by scott.gillum | Feb 2, 2017 | 2017, Sales

The organization has a short-term ‘sales culture’ so almost everything marketing does is oriented to creating a lead. You know that there are larger system/infrastructure issues that are impacting performance but you can’t anyone to invest/focus on them. You’re on a trend mill running as fast as you can, but going nowhere.

It’s a nightmare thousand of marketers are living everyday, so let’s get to fixing this issue, permanently. The problem, at its core, is money. Yes, resources and time are also issue but the bigger challenge is that you have is a budget loaded with program dollars intended to be spent on media, events and other lead generating activities. Unfortunately, little are earmarked to fix the web infrastructure, navigation and content issues that are keeping leads from converting. You have a system problem, without system dollars to fix it.

Step one in the process is to get a capex budget. Just like the one used to build the corporate website. And get a big one, depending on size of the website you’ll need at least $500K, and perhaps over $1M, to build a “system” that will improve conversion rates. Here’s how you’re going to spend it.

- Assessing Search – does the organization know what it wants to be known for (what topics, products, solutions) and how audiences search for those items? If not, pull together a top 10 list and get to work finding out. Use tools like Google Keyword Planner, Moz Open Site Explorer and Moz Keyword Explorer to gauge popularity and set priorities from your existing website.

- Increasing SEM spend – after assessing your top 10 priorities you’ll most likely find you need to increase your spend to improve your position. Determine how much, and for how long.

- Inventorying & Assessing Content – while your marketing dollars are working to help audience find you, the next step is to help visitors find the information they are looking for quickly. Assess the content on the following criteria: relevance (is it current, audience aligned, and insightful), accessibility (clicks and public view), and scanablity (ease of assessing key points)

- Evaluating Readability – time to take a hard look at the content you’re producing. Is it written in the audience language or your engineers? Is it compelling, will it engage audiences. Use tools like Flesch Kincaid Reading Ease and the Gunning Fog Index to help score content.

- Modifying Content – this could be painful. Try to leverage existing material. If you have videos, carve them up into 2 minute or less “snackable” insights. Long form content like white papers, etc., do the same. Chunk content into smaller more digestible bits. Next, create templates and guidelines for producers to follow so they know the type of content that will work best for marketing needs.

- Investing in UX – find out how visitors really navigate your site. You may be shocked by their lack of sophistication, and patience. Use tools like Validately to help assess users experience with your web properties.

- Optimization Everything – create pilot pages based on the UX findings and watch how visitors navigate and consume content. Use tools like Hot Jar to help track visitor clicks. Set performance metrics for bounce rates, time on page and conversion rates. Performance optimization is an ongoing effort so become comfortable with constant experimentation.

- Training Everyone – to produce the right content, invest the time and resources to train on how to use the new templates — product marketers on how to produce audience focused content, marketing folks on how to write ad copy that’s compelling, etc. Use insights gathered in steps 5 and 7 to convince folks to get onboard.

- Hiring an advisor – if this sounds like a lot of work, it is. If you don’t have the staff, the time, or the desire to take it on get someone to help you. You have a day job producing leads so put someone else on a parallel path of improving the process and performance. Chunk up the work plan mentioned above into quarters, align it to the marketing and the organizations priorities and set reasonable expectation on making progress.

Inbound marketing, content marketing, digital marketing, whatever you want to call it is not a marketing “tactic,” it is an ecosystem built from the outside in and requires a system thinking approach. The steps above will help you pinpoint issues within the system. “Digitalizing” an organization starts with audience facing sites so try to align this effort with any organizational effort related to digital transformation.

Getting the funding, use data points to prove the value of building a robust inbound lead generation capability. According to CEB, 71% of buyers start their purchase journey on the web. Build a market visibility index using your pipeline/waterfall metrics and market share. Reverse the numbers and find out what percent of the total opportunities available are in your pipeline. If you need more benchmarks, download Hubspot latest report on inbound marketing.

Need a case study? The process I just describe was implemented at a client this year. The results of the investment and effort have produced a 95% increased in MQL’s and an improvement in conversion rates by 65%. Inbound is now the top lead source in volume and performance. This organization has a hardcore outbound sales culture…which now, believes in the power of inbound marketing.

by scott.gillum | Dec 27, 2016 | 2016, Marketing

‘Tis the season for Christmas catalogs. Tons of them roll into mailboxes across the country and, shortly thereafter, into recycling bins. In our house, two catalogs escape this fate but for different reasons.

I am an “all-in” fan boy of the Patagonia brand. In my opinion, Patagonia is THE most authentic brand in the world. “Worn Wear” is probably its best brand campaign ever, and “Unbroken Ground” the best product launch campaign.

I believe in the company’s causes, point of view on the world, anti-consumerism message – all of it! The catalogs are as much about adventure and causes as they are about the clothing.

The other catalog that escapes the recycling bin, at least temporarily, is Orvis. Its prominently-displayed coupons on the cover have me at “hello.” “Free money” works for me – so much so, I’m conditioned to respond to a coupon that the last time I bought something without one I developed a rash. Yes, I know the discount is baked into the price, but it works. I peruse the catalog looking for an item to apply the discount as soon as the catalog arrives.

So here’s the difference: while I spend more time reading the Patagonia catalog, I buy more from Orvis. In fact, despite my love for the brand, I don’t own any Patagonia clothing. In the business-to-business (B2B) world, I am what you would call a “false positive.” I’ll consume your content all day long but I won’t convert. And in today’s world of deep targeting and conversion-focused metrics, I might get missed.

Brand advocates, like me, are incredibly important for B2B brands. In the book, “The Challenger Customer” by Brent Adamson and others, I would be described to as a “mobilizer.” Mobilizers advocate for brands with other decision makers within the decision-making team. In fact, the likelihood of a closed deal increases dramatically if you can find one to champion your brand.

In our home, I’m the brand advocate and economic buyer and my son is the user. The reason I don’t buy Patagonia is that I believe their clothing is more of a fit for a teenager who refers to it as “Fratagonia.” I’m more the Orvis generation, but I alert my son to things I think he would like because, unlike me, he spends zero time looking at “old school” offline catalogs.

This same pattern is repeated in the business-buying world. Brand advocates will spend hours reading your content, watching your videos, and attending your events. They’ll show up in Salesforce as leads but will never advance, causing frustration for sales reps and managers. So why shouldn’t we dismiss them? They’re also the ones who will recommend your brand to a colleague who is searching for a vendor to fit a need.

The challenge has been identifying and targeting “mobilizers” as described by Adamson and his colleagues. After spending about a year trying to figure this out, we’ve discovered three “markers” that might help lead you to these mystical influencers.

- Consumption of long form content. In a world moving to shorter and shorter content, mobilizers will invest time with your content. They’ll spend the seven, or even twenty minutes, to view a video if it’s well done. And don’t take all of the long form content off the website just yet. These folks will consume and summarize key points for others. Pay special attention to time spent on the page, along with visitor viewing habits on heavier content pages.

- Repeat visits over a longer period of time. Buyers who are in the decision-making process have a tendency to “burst” visits. They’ll hit your site in rapid succession and consume a large quantity of content over a brief period of time. Brand advocates – like mobilizers – consume content more consistently over a longer period of time. Watch and track your repeat visitors, and see if they are also subscribing to your e-newsletter, attending webcasts, etc. You need to track and trend these visitors over the year (or even two).

- Sharing habits. Another trigger for tracking these influencers is the sharing of habits. They’ll share content they find to be meaningful. Take a look at consistent content sharers. Make sure you have them identified in your ABM programs. Build email campaigns with content links that are intended to travel, and watch where they land.

Make sure you can aggregate all of the activity mentioned above against a single profile. You’ll need all the data to identify mobilizers. The other homework assignment is to take a hard look at your organization and ask if you have the type of content that would create and energize brand advocates. What does the organization stand for? What is its point of view, its purpose? If it’s “to sell something” or “to make money,” you don’t have it.

by scott.gillum | Nov 21, 2016 | 2016, Sales

Last week Tibor Shanto from Renbor Sales Solutions mentioned in his post that I questioned the value of the sales organization. Given the information shared with us at the CEB Sales and Marketing Roundtable meeting we attended, the question was relevant. He goes on to state that what I was really asking is why are so many sales reps struggling and what could marketing do to help them succeed. If the sales organization struggles, most likely marketers will struggle, and they may be the ones who will get the blame.

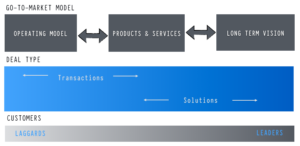

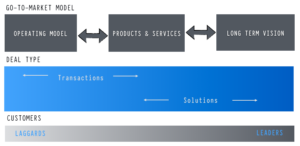

The more I thought about it the more convinced I became that the issue goes beyond sales and marketing, and their ability to correct it. I don’t think marketing can fix what ails sales, and vise versa. To illustrate the issue, I have created a framework that oversimplifies an organization go-to-market model. The core of the GTM model is the operating model, the product and services group and the organizations long-term vision.

Each part of the model plays an important role in determining the success of an organization. Additional detail on each group is contained below.

- Operational Model – the core of the business, how it delivers value to customers. It is also focused on driving efficiency and effectiveness in the delivery model.

- Product/Services – the physical manifestation of the value.

- Vision – how the company articulates their view of the world, now and in the future based on consumer/customer, competitor and market trends and needs.

Marketing develops and articulates the organization’s vision. It should be forward looking (at least three years), and challenge the product organization to “catch up.” It should enable the sales force to sell new solutions, enter new markets and differentiate the organization against competitors.

The product group builds, tests and perfects products, services and solutions that meet the needs of buyers today, and in the future. It should be able to define the market opportunity and the best route to capture it.

The “operating model” should be constantly evaluating those products and services most strategic to the organization (revenue, profit, etc.) and how to scale them. In some of the best organizations I’ve seen, this group enable the “visionary” solution sales reps to sell whatever they want early in a “wave,” as it works to pair down offerings to the few that are the most desired (market demand and/or profitability) As a result, choice, selection and pricing are simplified which helps them scale and enables the sales force to sell efficiently.

Aligning The Sales Organization

Solution Sales team – the solution selling team should be aligned to the front end of the go-to-market model. They have the capability, experience and navigation skills to configure and sell the vision and complex solution, both to internal and external audiences.

Product Specialist and Account Management teams – AM’s or PS’s are aligned to existing accounts and/or products and may be aligned by industry or type of solution. Their goal is to keep and expand the account. Reps that excel in this role are adept at understanding how to navigate the internal workings of the client — how to work the procurement process, position their products/organization against competitors, gain access to new buyers/opportunities, and how to anticipate future needs.

Telesales and Online Portals – the back end of the go-to-market framework where the “operating model” has shifted low margin “simple” products, to align with knowledgeable buyers. Allowing them to make a purchase transaction at the lowest cost and in the most convenient way possible. Sales reps may also dealing with “laggard” first time buyers who come late to a product or solution and have simple requirements.

Marketing’s role across this continuum varies. For the solution sellers, content marketing is critical and as Tibor states “insights built around business objectives.” Marketing has to help the sales organization articulate the organization’s vision (“air cover”) and the value of the product to the buyer, professionally and personally.

So what’s different about the sales model I laid out? Nothing. Does sales need a new model? Maybe, maybe not, but what it needs right now is the organizations commitment to executing the model that I just described. It isn’t throwing more resources and technology at sales, as the CEB research points out. Almost all (98%) of the sales leaders surveyed by CEB had added resources for sales support over the last four years, yet 76% of sales reps said that they have experienced an increase in the complexity of the support they are receiving.

Organizations have to commit to being good at all parts of the go-to-market model. Many of the organizations shortcomings and/or dysfunctional behavior become sales inhibitors. For example, organizations that are operationally efficient often lack the ability to articulate a long-term vision. On the other end, companies that have their heads in the future often miss simple things like scaling down the number of products sold, or simplifying financing terms or compensation plans.

What I took away from the meeting is, in today’s complex business environment, those organization that can simplify buying will win. The problem is that it’s easier to add and feel like you’re making a difference than it is to subtract or reduce and know that you making progress. It’s time to stop feeling like you’re making a difference and start putting a shoulder to making it happen.

by scott.gillum | Oct 25, 2016 | 2016, Marketing

Imagine this; you’ve booked a three-day trip to Miami. Would it make a difference in how you pack, the airline or hotel you select, even your mindset, based on whether the trip was for a vacation or a business meeting? Of course it does, and any reasonable person would start with the purpose of the trip and then plan from there.

With the intense focus on developing personas and mapping the buyers’ journey, many marketers are skipping that first piece of the journey, or the “purpose.” Marketers may know the buyer and their purchase behaviors – but they don’t fully understand their “why” or what motivates them to choose their organization.

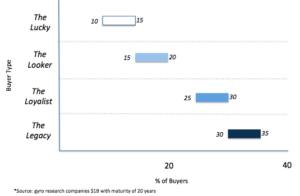

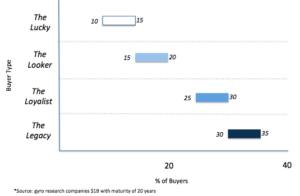

Based on research from a group of clients representing hi-tech, financial and information services with more than $1B in revenue, I’ve pulled together four common buyer groups. This is not intended to be “statistically significant,” but rather a framework for considering the uniqueness of buyer motivations. Try matching your customers to the segments (below). They should be easily identifiable and you may find a similar distribution.

Here is a short description of each group.

- The Lucky (10-15%) – prospects that your outbound sales and marketing efforts have reached with the right message at a time when they were open to discussing how you could solve a specific problem or need – a new acquisition.

- The Looker (15-20%) – buyers who are actively searching for information/solution that can help them with a need or problem. They find you and decide to engage in the sales process – a new acquisition.

- The Loyalists (25-30%) – your “champions” that have used your products or services in the past and faithfully bring you with them wherever their career takes them.

- The Legacies – (30-35%) they inherit the existing relationship and may, or may not, be familiar with your products and services.

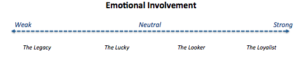

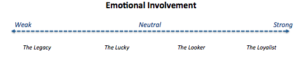

Each group ventures through the journey and engages with sales and marketing channels with a different mindset and set of motivators. It impacts how they interact with the decision-making group and perhaps, most importantly, their willingness to advocate for your brand and/or product. Hence, why you need to consider their emotional involvement in the process. Why? Because emotions fuel the wheels of motivation; they can drive them forward or put them in reverse.

Mapping emotional involvement by segment from strongest to weakest will help you develop an engagement strategy. “The Loyalist” group is motivated to advocate for your brand because they feel an emotional connection. It may have been formed by a past experience, or how it makes them feel about themselves and/or their role. CEB calls this “Identity Value.”

Your communication should reinforce their decision to work with you. Any awards or recognition received should be passed along immediately thanking them for their contribution. Any bad news should be quickly communicated and explained via a call, not digitally. Know this group thoroughly, understand their social engagement and make sure to track their career progress. The relationship is personal, so recognize and reward it.

On the opposite end is the “The Legacy” group. Although they inherited the relationship, they may not be motivated to keep it. The potential issue, according to Sirius Decisions 2016 B2B Customer Experience Study, is that “80% of B2B purchasing decisions are influenced by past customer relationships” and that experience, most likely, was not with your organization.

Assume low emotional involvement and do your homework on this audience. Here are some helpful hints on engaging them. We know from our research on the emotions executives experience in their careers that four emotions are always present, 1) excitement, 2) anxiety, 3) confidence, and 4) pride.

The “word cloud” is taken from research on the emotions experienced when an executive moves into a new role. Take advantage of a “Legacy” person being new to the role and leverage the excitement they feel by communicating how your product or service can benefit them professionally, and personally. Additionally, emphasize how your products and/or services may reduce their anxiety or apprehension that comes with the new responsibilities.

“The Looker” is motivated but may not yet be emotionally engaged with your organization. The thrill of discovery quickly fuels emotions. Continue to feed it by understanding their behaviors and journey. Give them reasons to personally connect to your solution or brand. Use insights to teach them something new about their business, needs, and/or their customers.

The “Lucky” become aware much later, and may never really become emotionally involved. For them this may be purely a transactional relationship. Focus on reducing risk that they may associate with making a bad decision. Use industry-specific case studies and customer testimonials to build their confidence in your capabilities.

If you’ve ever said, “I don’t feel like doing it” you get how emotions impact motivation. Your task now is to understand why your customers take the “journey.” Pushing an organization forward to a purchase decision is a struggle. Your advocate will become fatigued along the way. To win, you have to understand the emotions involved at key moments to motivate them to keep moving because at some point, they won’t feel like doing it either.

by scott.gillum | Sep 14, 2016 | 2016, Marketing

By Scott Gillum and Paige DiPrete

Modern marketers are “technology crazy,” constantly searching for the latest innovation to help them optimize the customer lifecycle and gain a completive advantage. For better or worse, marketers have plenty of options to play with, according to Scott Brinker the MarTech landscapes is enormous with 3,874 ISV’s and growing everyday.

In the past, Larry Ellison would of referred to the maturing MarTech space as a “killer field.” With the “Big 5” (Oracle, IBM, Salesforce.com, Adobe and SAP) swooping in like birds of prey picking off niche providers to fill out their product portfolio.

Marketers in the past would have been content with letting the industry leaders pick the winners and losers from this vast field of options. Preferring to consolidate their technology needs with one or two vendors making it easy to have “one throat to choke.” Companies like Oracle, have invested in making acquisition to fill solution gaps in functional areas as they have built their Marketing Cloud.

Unfortunately for Oracle and others, Millennia’s are not behaving the way traditional software buyers have in the past. In fact, there is growing evidence that they are pursuing a “best of bred” approach aimed at stitching together multiple platforms that follows the customer journey. Marketers are arranging their “stacks” either in a linked multi-platform approach, or with a spine in tag management products that hook up to an assortment of specific platforms and ISVs.

These new customer-centric clouds cut through traditional inefficiencies to motivate purchase intent. They are woven on the idea that consumers search for and choose customer-oriented brands, so marketing technology should reflect and enhance this in the evolving digital world. Most clouds only offer targeted suites in functional areas, which create both customer and internal silos. But these hybrid clouds humanize the digital experience and bridge integration seamlessly across all channels and touch points. All customer-facing departments are poised to address the public with a single strategy organized into one set of solutions.

A growing leader in the experience cloud space is Sprinklr, recently valued at $1.8 billion. Sprinklr has a focused acquisition strategy that concentrates on integration and is unlike any other in the business. First off, it doesn’t sweep up tools simply to increase their client base or rapidly grow, but it instead targets how well each can augment the customer’s experience. Sprinklr then completely rebuilds their software onto its own platform to ensure seamless integration.

And this could present a major challenge for the Big 5, as Oracle’s president Mark Hurd calls the idea of perfect integration between its products impossible, adding that, “There will never be a day where the depth of integration, unless it was all built from the bottom ground up, will be as integrated as any of us would like.”

When Sprinklr made its initial acquisition in 2014 of the Dachis Group, it was able to launch the first end-to-end operating system for brand marketing that enhanced customer relationships through multiple channels and touch points. Since then, its business ventures have made it a pioneer in converged media, advocacy, social communities, content management, audience segmentation, and social visualization – all to enrich its clients’ understanding of and engagement with customers.

Even though Sprinklr may be the fastest and most effective solution so far, it’s not alone in the move to deliver this new breed of experience clouds. In 2014, Gartner predicted that 89% of companies would be competing mostly based on customer experience by today, versus the 36% four years ago. The leading cloud giants like Oracle, IBM, Salesforce, and Adobe are starting to recognize this new wave and have shifted their strategies accordingly to offer their own experience clouds but integration remains a challenge.

Salesforce recently acquired Demandware as an integral part of its Customer Success Platform, but it yields weak integration between its various clouds. Similarly, Oracle and IBM are especially vocal about their experience cloud offerings and each present a large number of comprehensive solutions, but they are also limited on the integration front, both internally and with third party plug-ins.

It’s still debatable if there will eventually be “one cloud to real them all” but for now, the successful platforms will be those that can serve as a solid backbone through internal as well as external integration. Or as Sprinklr Founder, and CEO Ragy Thomas states it “Sprinkle, don’t shout. It’s not about who yells the loudest. It’s about who offers the most value in a relevant, nurturing way.”