by scott.gillum | Jun 18, 2018 | 2018, Opinion

The experience of selling our house has been a good reminder of the importance of goodwill in the negotiating process.

We were fortunate to get a couple of offers on our home. Hearing feedback from our neighbors and realtors, we learned that one couple with young children really loved our home, especially the trampoline in the backyard!

As we responded to the offers we made it clear to the realtor of a family with the young children that we really wanted them to have the house. Our children, now in college, were a similar age when we first bought the house. The neighborhood was a great place to raise kids and we thought it would be nice to “complete the circle.”

And that’s when the trouble started. Our counteroffer made it clear that we were negotiating in good faith trying to meet the couple in the “middle.” Except they didn’t. They stood their ground forgoing the traditional comprise an approach to pursuing a “we win, you lose” stance. As an emotionally charged seller, I can confirm that this tactic did not go over well.

The disconnect was that we were selling a home full of memories which we wanted to pass along to another young family. As the buyers, they were just making a purchase decision at the best price as possible. It was a transaction for them. And with that, they took out all of the goodwill.

For example, the family was moving to the area from out of town. We’ve lived in the area for thirty years, 14 years in our current location. There are things that would have been helpful to know about our home, our neighborhood and our community. Our children attended the school their children will mostly attend. Played on the soccer fields, and in the school gyms where their kids will play. Insights from a resident on teachers, coaches, neighbors are usually helpful to someone new to an area.

Because they changed the rules of the game none of that conveyed. The relationship had been killed. Think about that when you’re negotiating a business deal. Deals are made between humans so emotions are involved. In the end, you may get your price but at what cost? What goodwill may have been lost? What could the seller tell you that could help with implementation, use of the product/service, etc.

The secret to a good deal is that both parties feel like they gave up something but that they also got something in return. You may feel good about the short-term gain — but by making the other party the “loser” it might cost you in long run.

by scott.gillum | May 12, 2013 | 2013, Sales

John Wanamaker was an innovator, a merchandising, and advertising genius. But when he made the statement; “Half the money I spend on advertising is wasted, the trouble is wasted, the trouble is I don’t know which half.” He left legacy that has haunted marketers ever since.

New research from CSO Insights suggests that the day may have come for sales. In their annual Sales Performance Optimization study of over 1500 companies across multiple industries, CSO found that the accuracy of sales forecasting fell to a near all-time low of 46.5%. Or as John Wanamaker might say; “Half of your sales efforts are wasted, you just don’t know which half. “

And since the forecast, defined in the study as near-term (30, 60 and 90 day), is an output of the sales pipeline, one could also conclude that half (or more) of the pipeline is “junk.”

With the wide spread adoption and utilization of CRM (84% of the firms surveyed), marketing automation, and analytical forecasting tools, the question is how can this be?

Here are some thoughts on why this might be happening, and five tips to help you improve your forecast.

Reasons for poor forecasting:

- Impurities in the System – let’s go after the big one first. “Garbage in, garbage out”…as they say. There’s a laundry list of things to look for — from reps putting leads in the system right before they close, to not updating opportunity consistently, and leaving in dead leads too long.

- Sales Optimism – yes, the economy seems to be recovering but it may not be moving at the “speed of sales.” Sales folks are an optimistic bunch; they want to believe things are better than they may be in reality. For example, the average length of the sales cycle. In a report earlier this year by BtoB Magazine, 43% of marketers reported that the sales cycle had increased over the last 3 years. Which is consistent with the CSO Insights report where 42% of Chief Sales Officers stated that the sales cycle had lengthened, in particular with new acquisitions.

- Incentives & Goals – take a look at how reps are being incented, and/or their sales goals. You may find the reason why reps leave opportunities in the pipeline too long, and/or are over optimistic with their forecast. Pressure to build and maintain pipeline can sometimes cause counter productive behaviors.

- Gut Feel – even if the troops in the trenches are putting in accurate and timely data, the generals may change it to fit the political environment and/or their own personal bias.

- Changing Buyer Behavior – recent research has shown that the buyer’s journey, and the typical sales process are not aligned. Buyers frequently start and stop the journey, or will cycle at a stage, and even move backward in the process. CRM systems are typically designed in a linear approach, progressing from a lead to a close. It’s an internal view, and increasingly out of alignment with buyers’ preferences.

How to improve:

- Active Pipeline Management – The pipeline and forecast will never be 100% accurate. That said, you should have a feel for how far off it is, and what is needed to improve. For example, do you have an inspection process to keep the pipeline current? If so, consider doing it more frequently. Move quarterly reviews to monthly. Also, if everyone is responsible for updating the pipeline, then no one is responsible. Consolidate the “maintenance and hygiene” of the pipeline to one person. Others may be responsible for providing updates, but one person needs to police the system.

- Discount Probability and Value – conduct a post-mortem on past forecasts over last year or two. Assess the difference between forecasted and actual results. Create discounted probabilities based on that delta for: lead movement (from stage to stage), and lead value. If implemented, evaluate the accuracy of your “pre-set” discounts. It should help bring forecasts more in-line and ground “sales optimism” in a bit of reality.

- Govern the Process – to improve the accuracy of “output”, focus on implementing and managing a standard process. Accenture’s Connecting the Dots on Sales Performance found inconsistencies among reps in using their company’s defined process and methodologies to selling. A quarter of Chief Sales Officers surveyed stated that sales reps used their sales methodologies 50% of the time, 31% said it was used 75% of the time.

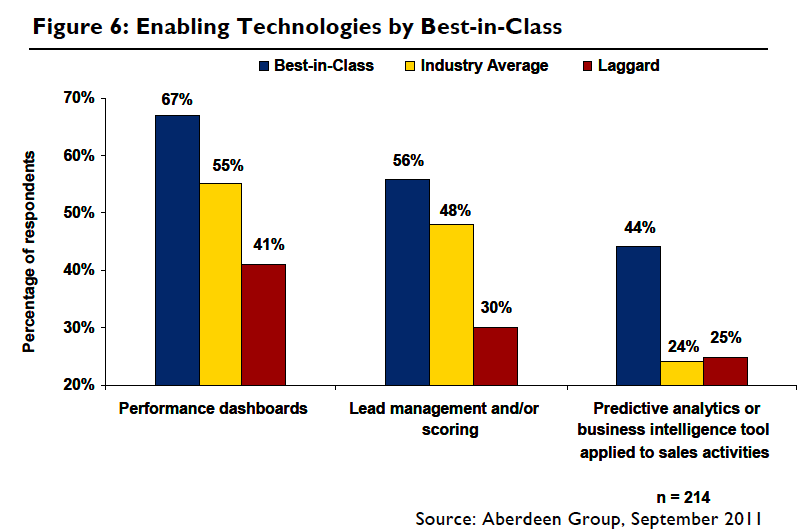

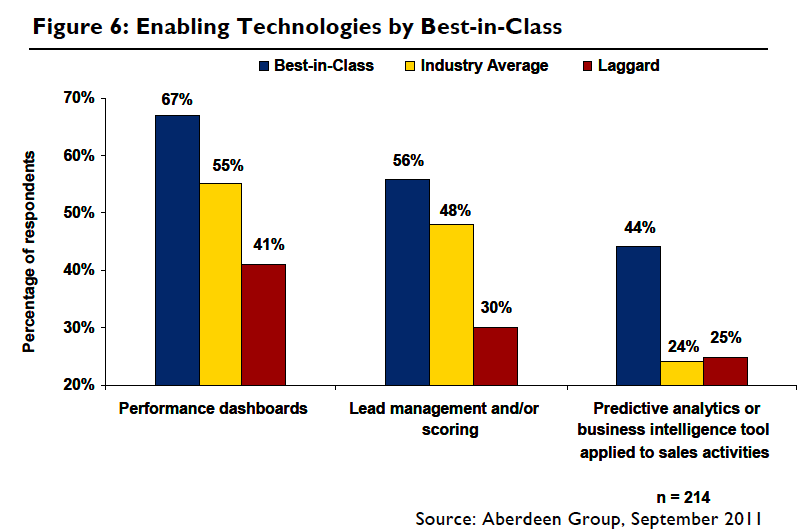

- Leverage Marketing – close the feedback loop with marketing to improve the quality of leads from campaigns and activities. In a report on Sales & Marketing Alignment by the Aberdeen Group, marketing accounted for 47% of the sales forecasted pipeline in the Top 20% of companies studied, compared to only 5% of laggard organizations (bottom 20%).

- Utilize Business Intelligence Tools – high penetration rates of CRM may equate to high visibility, but doesn’t automatically mean that it provides the best insight. Despite high adoption rates of performance dashboard, few companies are using business intelligence or analytics tools according to the Aberdeen Group report on sales forecasting. However, the report found that 44% of the highest performing sales organizations were using predictive analytics to reduce “gut feel” in the forecast.

Of all the options, perhaps the best lever for impacting accuracy is the rep. As Ashish Vazirani, a Principal in the Hi-Tech practice of the sales consultancy, ZS Associates says; “A sales person needs to be coached, or apprenticed on how to discern and input the right information for accurate forecasting. Technology can make us lazy and reliant on the tools to do the thinking, we need to emphasize the importance coaching plays in keeping the garbage out of the system. ”

Helping the troops become better soldiers through coaching should help improve the accuracy of the forecast. As well as, implementing the tips mentioned above. But you may still find that half of the pipeline is wasted, but hopefully, unlike Mr. Wanamaker, you’ll understand which half.

by scott.gillum | Jan 2, 2013 | 2013, Sales

Twenty-five years ago, I was a snot-nosed kid out of college who suddenly decided that law school was not in the future. With a recession on, and needing to pay the rent, I took the first job offered and went into sales.

Having learned nothing about the profession in college, I picked up a copy of Miller Heiman’s Strategic Selling — still have a dog-eared copy on my bookshelf. I learned everything I could about the buyer types, account management, and the sales process. “Know the process work the process,” as my first sales manager used to say.

Typically, that process came down to 5-to-7 steps that generally covered the following areas below.

Over the years, I found that working the process helped give you sense of control. It came down to the numbers; calls, leads, transaction sizes or conversion rate. Call on X number of qualified prospects to get Y amount of proposals, at Z close rate, and you made bonus.

But, research from Google and CEB entitled The Digital Evolution in B2B Marketing provides new insight into buyer behavior, and it challenges the conventional wisdom. According to the study, customers reported to being nearly 60% through the sales process before engaging a sales rep, regardless of price point. More accurately, 57% of the sales process just disappeared.

What are buyers doing if they’re not talking to sales? Well, they’re surfing corporate websites to identify and qualify vendors, instead of the sales forces qualifying them. They are engaging peers in social media to learn more about their needs, potential solutions, and providers. And they’re reading, listening to, and watching free digital content that is available to them at the click of a mouse. No longer is the sales force the sole source of information.

What does this mean for sales and marketing?

The study recommends focusing efforts in three areas; 1) improve marketing communication integration, 2) develop and activate a content strategy, and 3) strengthen multichannel analytics. Nothing new or breakthrough here, but the study provides good examples of how companies are executing against each point.

However, I found a number of other points to take from the research.

- It is not all bad news – for products or services with low price points and/or margins, having customers self direct themselves through the sales process can help reduce the cost of sale and/or create leverage for the sales force. In fact, in certain situations an organization will want to encourage and/or incent this behavior. The research also found that some customers felt comfortable going through 70% of the process before making contact.

- Changing buying behavior – an old manager used to say that technology changes fastest, then consumer buyer behavior, and eventually, organizations. The “57%” stated in the research makes for a good sound bite; the fact is, that number will vary, greatly by customers, transaction, industry, etc. The point is that change is a constant; the question is how far ahead or behind is your sales and marketing efforts? Are you keeping pace? The second question is, how would you know?

- Content Distribution – as the study notes, the sales force is still the most effective and important communication channel. When developing the content strategy ensure that the best and/or most valuable content is not in the public domain, reserve it for the sales force.

- Time to Take Social Media Seriously – with well-informed prospects, sales reps have to quickly learn what buyers know or perceive about the organization, products/services and competitors. Social media can help them better understand what is motivating buyers to take action, what buyers believe to be true, and perhaps most importantly, who they believe.

The Future

Business decision makers will continue to drive their buyer process deeper into the sales process. As a result, relevant content will continue to escalate in value, especially content related to consideration and purchase drivers, and the business application of the product or service.

Social media and monitoring has helped many marketing organizations understand this trend and to make the transition from being content “dictators” to information “facilitators.”

For sales, the research may be an epiphany. No longer can it be successful focusing solely on an inwardly directed process intended for reporting and planning purposes.

With ever-increasing knowledgeable buyers waiting longer to engage, sales has to transition from being a “product pusher” following a process, to an insight “provider” adding value to the buyers business. As the study states, sales must deliver “pointed insights and evidence that seek to challenge an entrenched point of view among potential customers.”

Finally, it is time to recognize that we’re not in control, and perhaps we never were. The traditional sales process is now obsolete; it is now time to follow the buyers’ journey.