how often I rush through this important step because of time constraints, pressure on revenues, and/or proposals. If customers think that the only time you call them is when you want something…this certainly confirms it.

- Customer Knowledge – no sophisticated databases, profiling or scripts. She did her homework by knowing what they ordered last year, what girls were no longer Girl Scouts, etc. which made it easy for customers to place orders because she knew them well.

- Attitude – sometimes people consider sales as a “dirty job” and/or that we may be they are inconveniencing/imposing on someone by pitching them…like a stalker (maybe that’s just me). Could this stem from the fact that perhaps we don’t believe in our product or the value it can deliver to our customers. Listening to my daughter, I heard her talk about how good some of the cookies are and know how much they and/or their children love them, how she likes to put the “Thin Mints” in the freezer because she likes to eat them cold or dunk the “Do-Si-Dos” in a glass of milk before bed. Having seen boxes of GS cookies disappear from our shelves, I can attest to how much she loves her product.She’s not imposing on others, even though she caught some folks at dinner, she’s turning others on to a great product that she loves. What a difference that makes…

- Product Knowledge – not only did she know all the cookies, including the new and classics, but also how many where in a box and how they were packaged. The best part was describing how to consume them…see above. I can’t tell you how many marketers I’ve worked over the years that don’t know the products their companies sell. I’m convinced that this lack of product knowledge is the leading reason why sales organizations dismiss or don’t respect marketing/marketers. Want to improve sales and marketing integration, train your marketers on products and see what happens.

- Reference/Customer Testimonies – when her personal testimonials weren’t getting the job done she started to talk about others in the family and/or someone they knew. It made me think, do customers really care to hear reps experience with their own products? Maybe not, but do they listen to how convincingly or passionately they’ll testify…you bet! Customer testimonies are always the best –the more relevant the situation the better, but they also judge reps consciously or unconsciously on how well reps make their case (see the bullet above).

- Handling Objections & the True Decision Maker – she went after a new customer who told her that they usually buy from a girl in the neighborhood. She then asked for the lady of the house recognizing the dad/husband was not the real decision maker (home schooled on this trick). She got an order but not the full order…the girl in the neighborhood will still get hers…but it will be a couple of boxes short.How often do our reps stop at “no” or get stuck dealing with the first contact vs the real decision maker? We all know that we’ll have to work harder to get the order than in the past, maybe we don’t go for the home runs as often, and settle for few singles instead.

- Incentives – simple and straight forward, no complicated % or calculations…sell this much…get this. A compensations consultant’s dream, straight forward and easy to implement. On the order sheet, it lists the prize the girls receive based on their sales. As she reached certain level (25 boxes, 50 boxes, etc) she would tell us what prize she was won and what she was going for next. But the big one, the President Club, the one that screams “I’m the Diva” was the Cookie VIP patch.Good old fashion recognition for a job well done that lasts all year. Oh, how we’ve complicated incentives plans over the years. The search for the ultimate motivator has many times led us down the wrong path. Is it time to simplify, not sure, but I would bet it’s worth investigating.

- Connecting it to Social Causes – this is the primary fundraising vehicle for the Girl Scouts and people know it. Can you write off the $3.50 per box as a donation? No, but you do feel good about placing you order, sure. We’re all so socially aware nowadays, are there opportunities to connect your products to the “greater good?” You may have seen the latest ads from IBM and how they’re products and services can help companies “go green.” It’s time to add this to the value proposition…or at least consider it.

Yes, I know that many of us have much more complicated sales processes and products/services, but how much of that is self inflicted? At the end of the day, don’t all customers want the same thing…a good product or service that satisfies a need/want representing good value acquired through a pleasant experience?

During this difficult economic environment, listening to my daughter was a good reminder of how well having a good product, knowing your customers and believing in the value that you’re providing can work. Is it time to simplify our products, value proposition, how we compensate our reps? It may depend on the company, the situation, the market…but I would bet it wouldn’t hurt.

At the end of the night, ten phone calls, 10 closes and over 70 boxes of cookies sold in the matter of 30 minutes (pleasantries, product description, and an order every 3 minutes). Not bad for a junior telemarketer with no training. The GS’s will sell over 200 million boxes of cookies over the next month…more than any cookie manufacturer will sell in the entire year.

Does simple work…for some, extremely well. The question is, can it work for you?

by scott.gillum | Jul 17, 2012 | 2008, Sales

Given our average deal size we used to think we needed to have a scaled down offer to get a foot in the door. Once in, we could then grow the account. We were wrong.

Considering the current economic situation, I know that many companies may be tempted to come up with a “door opener.” A subscale and/or entry level product/service intended to get a foot in the door with a new client and/or a new business division.

You’re also probably thinking about going down market into smaller accounts. Although this shift may help satisfy short term revenue needs it will do little to nothing in helping grow your business. Most likely those accounts will not expand and/or even be retained next year.

Here’s how I know. Looking back at the new accounts acquired over the last four years we found some interesting trends and confirmed some things that we knew intuitively (click on the image). When we measured the value of customers in their first year against the average time spent engaged with the client a few key insights emerged.

First, three “clusters” of accounts emerged;

- Customer that grew to beyond $800K in their first year

- Customer who had first year revenues between $350-$600K

- Customers who represented under $250K in total billings from the year.

Let’s start with the bottom and work our way up. Customers in cluster 3 had an average value of $150K. Accounts on the lowest end of the spectrum in the “One and Done” zone” (under $10K for example) were “workshop”…our “foot in the door” offer. Guess what, of the 8 that fit that description zero, zippy, nada, grew beyond the initial workshop. The other bad news…only 2 accounts led to follow on work and no company in that grouping was retained the following year.

I was speaking with Larry Emond, CMO of the Gallup Organization the other day and he mentioned that they saw a similar trend; “We found that only 4% of customers who were acquired under a certain price point grew to be substantial customers.”On the other end of the spectrum are the occasional customers who are big right out of the gate. The “Rare Birds” zone in cluster 1 includes those few customers who start big and for the most part remain large customers YOY. The key to success with this cluster is that they had/have a tendency to have a need for multiple service lines and/or desire a complex solution. This group was looking for a strategic partner versus a vendor for an immediate need. Year over year retention was also good at over 50% and if they used multiple services lines it was almost a sure thing they be retained….and grow.

As Larry also mentioned; “Our big customers today came in as big customers…”. We’ve had the same experience and have grown our top 5 largest accounts by an average of 90% over the last two years.

Customers in cluster 2, the “Sweet Spot” represented the best of both worlds. Although their value was not as high as the “Rare Birds” they were more plentiful. They also had higher price points, high percent of follow on work and YOY retention than the “One & Dones.” Retention rates although not as high as the “Rare Birds” was good (a little over 33%). Bottom line – they represent the model that we need to build our coverage and services bundle against. We have also realigned our resources to help account development/retention activities against this group.

Why do low price point and short engagement acquisitions perform so poorly?

We discovered five main reasons for this:

- Length of the engagement – too short to learn business/issues/meet folks/create a relationship, etc.

- They get the “B” team – the “A” team is on existing accounts, as a professional services firm that measure FTE productivity this will always be the case.

- Short term need vs long term problem – we were successful in building a relationship with target buyers within targeted accounts. So much so that they decided to “give us a try.” The problem with that is that it was usually a piece of work that wasn’t strategic.

- Size matters – our win rate and retention rate dropped dramatically on companies that had under $1B in revenues. The only exceptions were situations we were able to sell a solution as the first engagement.

- Culture/Attitude – some companies just don’t have a culture of working with outsiders. This very difficult to know until you’re in the door.

So as you are thinking about 2009 focus on aligning resources and efforts on;

- Retaining and expanding your biggest customers with new lines of business.

- Find your “sweetspot” based on this type of analysis…what is the right mix of services and price.

- Targeting big companies with big needs…there are many out there now just make sure you have the right offer.

Because at the end of the first engagement…a foot in the door just isn’t enough.

by scott.gillum | Jul 12, 2012 | 2006, Sales

Remember when you had a unique product, a top-notch sales force, customers who couldn’t get enough of your product and were willing to pay anything for it. Sales reps couldn’t close deals fast enough and the factory couldn’t keep pace with the orders. Little to no inventory cost, high margins, an incredibly productive sales force, big bonuses, soaring stock, etc…things couldn’t be better. But what happens when demand begins to slip?

One of the first things to occur is that your best customers, who in the past had no leverage, begin to feel the advantage shift their way and sales reps (unknowingly and for the most part unwillingly) help that transition.

As demand cools, good sales reps who are trained negotiators and born manipulators, begin turning their finely tuned sales skills on the organization. Feeling the pressure to close business and meet quota, reps begin “selling” the organization on what they need in order to get the deal done.

Instead of driving customers into existing solutions with a premium price, they take the course of least resistance, demanding that the organization bend to meet the customer’s (not the company’s) requirements. The company “customization” party goes on for as long as the sales quotas exceed market demand for the product.

The Hangover Effect

What does the company look like after the party? Unfortunately, like most good parties, the news of the festivities grows and involves most of the organization. At the end, it is not a pretty site and it take years to clean up. Here’s a list of the mess left behind:

- Large contract departments – When demand is high, customers typically agree to standard terms and conditions in order to get the product as quickly as possible. As demand slows customers begin to try to gain leverage by modifying the “T’s & C’s” of a contract to their advantage. Reps desperate to get the deal signed before the end of the quarter apply pressure to the legal and contract departments to accept customer terms. This results in contracts so complex to manage, that additional staff is needed to administer them. In one hi-tech firm, for example, it takes a staff of four to perform administrative tasks related to just one large customer contract. Multiply that by twenty large customers and you begin to see the problem.

- Complex product and price configurations – In the eyes of the customer, the value of the rep shifts from problem solver and solution provider to personal customer advocate. The same demand for customization of “T&C” is applied to product configuration and pricing arrangements. The result is highly customized solutions, hard-to-write service agreements, and complex payment terms that may end up costing the company money. The response from the product management team of an ATM manufacturer working on standardizing product configuration was: “We have been trying to do this for years, but the sales force wouldn’t let us.”

- Order Taking vs. Order Making — A nasty side effect of this hangover is that when demand slows it reveals flaws that would otherwise had been hidden. One of those is seen in the quality of the sales force. The difference between “order takers” and “order makers” becomes apparent in a slow marketplace. In this environment of longer sales cycles and fickle customers, sales reps must work harder than ever for the sale that doesn’t hold much appeal for reps who are used to making quota without much effort. A sales rep at a one-time highflying manufacturer of telecom and web equipment was overheard saying in the hall to a colleague; “…I’m afraid we are back to the bad old days when customers required a business case and ROI for every purchase decision…”

- A Service Nightmare – When product configuration becomes so highly customized, it limits the number of service reps who have the competency to work on the equipment. This results in long service times. Worse yet is when service reps turn over, new reps, which lack the knowledge of the original configuration, begin applying short term service “band-aids” that sacrifice product performance. In addition, complex product configurations bring complex service agreements. As is the case for orders, service contracts become incredibly difficult to administer and manage. For example, one customer of an equipment manufacturer demanded that each component of the product have its’ own unique service agreement…all 200 parts.

- Remarketing vs. Marketing – Marketing gets the opportunity to host the party. Because demand for most products already exists, marketers focus their efforts on having fun catering to big customers and satisfying the whims of the sales organization (big expensive customer events, sponsorships of sporting events, etc.). Their activities are nothing more than “remarketing” to existing customers to keep the party going.

As the downturn comes, marketing is stuck with pre-conditioned customers and reps who are looking for “fun” and “fluff”. Unfortunately in this environment, marketing never develops the types of programs and core competencies needed to effectively sell products and acquire new customers right when the company needs it the most.

Best Cure for the Hangover

It’s not the hair of the dog that bit you that’s for sure and unfortunately, this hangover does not respond to a quick fix like a couple of aspirin or a new technology. Here are a few tips for getting started:

- Map out a plan – you didn’t get into this overnight and you’re not getting out quickly. Start small and stay focused.

- Find/Create opportunities to standardize and/or simplify– force events such as technology implementation or new product introduction to standardize process, price and services.

- Understand that not everyone is going to make it – the hiring profile for reps and managers 10 to 20 years ago when the sales force was built may not make it – order takers vs. order makers. The service and marketing departments may also need retooling. New competencies, skill sets and training are also necessary for those who make it.

- Utilize new sales and marketing channels and retrain existing channels – introduce and pilot new sales and marketing channels that increase customer coverage, reduce overall sales cost, and improve customer acquisition. Help field sales reps find their “sweet spot” (closing large complex orders in new accounts) by providing training on multi-channel coverage models.

- Draw a line with customers – Analyze and determine the profitability of your customer base. Segment it into three groups: 1) Profitable, 2) Marginal but with Potential, 3) Unprofitable with no potential. Begin the process of re-conditioning the way customers in segment #2 buy. You’ve created the monster and now you have to tame it. In segment #3, begin the process of terminating the relationship.

In the end, it is like any hangover. You feel terrible, you have a few (or a lot) of regrets, you promise to yourself and others that you’ll never do it again — but…it was fun while it lasted.