by scott.gillum | Jul 2, 2013 | 2013, Marketing

A week doesn’t go by that I don’t hear clients express concern about their ability to produce a consistent flow of quality content, yet every day my inbox is full of emails offering white papers, research, webcasts and blog posts.

So we set out to solve this “paradox of content marketing.” How is it that clients are not able to produce quality content for their purposes, but I get an average of 35 emails a day offering me content?

Our Approach

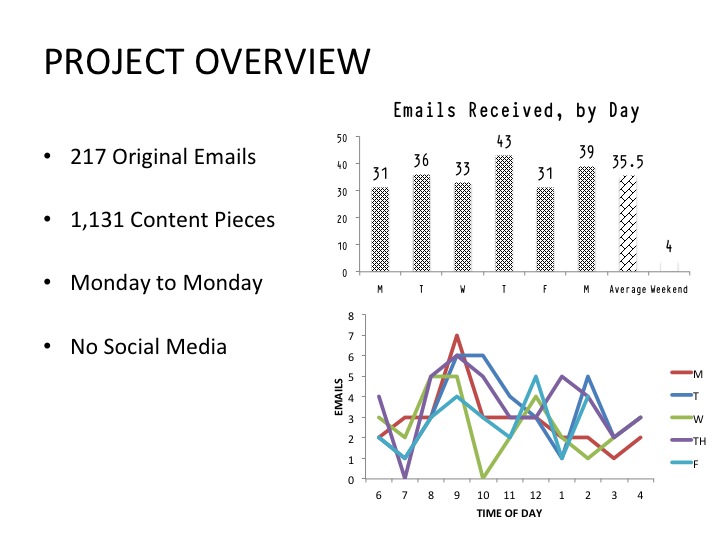

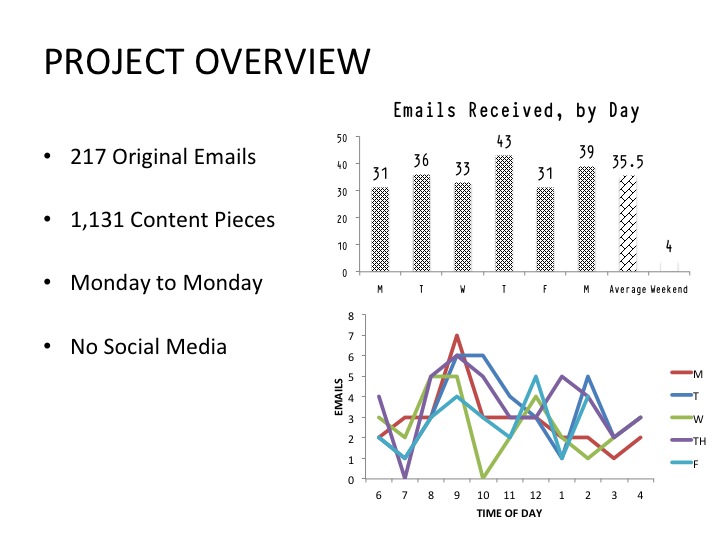

With the help of our summer intern, Sergio Pianko from Georgetown, I archived a weeks worth of content related emails sent to my primary work email. For this experiment, I did not include any other personal email accounts, social media or offline publications.

The Findings

Content Volume

For the week, I received 217 unique emails containing access to 1,131 pieces of content. Thursday was the peak day of the week, which surprised me, with 9 am being the peak time of day, which didn’t. I received an email offering me content, on average, almost every 15 minutes.

Content Type

A new report by the CMO Council entitled Better Lead Yield in the Content Marketing Field found that 87% of the respondents said that online content plays a major or moderate role in influencing vendor selection. The content they trust and value most? Professional association research and whitepapers 67%, industry research reports and whitepapers and customer case studies. The least valuable was vendor content, with 67% saying they don’t trust it.

What’s in my inbox? Well, I’m partial to content aggregators. My two favorites providers are MediaPost because of their ability to narrow the scope on relevant topics, and their expansive content producers (including this author). I also like SmartBrief publications, they provide e-newsletters on behalf of others, like the BMA. I find the layout to be quick and easy to peruse, and they usually feature a research offer.

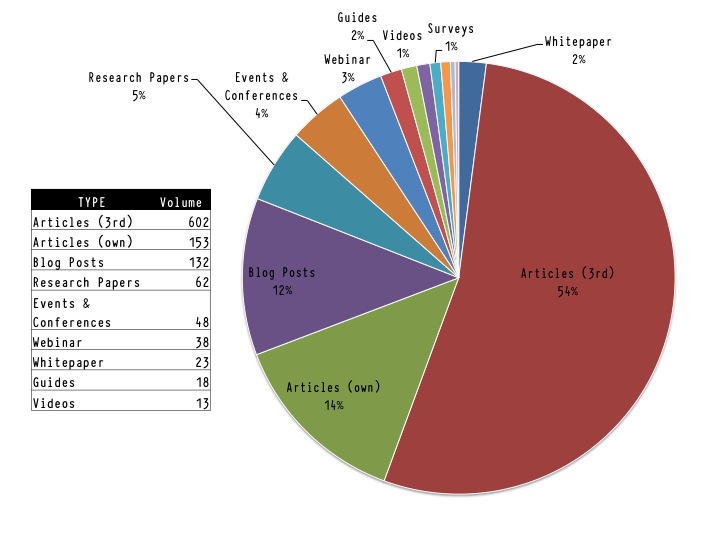

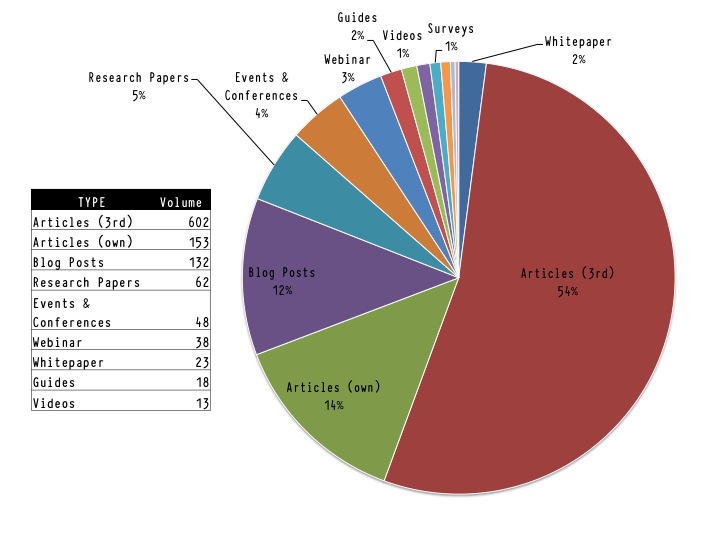

It was interesting to see that even though White Papers were mentioned to be the most valuable content piece according to B2B buyers, it represented less than 2% of the content I received.

Key Insights

Stop Calling Me

Downloading content that you offer for free does not make me a prospect. Save the $25 dollars you’re spending on the outbound telemarketing call and use it to track my behavior until I am qualified. Still not enough for you, we get that “free” comes with a price so consider this payment. According to the CMO Council report 87% of B2B buyers share your content with 5 or more people. Remarkably, 28% mentioned that they share it with more than 100 folks.

Overweight Content related to the Business Case

The first phase of the buyer journey is research. A prospect can cycle in this phase for weeks, even months, never reaching the next step, which is the business case. If you want to qualify real prospect, focus on providing them content that is related to making a business case for buying your product or service. For lead nurturing, overweight the scoring for pages or content that relate to this as well.

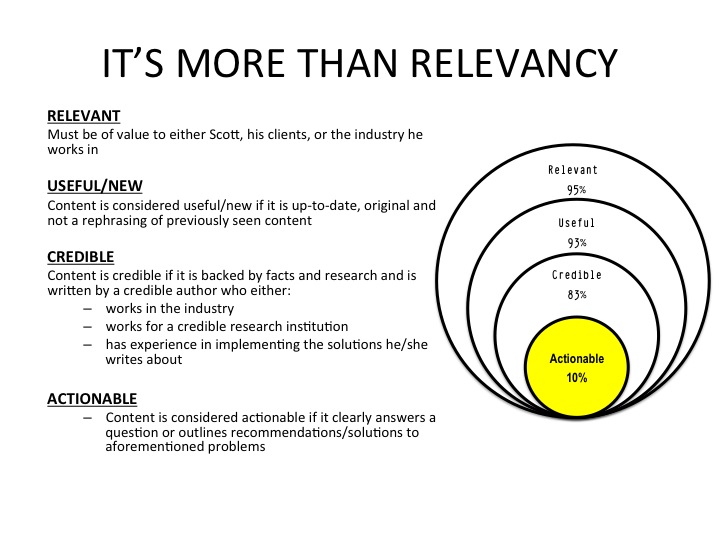

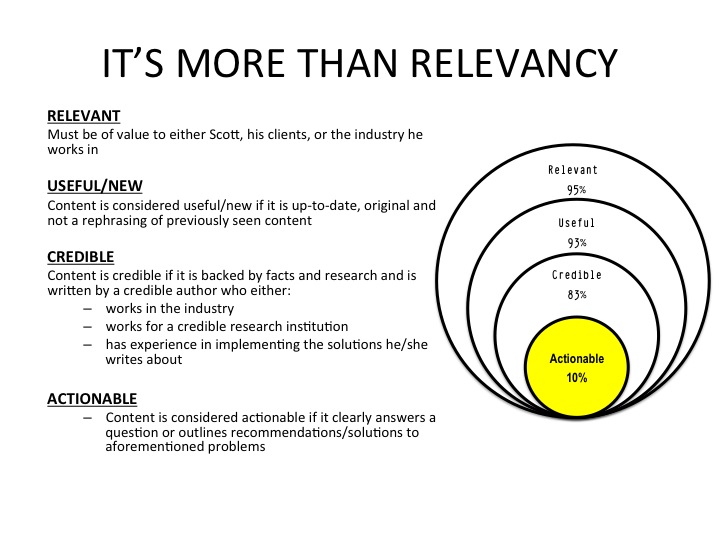

Content is not King, nor is Relevancy, Actionable is the Opportunity

Sergio sorted the content using four filters; Relevancy, Usefulness, Credibility, and Actionable, based on the definition in the chart (below). For the most part, I had selected information sources that produce relevant content, and because of my use of aggregators it kept me informed about industry develops or issues relating to my clients. We then check into the backgrounds of the content authors and found that for the most part, they were credible using our definition (below). But along the way Sergio did discover a couple of frauds, not surprisingly in the social media space.

The most interesting findings was that very little (less than 10%) of the content was “actionable” in that it provided recommendation/s or solutions to the problem or issue discussed. And most of the actionable content came in the form of Webcasts. As a content marketer this is the opportunity and, given its value, think strategically about how you deliver it. Because of the scarcity of this type of information, you can request an exchange of value with the audience, be it contact information, attendance at a webcast, etc.

Opportunity #2 – Video

Numerous studies have pointed to the growing influence and use of video content. Yet it represented only 1% of the content I was offered. Yes, it is more complex, time consuming and expensive but it will also drive better results. It’s worth exploring, from past experience early innovators reap the greatest rewards.

Develop Buyer Personas

To understand some of the findings it may be helpful to know my email and content profile. I am an active content seeker and email deleter. Unlike some colleagues and friends, I like to keep a neat and tidy inbox. I delete emails early in the morning, and late afternoons. During the day I may delete emails as previews flash on the screen. Also, because of my consulting background, I am drawn to market research and data oriented content. I download and archive many items that I later review…typically on planes.

That’s my content “persona.” Agencies have been creating audience personas for years and now, if you’re a client side marketers, it’s your turn. According to the Demand Gen Blueprint survey only 25% of marketers have developed buyer personas, and of those who have, only 35% have mapped content to buyer stages.

Who Does it Best?

To win, you have to make it in the inbox, get the email open and the content viewed. The organization that does that best, in this man’s opinion, is IBM. For their insight into the C-Suite, quality of research, and frequency of contact…which is only when they have something of value. They are the only “vendor” I let in my inbox.

Runner up is McKinsey, for their “big picture” thinking and ability to take complex problems and explain them in very simple terms (especially in 2 min videos). Best New “Up and Comer” is the Aberdeen Group, a recent change in their business model allows free access to quality research, which this “freegan” appreciates.

Content marketing will only grow in importance for business marketers over the next few years. There are opportunities to get your information viewed, and shared, but to accomplish that you have to understand your audience’s content consumption behavior, provide them something of value, and deliver it in the channel and/or through the content provider they prefer.

There is a lot of work to be done, so have at it. Looking for a starting point, do a similar experiment with your customers. Ask them to send you a weeks worth of content related emails, you’ll be surprised by what you find.

by scott.gillum | Aug 10, 2012 | 2012, Marketing

In 2004, I was part of research project with a professor at the Kellogg School of Management and the CMO Council that sought to understand what CMO’s believed to be critical for their success. The most common response was a seat at the table with other senior executives.

Four years ago, I was part of another research effort focused on the CMO’s top priorities, and number one on the list was to be viewed by their peers as strategic thinkers. Finally, I believe the day has come for that to happen.

Marty Homlish, the CMO of HP believes the line between business and consumer marketing is disappearing. Homlish states, “ Behind every B-to-B company is a consumer. The way you communicate to that person is as an informed consumer.”

Technology has allowed work to follow us home and our home life to the office. It has blurred the line between our personal and business personas. The concept of being ‘at work’ is now more a state of mind rather than a physical location or particular time of day.

If business buyers – who were once thought of only as rational decision makers – now need to be communicated with as informed and emotional consumers who no longer fit our past perception of work hours and locations, what might this mean for the future of business-to-business marketing?

To answer that question, one must first understand the difference between how business and consumer marketing operate. According to a Booz & Co and the ANA in The New B2B Marketing Imperative study, B2B marketing has primarily taken an “inside out” approach, focused on the needs of the company and accounts rather than customers.

By contrast, 85% of B2C marketers, who take an “outside in” approach said they were involved in growth initiative decisions which are considered to be strategic such as new market entry, customer relationships and market driven product development.

Additionally, 42% of B2C marketers play a key role in building customer relationships, versus 8% of business marketers. B2B marketers said that “Customers are rarely driving the process and their input is seldom integrated from end to end.”

If today’s business buyers really are “educated consumers” as Homlish suggests, then business marketers can no longer be left out of customer and product conversations. It also means that organizations that target business buyers, who has given lip service to transitioning from being “product led” (inside out) to “customer focused” (outside in) now need to act. And the tip of the spear for driving that change – is marketing.

By better understanding and influencing the needs, desires and emotional drivers of individual business consumers, marketers will be in the strategic conversation and lead the transition. This is the key to unlocking the executive suite.

However, the organization is not just going to give marketers a seat at the table and there is a good possibility that executives don’t get it. As one of the marketing directors said in the study; “Marketing is just not in the DNA of senior management.” You will have to make it happen.

The study concludes that; “Core marketing capabilities – those that directly influence customers – have the highest correlation to market share growth.” Senior executives may not understand marketing but they do understand growth.

by scott.gillum | Jul 19, 2012 | 2009, Marketing

My inbox is full of resumes of good marketers that I’ve been fortunate to come to know or work with over the years. Solid people, with great experience who are now having a challenging time finding new opportunities in this incredibly difficult economic environment. Many of these people could have had their pick of jobs as recently as last year. Given the situation, I thought I’d try to help by providing a viewpoint on what skills set, background and experience companies will be seeking once they start hiring again. I’ll use two data sources to make the case.

A few years ago, we teamed up with a professor (

John Josephs)at

Kellogg on a couple of research projects aimed at getting a better understand of what creates a high performance marketing organizations. Internally, we thought of it as the “head” and “body” studies because we first studied the marketing organization (

the body) and then the follow year CMO’s (

the head).

We surveyed not only CMO’s and marketers, but also CEO’s, about their views on what makes marketing effective. The research was then published by the

CMO Council. Here are a few things we discovered along the way.

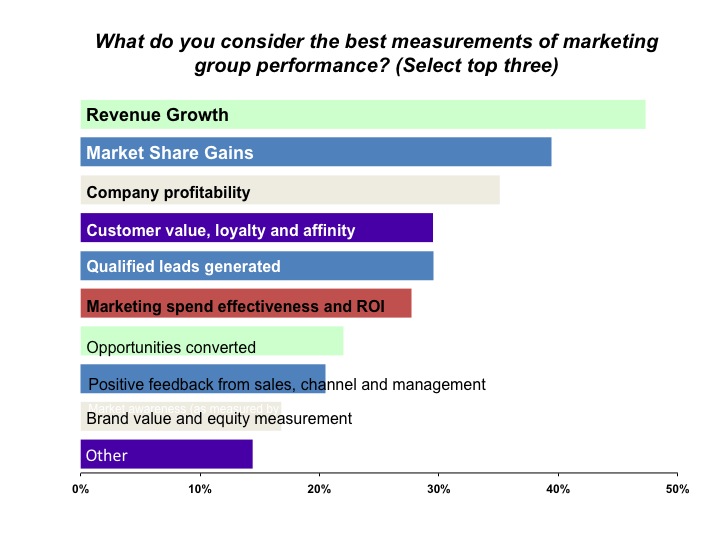

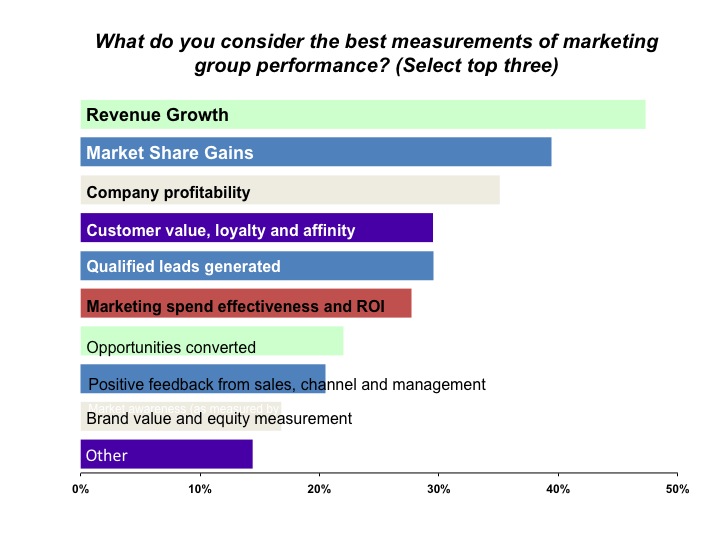

CEO’s view on how to measure marketings performance

How CEO View Marketing Value and Performance

This information is a few years old now, but I can tell you that based on client work that the down turn has done nothing to change this, if anything, it has placed greater importance on the top 3-4 responses. Keep the top responses on these charts in mind as we move to the next section.

Last month, I was given access to a database of senior level marketers (SVP and up) to do some analysis for the organization that owns it. We looked at the background and experience of over 800 marketers with the following titles:

- 50% were CMO’s

- 32% EVP’s of Marketing

- 8% SVP’s of Marketing

- And interestingly enough 10% had CEO titles but had recently been the head of marketing

They came from large, medium and small companies including start ups:

- 25% – Large (over $500M)

- 32% – Medium ($100-$500M)

- 23% – Small ($50-$100M)

- 22% – Start up or under $50K

We were interested in assessing their area of expertise, experience and tenure.

Although executives with Product Management and Sales Enablement/Demand Gen experience represent only 27% of the total group, they represented a disproportionate amount of executives with the longest tenure. In fact, they were twice as likely (as a representative percentage) to be in the 2-5 years tenure category than those with Brand, Advertising and Corp Comm backgrounds. And they made up half of the individuals in the more than 5 year category.

Another interesting thing we picked up is that markerters in the NYC area were more likely to be new in role versus other regions (higher than average churn…probably attributed to a higher supply of talent).

Spencer Stuart has for many years reported CMO tenure rates (less than the life of a gold fish) but I’ve never seen them look at tenure by background…which makes a difference based on our assessment.

Finally, let’s look at Supply & Demand.

The Top 20 Advertisers in the US have been decimated. Think about…half of the Top 10 advertisers in 2007 were automobile manufactures. As a result, agencies have put hordes of people on the street.GDP in Q4 2008 is estimated to have declined by 6.2% from Q3 that declined by 0.5%. Revenues are down on average of 30-40% from the prior year in most firms (at least the ones we work with).

As a result, there are a slew of marketers with advertising, branding, and corporate comm backgrounds (73% of the database that we analyzed) in the market.

Let’s put it all together:

- CEO’s measure marketing effectiveness by revenue growth and market share

- CMO’s see the greatest need for new talent being driven by the integration of sales & marketing

- A large supply of “above the line” marketers exist in the marketplace

Conclusion– potentially high demand and a low supply of marketers who can drive revenue. The marketers that will be in the highest demand coming out of the recession will be the ones who have been aligned or have had direct responsibility for growing revenue. Marketers that can speak the language of sales. Unfortunately, it will be a slow process for folks with a Brand PR and Corp Comm or the Ex-Agency/Media guys.Marketers with backgrounds in Product Management/Marketing who have owned a P&L, folks with sales backgrounds and/or marketers who can show that they can drive revenue/growth will be in demand first.

The challenge for the other groups is that of supply. It’s not to say that good Brand and Agency folks won’t find positions it’s that it’s going to be hard. Expect that you will be competiting with many other qualified candidates and it may be difficult to differentiate yourself.

by scott.gillum | Jul 14, 2012 | 2007, Marketing

Original Post Date April 23, 2007

The Define & Align the CMO report is avaliable to today after 2 years in the making. The report actually turned out to be more interesting than we orignal thought based on our working hypothesis.

The year-long research by the CMO Council and MarketBridge encompassed qualitative and quantitative interviews with CMOs, CEOs, board members, senior marketers and executive recruiters throughout North America. The 80-page report, priced at $295, along with a complimentary executive abstract, is available for download at http://www.cmocouncil.org/.

Here’s a teaser of some the insights coming out of the research:

- Confusion over the role – the casualty rate of Chief Marketing Officers can be reduced if CEOs and boards better understood the role, requirements and value of a CMO and empowered the right individuals to architect all aspects of a company’s operations around the customer experience.

- “A Fixer Upper” – the report points out that title inflation, unrealistic expectations, flawed hiring practices, talent deficiencies, and lack of requisite business and strategic leadership skills are big contributors to the limited shelf life of CMOs. The research also points to the fact that 50 percent of executive searches are to replace incumbent CMOs who are primarily hired to fix broken marketing organizations, not drive business value.

- R-E-S-P-E-C-T – the study uncovers startling contradictions in upper management: most executives consider the CMO a valued member of the executive team, yet they also believe many CMOs lack the background and skills needed to be a top managementplayer – a challenge numerous senior marketers share with their CIO counterparts at many companies. Additionally, in a sharp commentary on the connection between strategic value and performance, most CMOs involved in top-level decision-making get high marks from their CEOs for their overall performance, while those CMOs who remain in tactical mode get significantly lower grades.

- Show me the Money! – nearly three-quarters of the C-suite executives surveyed consider the marketing organization “highly influential and strategic in the enterprise.” At the same time, nearly two-thirds also say their top marketers don’t provide adequate evidence of ROI with which to gauge marketing’s true performance.

- Getting a Grade – In a clear sign of the strategic role played by marketing executives, nearly 70% of the CMO respondents to this study report directly to their CEO. However, only 40% of that number get an A grade for their performance from the CEO…most likely the ones who could demonstrate their value! For the most part, CMOs get more respect from the boardroom than from the CEO. Most of the board members surveyed, over 80%, believe that within the next two years, the CMO position will gain greater credibility with the rest of the management team. But in another reality check, less than 20 percent also say that an increasing number of CMOs will rise to the CEO position.

- Longer Tenure – A majority of the recruiters surveyed believe that CMOs have a shorter shelf life than other C-level executives. The average tenure of CMO respondents to this study was 38 months. (In a past report, the search firm Stuart Spencer pegged the number at 23 months). We had a professor from a top business school involved in our research…he’s a data/analytics guru. He was also familiar with the Stuart Spencer report, here’s a dirty little secret…CMO’s your tenure is longer than what SS reports. Don’t believe the hype…they are an executive placement firm.

The research concluded that the most successful CMOs are aggressively instituting rigorous performance measurement and analytics in every aspect of their organizations, and tying those metrics to revenue and profit growth.