by Christina | Jun 10, 2025 | 2025, Tech Trends

For the past month we have tested the performance of short form videos versus traditional blogs posted on LinkedIn.

Why do it?

Two decades ago, I started blogging. Back then, keeping a post under 2,000 words felt like a constraint. (I was a management consultant — so yes, I used a lot of words.)

A couple of years later I began writing for Forbes which trimmed my posts to 1,200 words. Then, while writing for The Drum,down even further to 800. As attention spans shrank, so did my word count.

Fast forward to today: content is everywhere, AI tools are flooding our feeds, and the pressure to stand out is greater than ever. So I find myself asking: Should I still write, or do I shift to short-form video?

The Experiment

To measure the effectiveness of each, we created three tiers of key metrics. Tier one being the most important, tier three being the least.

● Tier 1 – form fills on our website or DMs on Linkedin

● Tier 2 – profile views or website visits, views/read time of the content, new followers

● Tier 3 – reach, engagement (impressions, engagement, shares)

To track performance, we used Linkedin Analytics (post performance), Hubspot (form fills), GA4 (web performance), Warmly (web visits), and Looker Studio (blog performance). The time period included all posts and performance for the last 90 days (March 1 to May 30th) allowing us to have enough data to measure the performance before and after.

The top 8 viewed posts of the last 90 days were evenly distributed between video and blog content posted in the last 30 days as part of our test. The first video was released was the top viewed post, with the remaining three videos making up the 3rd, 7th and 8th most popular.

Correspondingly, blogs ranked 2nd, 4th, 5th and 6th, were almost of perfect distribution to compare, with both having a median between 4 to 5.

Overall performance for the last 90 days on LinkedIn, compared to the previous period, experienced a 20% lift in content performance (impressions) and a 42% increase in engagement. Even more striking is the 28 days compared to the previous period, which produced a 408% increase in impressions, and a 290% increase in engagement.

Given the Tier 3 performance, it might be logical to believe that increases will be seen in the other tiers.

The Results

Before I jump in, it’s important to recognize how LinkedIn counts impressions and views of videos.

An “impression” is registered every time your post appears in someone’s feed. It reflects overall visibility, not necessarily engagement, or that it has been seen/read. Think of it as a billboard along a road. The cars pass by but may or may not glance at it.

LinkedIn’s algorithm, based on the content and responses to it, then decides to distribute more broadly…or not.

A video view is counted when someone watches for at least 2 continuous seconds (down from 6 seconds in 2023), either via autoplay or a manual click. In this case, we are using autoplay.

To dig deeper into evaluating the performance we downloaded Richard Van der Blom’s Algorithm Insights Report 2025 for LinkedIn metrics and benchmarks. We tried to download LinkedIn’ Benchmarks for Brand Awareness, but the link is broken on the LinkedIn for Marketers page…I’ll let you draw your own conclusions.

Okay, now for the results. I’ll start with “members reached” defined as the number of distinct members and pages that saw the post. Caveat, this number is an estimate and does not include repeat displays. I’ll begin with Tier 3 metrics and work my way to Tier 1.

- Reach – no real difference between videos (60%) and blogs (57%).

- Consumption (read or watched) – video (70%) outperformed blogs (12%) but that number is misleading. The videos were set to autoplay and a view “counts”, even if it’s for only 2 seconds.

- View/read times – this becomes a more important metric given the prior statement and is closer to the truth. Videos still outperformed (35% to 20%), but this is an average. For video, it’s total viewed time divided by views, for blogs it’s average read time divided by total read time (eg. 1 min read time on a blog that is a 5 mins read).

- Reactions (likes, etc.) – video outperformed content significantly (almost 2 to 1), but that is skewered by video #1 which has nearly half of all the video reactions.

- Comments – viewers were more likely to comment on blogs, by 52% .

- Reposts – viewers were 5 times more likely to share a video.

- Profile views – blogs were twice as likely to generate a profile view. But, when compared to the previous period, my profile views over the last 28 days decreased.

- Audience growth – you might assume given the previous statement about the 90 day overall improvement in performance would net an increase in my audience, but unfortunately, that was not the case. There was no change. Additionally, most of the views, (almost 90%+) came from my first connections.

- Web visits and/or visits to the Linkedin Company page – recognized no change, and visits to our corporate page actually declined by 18% during the period.

- Tier 1 metrics – neither format produced a form fill or a DM.

Interestingly enough during this test period, a post on ABM written by Ruth Stevens, mentioned an article I had written years ago drove more traffic to our site in one day than anything else we did on LinkedIn the past 90 days..

Learnings

How you view these results really depends on how you view LinkedIn as a channel and your desired goals…a la the key metrics listed. I also came away with as many questions as I did answers.

For me, blogs have a slight advantage over short form videos (for now), purely from the ease of creating them. Additionally, based on the performance of the comments and profile views, I feel like viewers were more invested in the content.

Now for some caveats… I’m making this comment as a Gen X twenty-year blogger with a mature senior executive audience. This brings up an interesting challenge we faced, and soon I’ll be creating another post going into more detail.

Trying to reach a new audience, we tested upgrading my account to Premium and using paid ads on our corporate site, hoping to boost video views for the last two weeks. Neither produced the results we hoped for, and/or was promised by LinkedIn.

LinkedIn Premium claims it will “expand your network and increase visibility.” We saw no evidence of that being true, as I mentioned 90%+ of the reactions came from 1st connections. Paid ads dramatically increased impressions (a relatively meaningless Tier 3 metric) but performed poorly, producing a 0.13% CTR with no conversions.

This raises a question on the value of the 800 lb gorilla of B2B channels, LinkedIn. LinkedIn has changed its algorithms to bring you more content from the creators you interact with, which somewhat explains the concentration of my audience.

The key insight from this experiment, at least for me, is that LinkedIn’s algorithms are geared towards the content consumer and not the creator.

The change in their algorithm means you are more likely to see more content from one creator than a vast group of creators. For example, you are 60% more likely to see a post from someone that you have interacted with on your feed. LinkedIn, like other social media platforms, is changing what you see in real time as you interact with what’s on your feed.

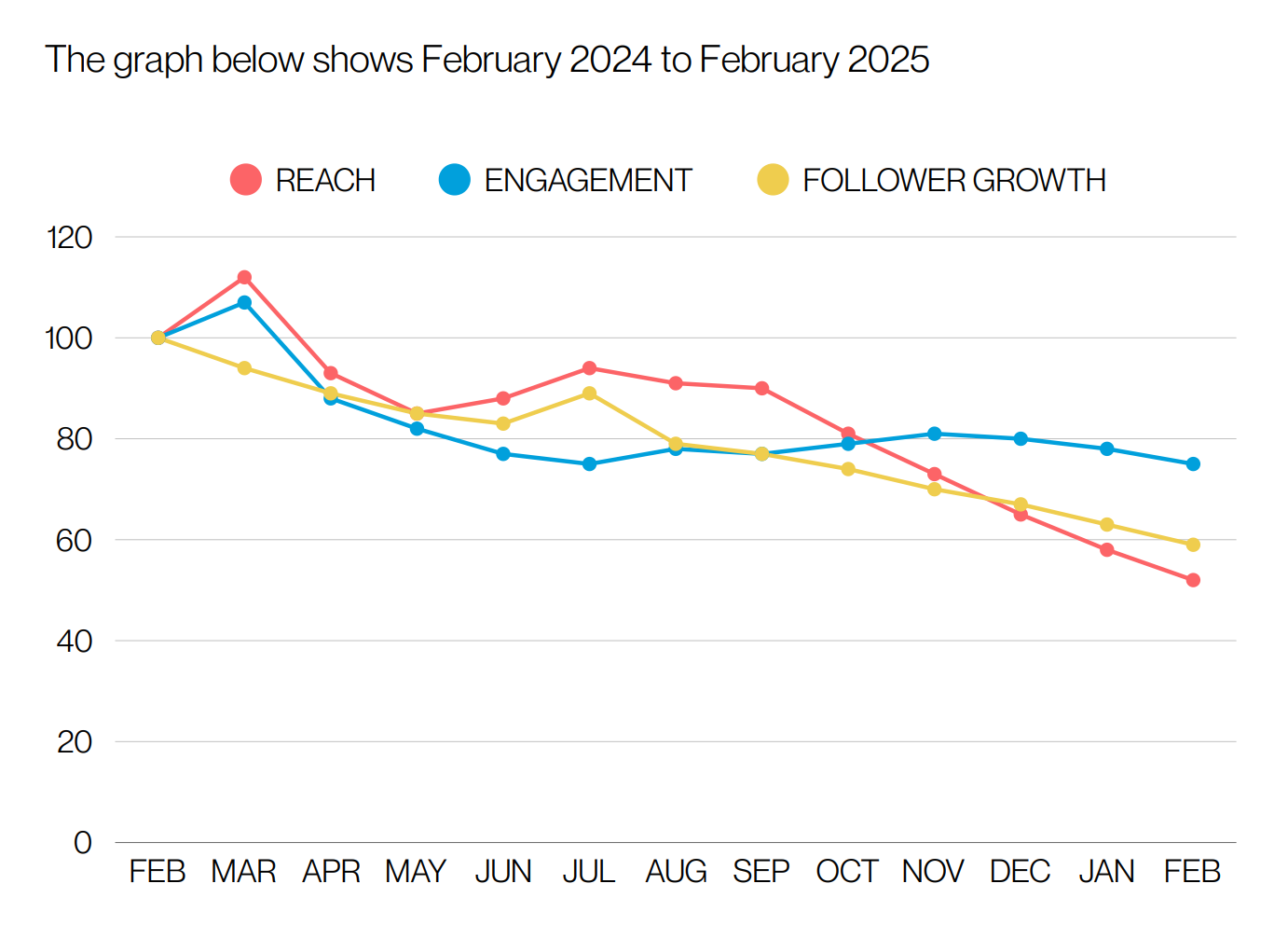

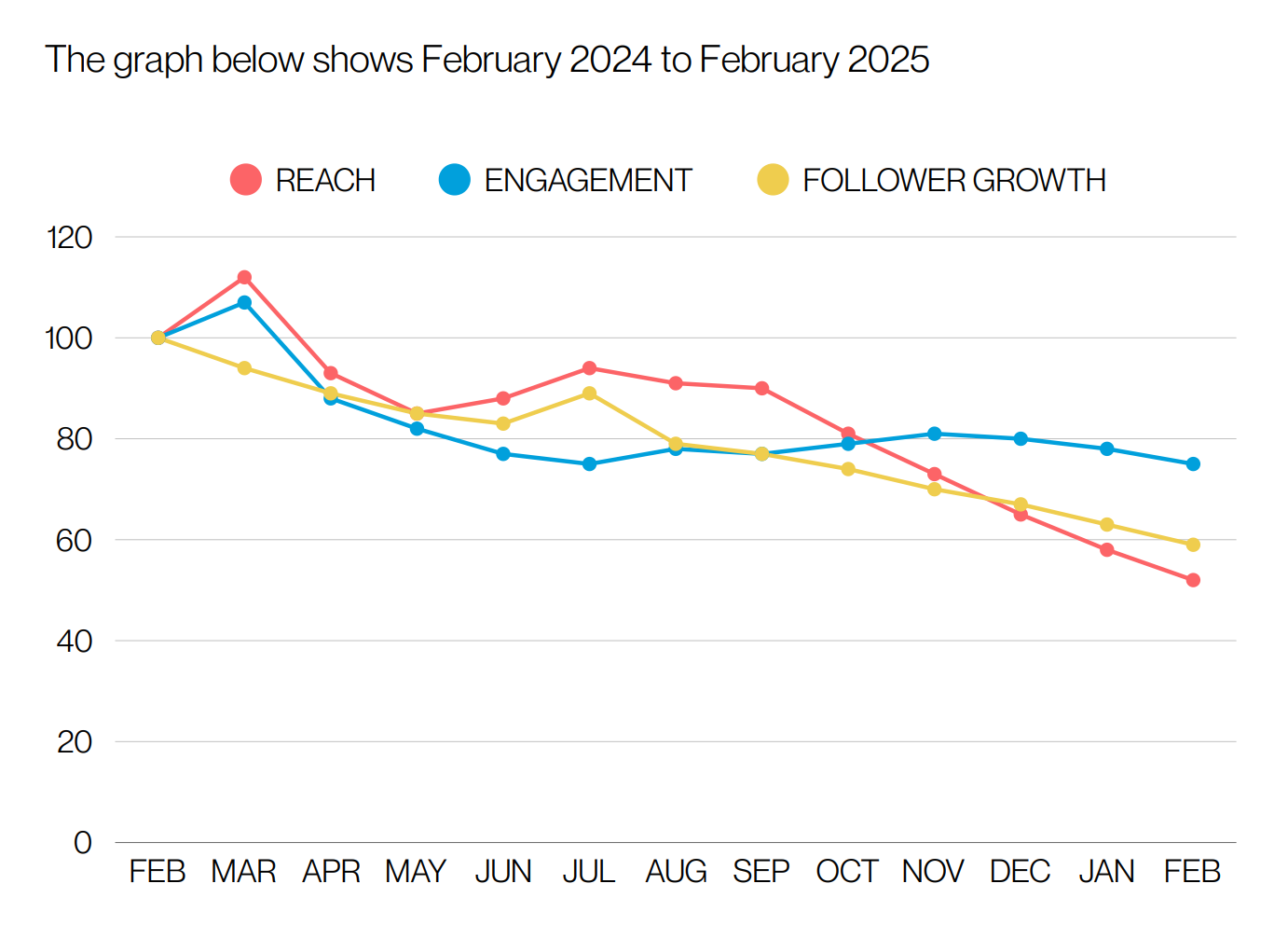

As a result, as pointed out by the Algorithm Report, reach, engagement and follower growth have declined dramatically since last year.

Source: Just Connecting™ and Richard van der Blom

The bottom line – the performance of short form videos may have been handicapped because I wasn’t able to reach an audience that prefers that content format.

LinkedIn lives on creator content and that content, according to the report, is quickly moving to video (an increase of 23% in 2024 over 2023). What the report doesn’t show, nor could we, is that it is any more effective than anything else.

If you’re searching for an ROI for the business impact of any type of content posted on LinkedIn, it may not be the format but rather the channel that is the problem.

Now let’s see if anyone reads this content…don’t make me do another video!

Special thanks to Ben Armstrong at 9Mile media for the creation of the videos and Naheed Somji, our social media guru for his support and advice.

by Christina | Jan 23, 2025 | 2025, Tech Trends

As previously published on 1/16/25 in MarTech

An interesting piece of research was released last week but may have been lost in the busy holiday season.

Previsible, an SEO consultancy, announced that traditional Google search has “basically plateaued and has begun to have its search dominance degraded.” Why? People are using AI assisted search because it has gotten more capable and accessible.

ChatGPT, Claude, Co-pilot, and even Google, offer an AI search version available to most users. Compared to the traditional search, which relies mostly on keyword matching, AI search uses advanced algorithms to understand the context and intent behind the query. As a result, at least in theory, it should provide more relevant and personalized results.

The new capabilities and changing user behaviors are creating a potential warning about the risk of relying on AI. Because of AI’s ability to draw upon vast amounts of information, users often default to trusting that the query output is most likely to be the right answer, solution, recommendation, etc.

As opposed to the traditional search which returns the links to what are the most likely options to answering the query, the user has to make the effort of analyzing the results, reading and filtering information, and drawing conclusions.

And here lies the potential problem.

Nvidia’s CEO, Jensen Huang, stated on the company’s most recent earnings call that we are “in the beginning of a new generation of foundation models that are able to do reasoning and long term thinking.”

Cognitive scientist Gary Marcus says the AI we are currently building is basically like “System 1 thinking,” a reference to Noble Prize winning psychologist, Daniel Kahneman’s, “Thinking Fast and Slow” book.

In his book, Kahneman explains the dichotomy of human thought. System 1 being intuitive and fast with no voluntary control. This being one of the reasons he concluded that humans are bad at making decisions. System 2 thinking allocates attention to the effort that demands focus, oftentimes because of its complexity and/or need for computations. Think of the two systems as instinct or “gut feel” and critical thinking.

If, as the AI experts state, we are building System 1 AI models then users are at risk of making the same mistakes using AI as they might make in day-to-day decision making. And, as an observer of younger generations of marketers using AI, they may be particularly vulnerable.

My son, home for the holidays from grad school, mentioned that classmates are not only using ChatGPT to summarize course work, but also to write their presentations. And…they’re not questioning it, they follow the recommendation completely because it “saves time.”

B2B marketers are using AI tools profusely for research, writing, and recommending actions because they are “quick and accurate.” They have grown up in an environment that has emphasized scale and speed, and they lack the experience or interest to question the accuracy of what is being outputted by AI tools.

Where is this headed? Combine all of these factors and it could point to a massive wave of “group thinking” marketers that either lose the ability to think creatively and/or strategically, or eliminate it completely because they are wired to trust AI.

Generative AI has already come for the creative department as witnessed by Omnicom’s recent acquisition of IPG. If marketing executives don’t act now to create a plan to manage AI, “Hal” could become your CMO in a few years.

How should marketing executives respond to this threat? Daniel Kahneman might suggest focusing on skill development that emphasizes System 2 thinking. Teach your team how to do long term, critical and strategic thinking.

Combine the strength of using AI System 1 thinking to enable your staff with training on higher level System 2 type efforts like competitive intelligence (which I rarely see any more), market intelligence and strategy.

There is good reason to get back to these core strategic marketing building blocks. Marketing performance in 2024 was significantly down across channels and activities. It’s time to dig in on strategy. There are significant challenges to address. Going faster and creating more noise in the market is not a strategy that will win.

In 2017, I wrote an article on how Amazon had become the default search engine for buyers who knew what they wanted based on our research on buying behavior. In that post, I predicted that because of that trend, Amazon would soon eat away at Google’s advertising monopoly. At that time, Amazon only had 1% of the global advertising market. By 2020, it had grown to over 10%. This year it will be 14%, and by 2026, it’s estimated to become over 17%.

I see a similar trend with AI eating away at the marketing department, not because of the tools themselves, but by how behaviors are changing because of them (similar to what I observed with consumers and Amazon). To be clear, it’s not necessarily the technology that is the threat, but rather the behavior change caused by it.

If marketers want to remain valuable inside their organizations they will have to learn how to use AI tools to enable better decision making and not default to them as the decision maker. Or as my son’s professor said; “use them to become a better student, not to be the student” and remember, they’re only System 1 thinkers 😉.

by scott.gillum | Mar 19, 2019 | 2019, Tech Trends

by Glen Drummond, Chief Solution Architect

Blockchain might be in the trough-stage of the “hype-cycle,” but there are some convincing arguments that blockchain will change things. These arguments are not, incidentally, dependent on the success of bitcoin or blockchain currencies generally. Rather, they are based on the compelling integration of a distributed ledger, smart-contracts and micro-payments.

I have a hunch, one that I’ll lay out in a minute, that this combination could have an impact on the B2B demand-gen space. Before that, let’s step back and look at the kind of blockchain use cases that are already underway.

There’s nothing particularly mysterious – or blockchain-dependent – about “smart contracts.” They’re already a part of our lives. When you step out of an Uber ride, you’ve executed a smart contract – with the help of the Uber platform and your credit card. When you close the door to leave your Airbnb you’ve executed another. When you buy groceries in an Amazon Go store, you’ve executed yet another.

From a user’s standpoint, what makes these contracts smart is that they focus your experience around the core satisfaction of your goal. Everything that’s not core is automated out of the foreground and into the background of your experience. The experience in other words, is more about what you want, and less about what you have to do to get it[2] . In a not unrelated extension of this point, what makes these contracts smart from a business standpoint is that they kick the stuffing out of incumbent business models and grab market share like a gangsta. Especially when network effects tip in their favour.

Now, clearly, from the examples above, you don’t need a blockchain in order to have smart contracts. So, what conditions make it helpful to combine the concept of blockchain technology (an indelible, distributed record of events) and the concept of a smart contract? The answer cited by blockchain experts is in conditions where there are numerous independent participants in a value chain.

Think, for instance, about the farm-to-table journey of a single bag of pre-washed lettuce.

Let’s run a speculative tally of independent participants in this value chain:

- The primary producer who grows it and hauls it to the processing plant.

- The processor/packager who buys the lettuce and prepares it for its journey to market.

- The long-haul transport that moves it from the packaging facility to food terminal or retailer warehouse.

- The food terminal or retailer warehouse.

- The transport firm that moves it from warehouse to retail point.

- The retailer.

- The purchaser.

Potentially, that’s five different databases through which the record of that bag of lettuce needs to travel.

So what?

Well suppose that bag of lettuce is determined to have some E. coli problems. Tracing the problem back to source goes more quickly and certainly when all of these independent members of the value chain collaborate in a single system of record that tracks each skid of lettuce in an indelible, externally-validated way. (If you want to learn more about this sort of farm-to-table traceability, there’s lots written about it, like this essay in Medium.)

Now let’s overlay smart contracts on this case.

Let’s suppose the retailer knows that the progression of E. coli in a bag of lettuce is a function of (a) bacterial levels at origin, (b) the management of the cold-chain over the journey, and (c) the duration of the journey. Still assuming, say that the retailer is very interested in not having any customers getting sick, or worse, from ingesting produce purchased at their store. In that case, it would be in the retailer’s interest to orchestrate a system in which smart-contracts link compliance with source quality assurance testing, cold-chain standards (as measured by IOT sensors) and delivery-timing standards to payment.

Non-compliance with standards could produce non-payment. Performance above standards might produce incremental incentive payments. And once translated into smart contracts, this system of aligned incentives could operate persistently without much cost and effort devoted to enforcement, validation or back-office. This kind of thing is actually happening now and other examples are coming very soon.

Now that we’ve established the lettuce use-case as the basis for an analogy, let’s think about the number of independent participants involved in enterprise-scale B2B demand-gen. We’ll begin with software providers.

At last count, according to Scott Brinker, the marketing organization of the average enterprise employs 91 cloud services, and Sales uses another 43. To develop the analogy, think of the IP address of a prospective customer like a bag of lettuce, traveling through the hands of dozens of separate parties (the cloud-software providers) on its journey to a purchase from the enterprise.

Granted, these hand-offs happen very quickly because they take place in virtual not physical space. But they happen, and they certainly cost a substantial amount of money – paid for today mostly through SaaS subscriptions. (More on that in a moment).

Then there are the creative contributors. Most Enterprise B2B firms have some combination of agencies (plural), in-house contributors, and freelance talent. Are enterprises today able to truly connect remuneration with performance from those contributors? Attribution of marketing effectiveness (ROMI in industry jargon) is not yet an exact science. And that’s probably putting it mildly.

So then, what if an enterprise involved in B2B demand-gen were to approach the providers of both technology and creative services and ask them to restructure their compensation model into smart contracts instead of monthly SasS fees on one hand and, creative and professional services fees on the other?

Imagine a blockchain infrastructure, spanning the host of technologies that span the journey of a prospective buyer’s web-browser, from first contact to signed contract.

Imagine smart contracts arranged around indicators of progressive buyer engagement, executing micropayments for content that works, and software processes that help.

And imagine an incentive framework in which there’s no question that the work that matters is rewarded, and the work that doesn’t is of less and less concern to everyone involved.

Of course there will be many obstacles.

We will need a blockchain platform that is vastly more energy-efficient than the one powering bitcoin.

We will need a blockchain platform that is viable for micropayments at the fraction of a cent level and free of the transaction overhead levels associated with traditional financial clearing services.

We will need at least one determined and courageous enterprise to create the conditions for technology and creative contributors to join this loose-knit smart-contract consortium.

We will need a period of experimentation and learning.

And, perhaps most difficult, we will need the people in charge of those technology and creative firms to deliberately challenge their current business models.[3]

But, with the relentless drive for more accountability around marketing spend, it’s not hard to imagine how attractive it would be for an enterprise to focus [4] remuneration more directly around the core satisfaction of their goal, while everything that’s not core is automated out of the foreground and into the background of their experience.

No more agency hourly rate cards discussions.

No more scope-change discussions.

No more annual SaaS subscriptions.

No more “supplier lock-in” worries.

The enterprise will, instead, automate remuneration for both technology and creative services through smart contracts triggered by purchaser behaviour. It’s a “pay-for-performance” model with almost unlimited granularity, and once established, very low friction.

With seven thousand mar-tech software firms now competing for a share of the same B2B enterprise demand-gen budgets, it’s not hard to imagine that late-comers on the long-tail of this community would seek an invitation to the party by means of a business model shift. For the major SaaS players, smart contract revenue could offer a strategy for reaching a broader market, and for testing new offers.

With agency business models under pressure from all sides, there are clearly incentives for a change that better rewards creative excellence and expertise according to the value of its performance. Smart contract revenue could also buffer the revenue volatility inherent to businesses with a handful of big clients that come and go, since smart-contract revenues could continue to flow from content that continues to perform in the aftermath of a client’s departure.

Blockchain enthusiasts have suffered from the accusation that blockchain is a hammer looking for a nail; a solution looking for a problem. But in B2B demand-gen, we have pent-up stubborn problems at multiple points in the value-chain.

When we look at how the incentives of all these players align around this new model, there are reasons enough to imagine that network effects will eventually kick in, if someone can get this ball rolling. But what will it take for that to happen?

As noted above, we’ll need some new technology – specifically a blockchain platform that is energy-efficient and can handle micro-transactions at scale.

We’ll need a handful of firms in every stage of the value-chain who view their business model as an instrument of their strategy rather than an expression of their identity.

We’ll need a leader who goes first: An enterprise marketing leader who is willing to take the risk of creating a new paradigm for managing B2B demand-gen, in order to achieve persistently guaranteedreturns on marketing investment in both technology and content.

And, we’ll need a community of innovators, all across the demand-gen value chain, who want to collaborate on solving the novel problems that will come up.

So, there you have it – a back of the napkin (abeit a big one) sketch of a B2B Demand Gen Blockchain. Nearly impossible. Or inevitable. Or both. What do you think? I’d love to hear your thoughts.

Be among the first to get all of our updates delivered straight to your inbox by join our email list here!

by scott.gillum | Mar 9, 2017 | 2017, Tech Trends

It’s coming, the “futurists” are saying that the hype about Artificial Intelligence is real. The reason according to Andrew Ng, chief scientist at Baidu, is that AI is no long a “magical thing” but is now creating real value for companies, like Google and Baidu. Companies are now finding “pockets of opportunity” to invest in AI. But there is also something else at play that is also making the timing right for AI.

Americans are now living in highly polarized political environment. We’ve seen it play out in TV commercials, “resistance movements,” and daily news coverage.

At the same time, researchers have recently shown that it’s more than a person’s mindset that determines their political beliefs; it’s their actual mind itself. More specifically, the physical structure of the brain of those people on the ”right” and the “left” are different, and it impacts how information is interpreted, decision are made and how you see the world.

People who describe themselves as “liberals” tend to have a larger anterior cingulate cortex, the area that is responsible for taking in new information and that impact of the new information on decision-making. Meanwhile, “conservatives” tend to have a larger right amygdala being a deeper brain structure that processes more emotional information, in particular, fear-based information.

As a result, the adult world is made up of, to a certain degree, two hard-wired types of people, who see and interpret the world differently. In fact, according to the Pew Research Center there has been a dramatic political polarization of Americans over the last 20 years (see the graph below).

Put it all together and you have a perfect scenario for AI machine learning. Machines look for consistency in patterns to make predictions, and apparently we have become more predictable than ever before. Using psychographic segmentation along with online research tools, machines can more accurate and effective target and message to unique audience segments.

Our minds are already predisposed to interpret information differently. Layer on that our opinions and beliefs are becoming more distinctly aligned with other like individuals and you’re seeing the “middle” is disappear.

These distinct groups also use unique channels for information and communication that reinforce their beliefs and opinions, making it easier to find and message to them. In the end, the target, channel and message are all becoming increasingly more defined as a result.

While polarization is making it more difficult for one group to understand the other, it is making humans a lot easier for machines to understand.

Get Carbon Design’s latest news and blogs delivered straight to you inbox! Join our email list here!

by scott.gillum | Mar 30, 2015 | 2015, Tech Trends

Last week I had the opportunity to attend two conferences that spanned the horizon of marketing. I went from “hoodies” at SXSW to “blue blazers” at the Institute for the Study of Business Markets (ISBM) Winter Member Meeting

Attendees at SXSW Interactive were young digital marketers, at the early stage of their careers. The ISBM crowd was comprised of mostly senior-level executives with 20 to 30 years of experience working for established companies.

Below are some insights from both of the events:

- Marketing is a tech wonderland. I had the chance to wander the event floor at SXSW, marvel at all of the new technologies, play with new apps, as well as attend a couple ofsessions by new tech vendors. The theme of the ISBM event was Analytics & Analysis, and I got more than my fair share of data analytics, business intelligence, econometric modeling … you name it. If you still think that half of your marketing budget is wasting away, but you don’t know which half, you’re behind the times.

- Analytics and dashboards are foundational. I saw a great presentation by Dell, which showed how the company has now mapped buyers across the buying process, complete with understanding their needs, time spent at each stage and how to optimize the experience. Likewise, Wesco and Teradata shared a wonderful journey of how Wesco put into place the tools needed to become a data-driven marketing group, enabling the company to tie its activities to business outcomes, or in this case, revenue. From what I heard and saw, companies have built the foundation to pull, analyze and report marketing performance data. Some have even made the leap into forecasting and predictive modeling.

- Investment is still a challenge. A thread ran through the ISBM event concerning the challenge of securing the funding to buy new marketing tools and/or staffing teams. Despite several speakers presenting solid case studies with clear ROIs, they were still challenged with getting the support and funding needed to continue making progress.

After having time to digest the week’s sessions, I still had a few lingering questions in my mind concerning what I heard and saw. For example:

- Is there a lack of organizational acceptance and/or appreciation of marketing insight and activities? The question that popped into my head regarding the funding challenge was, “Are marketers able to make the business case in a way that makes executives want to fund their request?” The other issue was marketing’s ability to communicate effectively across the organization based on it

s culture. One speaker, Bill Rozier from Ciena, provided insight into how to do it effectively. Bill created a lead generation report in an easy to understand PowerPoint slide. As Bill said, “The sales team has to be able to get all the information they need in 30 seconds or less, or we’ve lost them.” Since Bill’s new report launched less than two months ago, lead reconciliation rates have gone from 13 percent to over 70 percent.

s culture. One speaker, Bill Rozier from Ciena, provided insight into how to do it effectively. Bill created a lead generation report in an easy to understand PowerPoint slide. As Bill said, “The sales team has to be able to get all the information they need in 30 seconds or less, or we’ve lost them.” Since Bill’s new report launched less than two months ago, lead reconciliation rates have gone from 13 percent to over 70 percent.

- Is there, or will there be, a communication gap between the “Hoodies” and “Blue Blazers”? It’s not necessarily a generational one, although there is that. Rather, it’s one based on what they view to be important and valuable. I saw some great social media tools at SXSW that provided deep insights into audience engagement and buyer intent. But close to half the marketing executives at the ISBM meeting had revenue targets, and almost all had lead targets. It made me think that there may be, or may soon be, a potential communication issue between the digital-savvy “engagement and intent” crowd and the “lead and revenue” veterans. From what I saw, there is still work to be done to close the gap between social media results and the connection to key performance metrics valued by marketing executives.

- Will marketing overplay analytics? Perhaps my biggest concern reflecting on the week is twofold. In business-to-business companies with strong product (and engineering) cultures that are empirically driven, will the utilization and reliance on new marketing tools and data limit an organization’s creativity, and/or innovation? The second concern has to do with organizations where marketing feels like they are under attack. Will marketers use their new reporting capabilities as a defense mechanism, hiding behind the data, instead of using it proactively to provide the organization with new insights and opportunities?

Despite these and other questions still weighing heavily on my mind, I did reach two solid conclusions. The first, Austin is by far the best food-truck town in the United States, and the second is that Tampa’s weather is the salve for the burn of the harsh Northeast winter — a point brought home to me as I returned from Tampa just in time for our first-day-of-spring snowstorm.

by scott.gillum | Sep 15, 2014 | 2014, Tech Trends

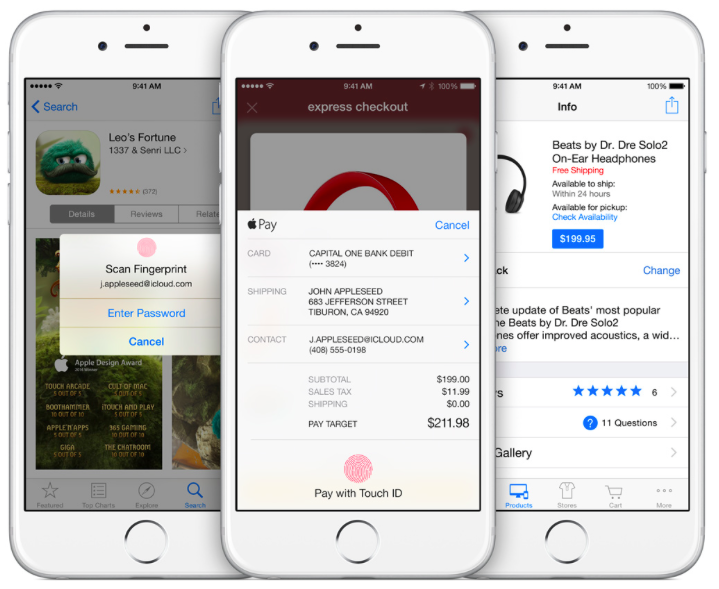

Like much of the world I tuned in last week to watch Tim Cook unveil the latest Apple products and services. Afterwards, I was curious to see the analysts and so called “tech experts” reactions on the announcement. Most were ho-hum “nothing new here”, and “it was what we expected,” the market response was similar, with the stock getting a small bounce then falling after the announcement.

Apple, better than anyone, gets the “use case” right for its technologies. And it is why I was surprised by the media and analysts reaction. Listening to the announcement and recap, most of the focus on Apple Pay was on Retail use. In the press release, Apple discusses the near field communication (NFC) technology, names its retail, credit card and bank partners. Pointing out that there are merchants ready to accept Apple Pay as a very secure payment method. But nothing that really got the media excited, go into any Starbucks on any day and you will see plenty of mobile transactions.

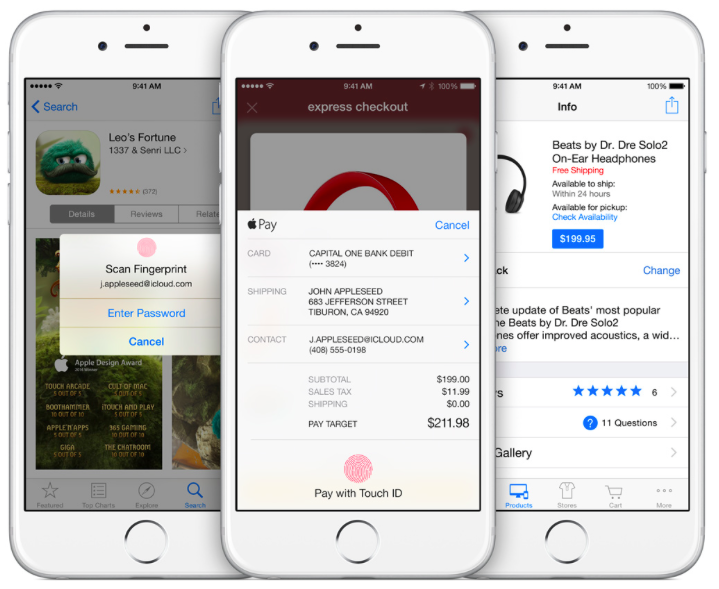

Digging a little deeper, buried at the bottom of the announcement is something more intriguing – “Touch ID” which enables “one touch checkout” for Online Shopping Apps. Say good-bye to the hassle of entering your credit card information on the small screen. See something you like, touch it, and it’s yours!

App developers have already started building Touch ID into retail apps. On the same day of Apple Live, Target announced that it has adopted the Like2Buy platform that which allow the chain’s Instagram followers to buy products featured in photos and Target is now integrating Touch ID into its mobile app. Touch ID for mobile apps is the big deal, but not for the reasons you might think.

Apple is a “big play” kind of an organization. A $349 watch, and people upgrading to an IPhone 6 isn’t going to move the needle for a $171 billion dollar company. Apple Pay helps but that’s a basis points play that gets split multiple ways between the service provider, credit card company, the bank, etc., and it will take years for it to be widely accepted. So where’s the “big play” with Apple Pay?

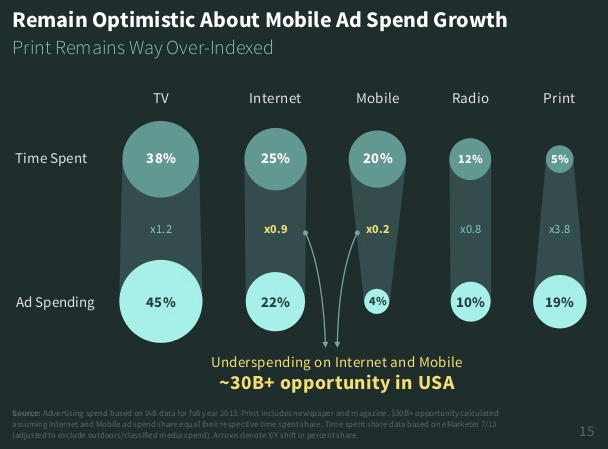

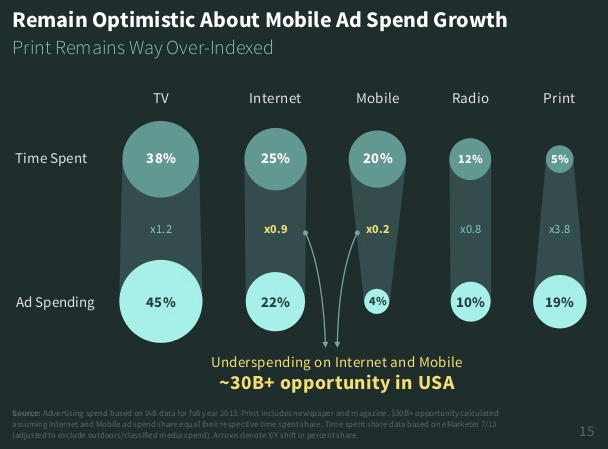

It’s mobile advertising. According to Mary Meeker in her 2014 Internet Trends report, mobile advertising represents a $30B opportunity in the US alone, based on time on device. Ad spend has lagged because of issues relating to tracking and measurability.

This is why Apple Touch ID is so important; it has the potential to improve tracking, measurability and ROI significantly. With TouchID the buyers never leaves the screen to transact. Attribution, tracking and conversion rates will improve, but the challenge remains — how do you get consumers to transact?

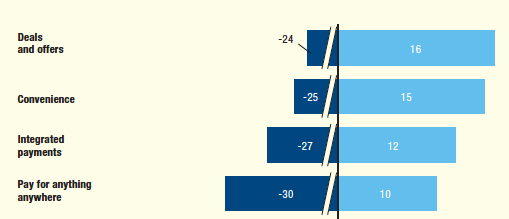

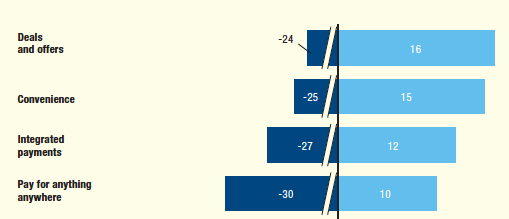

According to McKinsey’s From solutions to adoption: The next phase of consumer mobile payment, you give them a special deal or offer – an ad. There’s the closed loop.

Most important Drivers of Mobile Payments

Respondents ranking most important (light blue) and least Imports (dark blue)

Apple has had a long history of introducing products at the beginning of the “hockey stick”, usually relating to the consumer adoption curve of new technologies, this time the hockey stick is mobile advertising. The real payoff of Apple Pay for now, in my humble opinion, is not retail, it’s mobile and it is about buying on your phone versus paying with your phone.

s culture. One speaker, Bill Rozier from Ciena, provided insight into how to do it effectively. Bill created a lead generation report in an easy to understand PowerPoint slide. As Bill said, “The sales team has to be able to get all the information they need in 30 seconds or less, or we’ve lost them.” Since Bill’s new report launched less than two months ago, lead reconciliation rates have gone from 13 percent to over 70 percent.

s culture. One speaker, Bill Rozier from Ciena, provided insight into how to do it effectively. Bill created a lead generation report in an easy to understand PowerPoint slide. As Bill said, “The sales team has to be able to get all the information they need in 30 seconds or less, or we’ve lost them.” Since Bill’s new report launched less than two months ago, lead reconciliation rates have gone from 13 percent to over 70 percent.