by scott.gillum | Jan 21, 2020 | 2020, Sales

by Scott Gillum

Estimated read time: 8 Minutes

“The best sellers are the people who make the product,” said my son as we were walking out of a store in a quaint town in Los Cabos, Mexico.

It was an interesting comment made after I had just purchased a pair of earrings for my wife in a jewelry boutique. The buying experience turned out to be an interesting “Goldilocks and the Three Bears” sales story, or in our case, the “Tourist and the Four Brothers.”

A few nights prior, after enjoying dinner in town, we walked the streets visiting local shops. The first jewelry store we visited was run by one of four brothers, all jewelry designers who had followed their father into the business. Each brother had their own style, which was reflected in their jewelry, shop decor and personalities.

The first brother’s store was white and teal, very similar to Tiffany’s. The display cases were decorated with high-end tequila bottles sprinkled among the jewelry, which immediately caught my eye. My wife, perusing the counters, settled in an area with rings while I chatted with the clerk behind the counter about the family and their business.

In working with my wife the sales person failed to realize that he wasn’t selling to a naive tourist but rather a very knowledgeable buyer who at one point in her career had managed a jewelry department for a high end retailer. A mistake often made by sales people who fail to do research on their potential buyers. As he pitched her on a ring she had intentionally requested to see, he failed to notice she was wearing one similar.

When buyers are in an unfamiliar environment, like we were, they will seek to find a frame of reference or an “anchor.” Something that they can connect to their knowledge base to aid in decision making. Being new to the store, and pricing in pesos, my wife “anchored” on a familiar ring. Trying on the ring she was able to assess that it was roughly twice the price and half the weight as hers. Now that she had a reference point, she determined that the store markup was about twice that of a US store.

The second brother’s store was bigger and had a vast selection of jewelry (and no tequila). The clerk, a niece of the designer, greeted us and carried around her calculator while following us around the store. A not so subtle message that she was ready to make a deal.

My wife found an area of rings and picked one out. As she asked questions, the store clerk mentioned they were having a promotion. She then tried to discount to close the deal which kept falling as we were walking towards the door. By the time we left, the price had fallen 40%, with an offer to call her Uncle to get maybe an even better price.

The last store we visited was white, simple and elegant. It didn’t contain a lot of inventory, in fact, one of the display cases was completely empty. The person working behind the desk was not a sales clerk, but an assistant designer who introduced us to the youngest brother in the family and owner of the store. He was the designer and told us about his creations apologizing for the lack of inventory.

We talked about his life, his education in London, and the fact that he didn’t want to get into the family business, but his love of designing drew him in. His real passion was designing furniture which he hoped to start retailing soon.

My wife found a pair of earrings and tried them on. As she did he explained the process used to give the silver hoops their shimmer along with the details about the gems used to enhance them. He brought over other silver earrings and pointed out the differences in the design process.

Deciding to purchase the earrings, we asked if they had a “promotion.” He said that Visa or Mastercard were offering a 10% discount on a purchase. The card companies, not him, offered the promotion.

As we were paying, I noticed a unique bottle of tequila sitting behind the desk. A dark blue bottle with carved symbols of the tequila making process along with the history of the Los Cabos area. He said it appealed to him “because as a designer” he appreciated the craftsmanship of the bottle. I loved the story (and the taste) of the tequila and he offered to connect me with the owner who lived locally to secure a bottle.

The first store tried to position itself as the Mexican version of Tiffany’s. The problem was, we had no prior exposure to the brand, so the brand promise and value were empty. The second store offered choice and price but made us question it’s authenticity and quality. (Given the amount of products offered we suspected the owner couldn’t have designed everything, and the discount made us question if the stone used in the ring was natural or man made.)

Later that night, I got a text from the store owner where we made our purchase, sharing the price and location to pick up the tequila. He didn’t have to follow up with me after we made the purchase but he did. It wasn’t an empty promise made to close the deal which happens far too often, but a genuine gesture.

In the end, my wife received a piece of jewelry she loves and I got a unique bottle of tequila but what we really bought, was the owner of the store. For the 20 minutes we spent in the store, a connection and relationship were formed through storytelling. It was both authentic and passionate, building a foundation of trust.

The experience made me reflect on the effectiveness of our sales and marketing efforts. What if we could train our sales people to act like “owners” or “designers” of the product; how might that impact their success? That question prompted another one which was, how many sales people ever receive training by the product group, or really know or understand the story behind the product or service they sell.

We can’t give the passion that comes with the pride in ownership, but we can train them to be storytellers, because as we experienced, buyers don’t buy from you, they buy into you.

As for the fourth brother, his store never opened. Guess it’s true, showing up is half the battle.

Follow along for more tips on marketing, business, and thinking differently delivered directly to your inbox, subscribe to our newsletter at www.carbondesign.com/subscribe.

by scott.gillum | Jan 28, 2019 | 2019, Marketing

By Glen Drummond

How far have we really come since the Cluetrain Manifesto? It’s sad to admit, but arguably true, that much B2B marketing still flirts with mediocrity. Why? Part of what contributes to the mediocrity is the tendency of B2B marketers to race towards “best practices,” seeking, paradoxically, to achieve brand differentiation by imitating the past practices of competitors and predecessors.

In marketing strategy, the perceived safety of doing what others have done is an illusion. “Best practices” are properly reserved for simple situations that can be dealt with according to simple categorical logic. Branding problems can rarely be reduced to such simplicity without overlooking dimensions of the situation. Sometimes those dimensions are critical factors in success or failure.

Once we acknowledge that “strategy by imitation of practices” has a poor prognosis, it’s a short step from there to go looking for a theoretical foundation for action.

Our theoretical foundation takes the form of a “dissenting opinion” towards a handful of (largely unexamined) theories that are implicit in practices and advice widely found in the B2B marketing space. At Carbon, we exploit this contrast as an engine of strategic differentiation for our clients. Here are 5 components of that engine:

1) People have a deep and profound need as social animals to belong to groups, to achieve and maintain status within groups, and to construct and signal identity in the context of these groups.

Few people would disagree, but just the same, this point of view on motivation is still mostly ignored in B2B marketing and sales strategies that emphasize rational business benefits. As deals get bigger, and buying committees get larger, the error of underestimating this factor in motivation becomes more regrettable.

2) Most of the time the human mind is operating in a state characterized by a fast, non-deductive, association-driven path.

This view, deried from behavioral economics, stands directly opposed to the classical economic imagination of people as “rational actors.” Something at stake in this dispute is our understanding of how we best achieve desired meanings in the mind of our customer. Should we focus on telling people what we’d like them to believe, or should we design a coherent fabric of associations and invite people to participate in constructing meaning from it? Most zig, we zag.

3) B2B buying is a group decision, and group decisions are chaotic and non-linear. On good days they resemble the pursuit of design problems. On bad days they resemble a garbage can.

This take on decision theory (and thus buying) stands in contrast to the (usually unexamined) assumption that business decisions are pursued in a logical process that begins with a stable set of identities, goals preferences, and advances in a straight line towards the optimization of outcomes. This assumption is perfectly aligned with the metaphors of “funnel” and “buying journey.” Just not with reality.

4) Experiences are meaning-making opportunities. Stimulus and response are separated by a meaning-making operation.

This stance is opposed to the mechanistic behaviorism that lurks beneath notions like “monetizing eyeballs,” “unique selling propositions” and “the b2b content factory.” Notions like these come and go, but the underlying assumption, for all its flaws, seems hard to kill.

5) Firmographics and role titles are more useful for counting potential customers than they are for building strategies that move those customers to action.

This stance contrasts the segmentation assumptions of most B2B marketing and sales organizations. We see that as limiting in two ways – first, it’s non-differentiating since firmographics and role titles are no mystery to competitors. And second this knowledge is not as helpful as people generally imagine in persuading prospective customers to adopt a belief or a behavior.

We don’t dispute that strategies resting on contrary philosophies have worked in the past. But looking forward, we see value migrating from tangibles to experiences. B2B buying groups will grow larger in the face of more difficult decisions. The pace of change and disruption will pick up. B2B commercial opportunities will increasingly be initiated by customers and mediated through inbound channels as the first point of contact. As a result, this is an environment that favors our “dissenting view.”

by scott.gillum | May 12, 2013 | 2013, Sales

John Wanamaker was an innovator, a merchandising, and advertising genius. But when he made the statement; “Half the money I spend on advertising is wasted, the trouble is wasted, the trouble is I don’t know which half.” He left legacy that has haunted marketers ever since.

New research from CSO Insights suggests that the day may have come for sales. In their annual Sales Performance Optimization study of over 1500 companies across multiple industries, CSO found that the accuracy of sales forecasting fell to a near all-time low of 46.5%. Or as John Wanamaker might say; “Half of your sales efforts are wasted, you just don’t know which half. “

And since the forecast, defined in the study as near-term (30, 60 and 90 day), is an output of the sales pipeline, one could also conclude that half (or more) of the pipeline is “junk.”

With the wide spread adoption and utilization of CRM (84% of the firms surveyed), marketing automation, and analytical forecasting tools, the question is how can this be?

Here are some thoughts on why this might be happening, and five tips to help you improve your forecast.

Reasons for poor forecasting:

- Impurities in the System – let’s go after the big one first. “Garbage in, garbage out”…as they say. There’s a laundry list of things to look for — from reps putting leads in the system right before they close, to not updating opportunity consistently, and leaving in dead leads too long.

- Sales Optimism – yes, the economy seems to be recovering but it may not be moving at the “speed of sales.” Sales folks are an optimistic bunch; they want to believe things are better than they may be in reality. For example, the average length of the sales cycle. In a report earlier this year by BtoB Magazine, 43% of marketers reported that the sales cycle had increased over the last 3 years. Which is consistent with the CSO Insights report where 42% of Chief Sales Officers stated that the sales cycle had lengthened, in particular with new acquisitions.

- Incentives & Goals – take a look at how reps are being incented, and/or their sales goals. You may find the reason why reps leave opportunities in the pipeline too long, and/or are over optimistic with their forecast. Pressure to build and maintain pipeline can sometimes cause counter productive behaviors.

- Gut Feel – even if the troops in the trenches are putting in accurate and timely data, the generals may change it to fit the political environment and/or their own personal bias.

- Changing Buyer Behavior – recent research has shown that the buyer’s journey, and the typical sales process are not aligned. Buyers frequently start and stop the journey, or will cycle at a stage, and even move backward in the process. CRM systems are typically designed in a linear approach, progressing from a lead to a close. It’s an internal view, and increasingly out of alignment with buyers’ preferences.

How to improve:

- Active Pipeline Management – The pipeline and forecast will never be 100% accurate. That said, you should have a feel for how far off it is, and what is needed to improve. For example, do you have an inspection process to keep the pipeline current? If so, consider doing it more frequently. Move quarterly reviews to monthly. Also, if everyone is responsible for updating the pipeline, then no one is responsible. Consolidate the “maintenance and hygiene” of the pipeline to one person. Others may be responsible for providing updates, but one person needs to police the system.

- Discount Probability and Value – conduct a post-mortem on past forecasts over last year or two. Assess the difference between forecasted and actual results. Create discounted probabilities based on that delta for: lead movement (from stage to stage), and lead value. If implemented, evaluate the accuracy of your “pre-set” discounts. It should help bring forecasts more in-line and ground “sales optimism” in a bit of reality.

- Govern the Process – to improve the accuracy of “output”, focus on implementing and managing a standard process. Accenture’s Connecting the Dots on Sales Performance found inconsistencies among reps in using their company’s defined process and methodologies to selling. A quarter of Chief Sales Officers surveyed stated that sales reps used their sales methodologies 50% of the time, 31% said it was used 75% of the time.

- Leverage Marketing – close the feedback loop with marketing to improve the quality of leads from campaigns and activities. In a report on Sales & Marketing Alignment by the Aberdeen Group, marketing accounted for 47% of the sales forecasted pipeline in the Top 20% of companies studied, compared to only 5% of laggard organizations (bottom 20%).

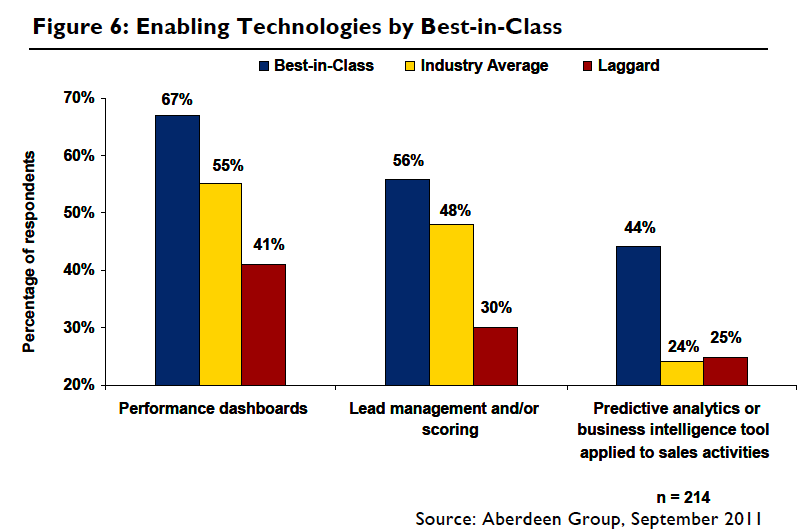

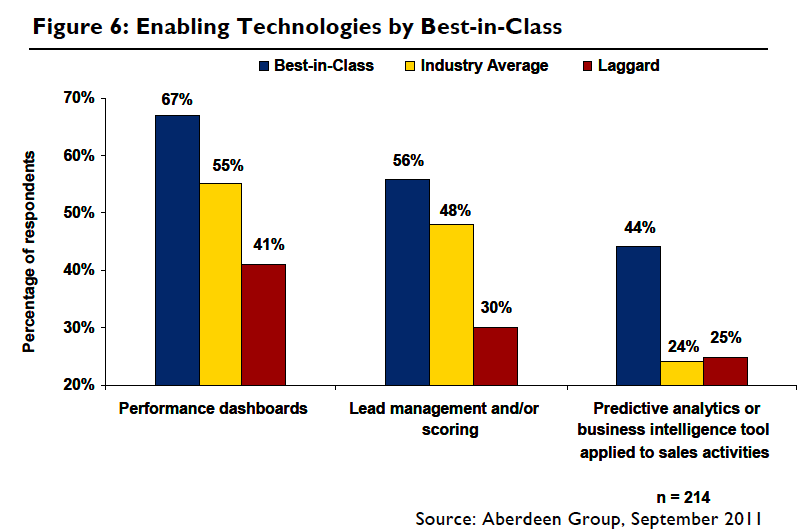

- Utilize Business Intelligence Tools – high penetration rates of CRM may equate to high visibility, but doesn’t automatically mean that it provides the best insight. Despite high adoption rates of performance dashboard, few companies are using business intelligence or analytics tools according to the Aberdeen Group report on sales forecasting. However, the report found that 44% of the highest performing sales organizations were using predictive analytics to reduce “gut feel” in the forecast.

Of all the options, perhaps the best lever for impacting accuracy is the rep. As Ashish Vazirani, a Principal in the Hi-Tech practice of the sales consultancy, ZS Associates says; “A sales person needs to be coached, or apprenticed on how to discern and input the right information for accurate forecasting. Technology can make us lazy and reliant on the tools to do the thinking, we need to emphasize the importance coaching plays in keeping the garbage out of the system. ”

Helping the troops become better soldiers through coaching should help improve the accuracy of the forecast. As well as, implementing the tips mentioned above. But you may still find that half of the pipeline is wasted, but hopefully, unlike Mr. Wanamaker, you’ll understand which half.