by scott.gillum | Jun 10, 2014 | 2014, Marketing

Tell me if you have heard this before; “we need more, and/or better leads.” The chances are, if you’re in hi-tech marketing you may hear it on daily, weekly and monthly basis. Why? According to Forrester consultant Tom Grant, it’s because of the need to feed the funnel.

In his report Tech Marketers Pursue Antiquated Marketing Strategies Grant compared hi-tech firms to other industries “B2B technology companies treat marketing as an opportunity to sell new products and services to new customers.” As he stated “the product is the axis around which marketing efforts turn,” and as a result, the primary objective of marketing is to produce leads.

Similarly, marketers have long held the belief that because of sales short-term focus on making quarterly objectives, it either lacks the appreciation of, and/or the sophistication to understand anything other than lead gen, for example longer-term brand building and awareness activities.

But what if both of these viewpoints were actually wrong. What would happen if you asked sales what they valued, rather than assumed you knew the answer? How might it change how marketing thinks about its impact on the organization?

For one B2B Tech Company, feedback from the sales force is helping them refine their value to the organization. “When it comes to enabling the sales force, we’ve previously relied on what I call “measurement-by-anecdote.” Our goal with this study was to quantify what sales values from marketing so we can focus on the things that make a difference.” said Rick Dodd, SVP Marketing of Ciena, a $2 billion global optical and packet networking company.

To gain that insight the company surveyed its global sales force, including five types of sales reps covering five different account types. Over 400 sales reps provided feedback on their priorities for marketing and marketing’s performance.

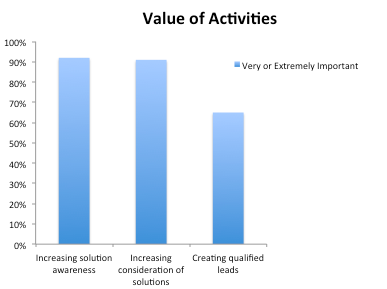

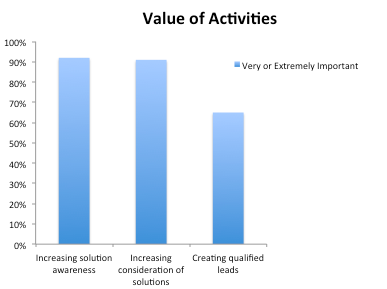

According to sales, the highest ranked marketing activities were at the top of the funnel, 92% of sales said that increasing the awareness of solutions was very or extremely important, increasing consideration was close behind at 91%, only 65% mentioned lead generation.

“Our sales force is very experienced; they understand that technology and industries change quickly. We’ve obviously been successful positioning ourselves for today’s market, and now we want to take best advantage of the big shifts in our landscape. The survey showed us that for sales to be successful, marketing has to be able to change customers and prospect perceptions,” according to Dodd.

Perhaps the most interesting insight to come out of the research, is how Ciena is now thinking about measuring and reporting marketing’s impact on the organization. “Measuring pipeline value is a struggle in our business”, said Bill Rozier, VP of Marketing. “We have long, complex sales cycles that make it difficult to isolate marketing’s impact.”And they are not alone it in that challenge. The Aberdeen Group’s recent Demand Generation study found that 77% of respondents rated visibility into lead performance across stages as very valuable, but only 43% indicated they can do thi effectively.

Instead of spending a lot of time and energy in trying to perfect an imperfect process, thecompany is focusing efforts on measuring marketing performance at the macro level. “At the end of the day, our performance is ultimately measured in sales success, so that’s what we are focusing on measuring”, said Rozier.

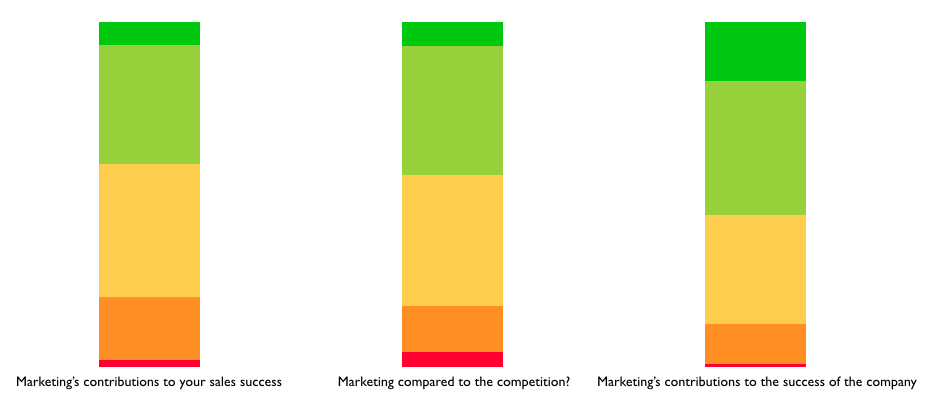

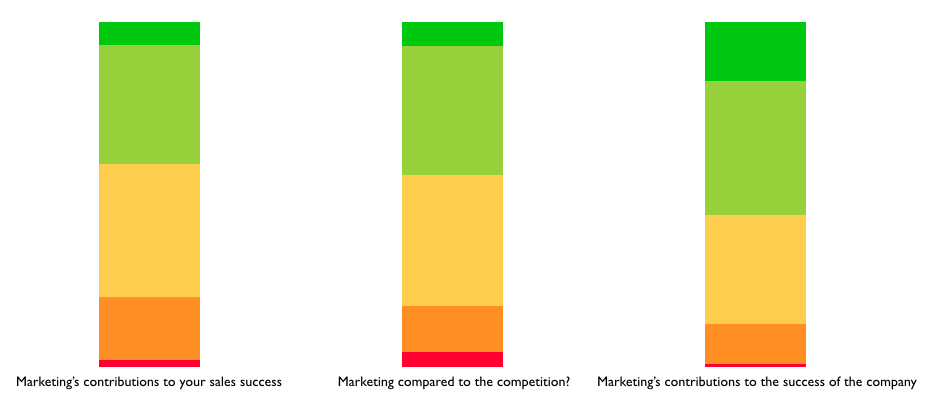

To do that, the company has created a quarterly dashboard from the survey. Two regional sales organizations each quarter will be asked to evaluate marketing’s performance in three areas: 1) Marketing’s contribution to sales success; 2) Marketing’s performance compared to competitors; and 3) Marketing’s contribution to the success of the organization.

It’s a unique approach, and perhaps one that should be considered by others, because the challenge in performance management is often in defining the right metrics to drive the intended behaviors.

Ciena’s approach, as Dodd concludes, is to put the focus on the right conversation; “As we learned through the research, contributing to the success of the sales force isn’t just about one thing, it isn’t just lead gen. I appreciate that they give us credit for doing a good job when compared to competitors, but what we’re most interested in understanding is how well are we doing in enabling them to win. If the sales team rates our contributions as being valuable to their personal success, then we know we’re doing the right things.”

by scott.gillum | Oct 27, 2013 | 2013, Marketing

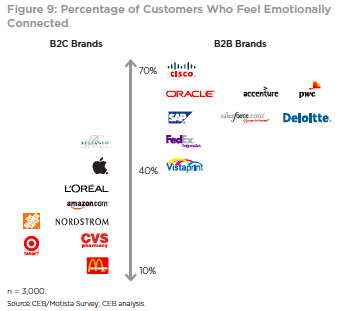

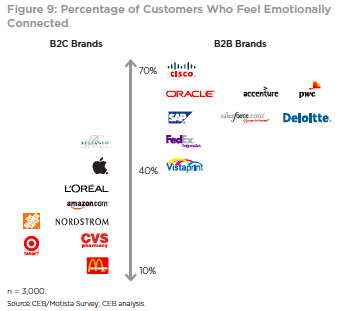

What company do customers feel most connected to emotionally?

Apple? Nope. Amazon? Sorry. It must be Nordstrom’s then, right? Not even close. To find the company that has the strongest emotional connection with customers, you have to leave the consumer world behind. Blows your mind, doesn’t it.

According to new research from Google and the CEB, customers are more emotionally connected to B2B brands, and it’s not even close. The company customers say that they are most emotionally connect to is…Cisco.

Why? Well, it’s about understanding risk. The more risk involved with a purchase decision, the higher the likelihood of an emotional connection. Increase the variables related to risk (e.g. losing a job, wasting corporate investments) and you have the ingredients for an emotionally involved buyer. Personal risks peak when others are counting on you to make the right decision and the stakes are highest.

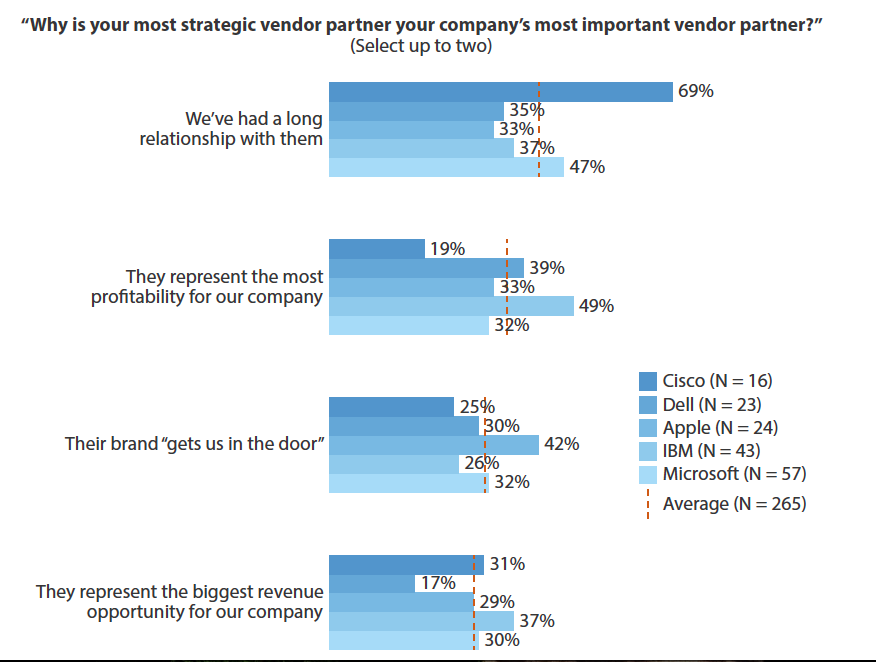

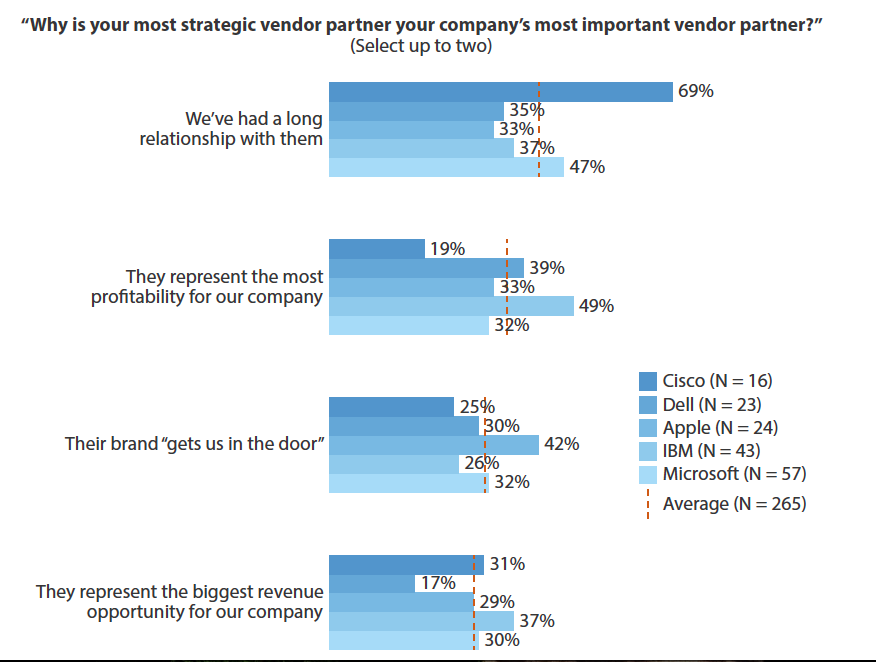

How did Cisco become number 1? It has to do with Cisco’s ability to reduce risk with buyers. Forrester ‘s Evaluate Your Channel Partner Loyalty Program, surveyed over 250 hi-tech business partners to understand the drivers of loyalty. Partners were asked to select the reason/s “why their most strategic vendor is their most important vendor” (see the table below).

Partners, buyers of Cisco gear, selected Cisco for the strength of the relationship, despite that fact that Cisco was also the most profitable vendor (established earlier in the research). Cisco partners value the relationship more highly than other partners, 26% more.

Partners, buyers of Cisco gear, selected Cisco for the strength of the relationship, despite that fact that Cisco was also the most profitable vendor (established earlier in the research). Cisco partners value the relationship more highly than other partners, 26% more.

The reason is related to how Cisco is able to create and communicate what the CEB and Google research describes as “personal value” consisting of four parts; professional, social, emotional and self-image benefits. Some of which are communicated, others realized through the customer experience. For example, existing customers understand the “personal value” associated with an existing vendor 2X that of non-customers.

Cisco has built a strong “personal value” equation by investing heavily in their partner’s success. It supports them professionally through training and certification programs. Invest in the brand to support the emotional bond and self-image, and in sales and marketing activities to drive demand.

All of which reduces the risk associate with failure, be it personally or professionally. And in return, they trust Cisco with their livelihood, valuing the “Relationship” above rational drivers, like profits and revenue.

Getting Personal and Emotional

How can we leverage this insight? To start, focus on better communicating “personal value” to non-customers. The research found that brand messaging connects with buyers early on, but the excitement wanes over time as we move down the buyer journey into the evaluation phases.

The rational brain takes over to assess risk, and the complications associated with the purchase, at this point as much as 50% of the potential deals stall or fall out of the process. Risk impacts their initial positive emotions, and unfortunately, we don’t much to help them.

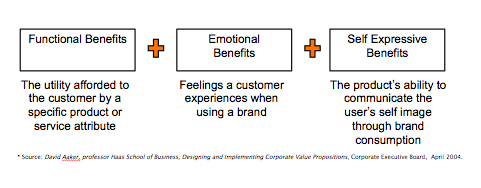

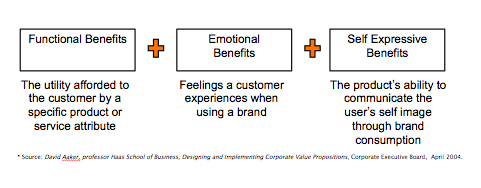

To counter those feelings engage them with personal-value messaging, go beyond just using feature/functionality language (functional benefits) to describe products or services by combining the emotional and self-expressive benefits as well (see below).

Like Cisco, understand how your products or services impact buyers. Does it make them feel “smarter” by having the latest technology, or more “secure” in their role. Although buyers are individuals with unique personalities, and should be treated that way, they most likely share the same fears, uncertainties, and doubts we have in our roles.

Get to know them, like you know yourself. Stop assume they are always rational and buy on price and/or functionality. And finally, realize that there are customers who are emotionally connected to your brand, and/or highly value their relationship with your organization, and when they say that they “love your product or company”…they actually might just mean it.

by scott.gillum | Sep 22, 2013 | 2013, Marketing

Do you think the senior executive team is excited about the big lead generation campaign you just launched? Nope. How about the number of “Likes” on your corporate Facebook page? Think again. Marketing doesn’t matter in many organizations, because it thinks, operates, and worst of all, reports “small.”

Executives sitting in the “C-suite” got there by thinking big, managing big, and reporting “big”. Marketers commit hari-kari with this group by reporting tactical level activities – “minutia,” that garners no ones attention. Do you think the head of sales is reporting the number of sales calls reps make a day? No. If you want to get their attention, you have to make marketing more important to them. Here are five ways to go “Big.”

- Big Bets – if you want marketing to be valued you have to understand, and link, to what the organization values. It’s that simple. If it’s market share, connect marketing objectives and activities to acquisition or/and account penetration. If it’s profit, understand the drivers and align your teams’ efforts appropriately.

- Big Strategy – once you understand how to link marketing to the business objectives your job is then to connect those big bets to day-to-day marketing activities. Your smarts will be needed to take the marketing requirements from the product and sales organizations (which may be very tactical) and link them to the overall marketing strategy that aligns to the “big bets.” Warning – this will require math, perhaps lots of it.

- Big Plays – to execute, organize your marketing objectives as defined by your internal stakeholders into 2 or 3 “big plays.” If market share is a key growth objective, a big play should focus on an area that has the greatest opportunity to do that…a specific market, product and customer. All marketing activities/campaigns should be nested around that “play.’ Messaging is critical here because it is the “big play” wrapper that creates consistency in the communication across execution –think “Smarter Planet.” IBM discovered years ago that the best performing campaigns stayed in market the longest, and had the highest level of integrated tactics. It takes focus and discipline to do, but if you can get there it will make your life easier by allowing you to organize everything under a big play umbrella, and if things don’t fit…then maybe you don’t do it.

- Big Results – the first rule here is to understand that measurement and reporting are different. Measure everything, but only report “process” or “results” metrics. Executives care about “outputs,” not “inputs.” Inputs are activities, outputs are results, know the difference.

- Big Balls – ya gotta have ‘em. You are going to have to get comfortable with, and embrace risk. If you do this right, you will be placing bets, that at the time, you will not know how, or if, they are going to pay off. Years ago, I worked with a CEO that committed to double the size of the business in three years. The CMO calculating sales cycles realized to support that growth marketing needed to double the number of leads that year. She had no idea how she was going to do it, but it caught the attention of the senior management team, focused her team, and it happened. But as she learned, you don’t try to go it alone. Reach out to others with your plan, get their buy-in and support. Level set expectations on timing and performance, it may require a significant investment in time and money for the “big bets” to pay off. Set big goals, but be realistic in getting there.

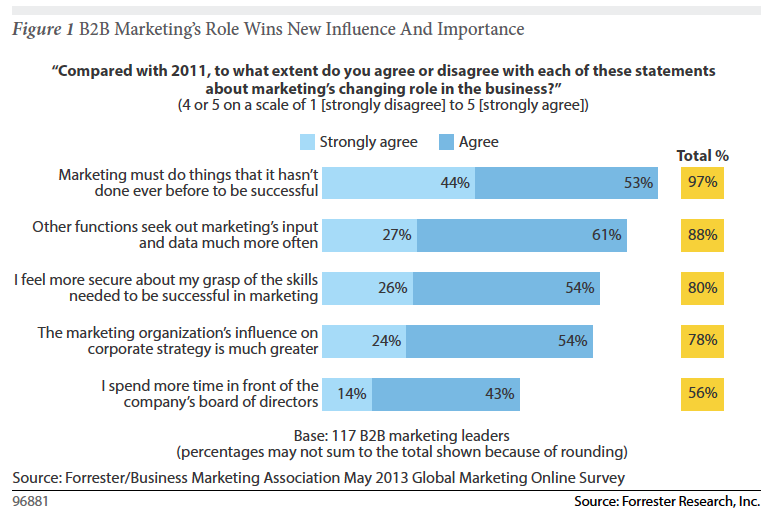

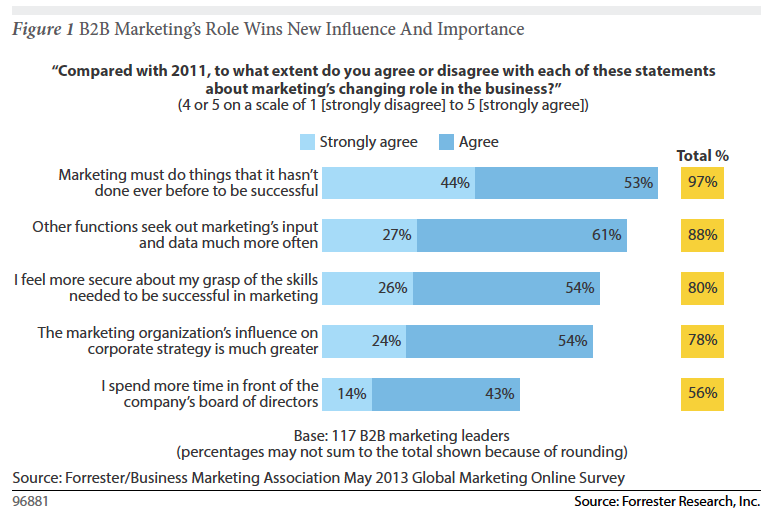

The time for going “big” is now. In Forrester’s recent B2B CMO’s Must Evolve or Move On report, 97% of marketing leaders who were survey agree with the statement that “Marketing must do things that is has never do ne before to be successful.”

ne before to be successful.”

The other interesting, and important nugget from the research is that marketing is playing a bigger role in influencing corporate strategy, and other functions. Make sure you’re capturing this opportunity at your organization by thinking, and by being — “Big”.

by scott.gillum | Nov 26, 2012 | 2011, Sales

Original Post Date 9/22/11

Even if you believe in love at first sight, the likelihood of a marriage proposal on the first date is highly unlikely. Committing yourself to someone without getting to know him or her first is a ridiculous idea. Yet far too often companies are asking audiences to “commit” at the hint of an interaction despite knowing little about each other.

Why?

In the tech industry and according to author Tom Grant, Ph.D, companies desire early commitment, due to the industry’s “voracious appetite for leads.” As Grant explains in his report, Tech Marketers Pursue Antiquated Marketing Strategies, the “high-speed innovation” rate drives a hyperfocus on product marketing and lead generation compared to other industries.

In fact, only 22 percent of marketers in the technology industry said that customer relationship management was one of the two most important priorities. Contrast that with 52 percent of marketers in non-tech companies. The focus is obviously on producing a measurable outcome that drives the product P&L: leads.

Developing a relationship with an audience takes time and resources, and it can be perceived as a distraction to the task of finding “ready to marry” prospects. This inward-out view of marketing ignores audience needs and assumes that all audiences are the same, and that all searches must indicate intent.

However, the key to driving demand and lead generation in today’s economy is not being more aggressive and pushing harder, but rather, taking time to develop and nurture relationships. Audiences, like dates, can sense desperation. Perhaps the way to go faster is to slow down and shift the focal point from the conversion to the conversation.

We have long known that relevancy drives conversion and that conversion drives revenue. Getting to relevancy requires us to engage with the audience to understand their unique needs and motivations. As a result, our role changes from dictating to facilitating and understanding that it’s now on the buyer’s time frame, not ours.

New technologies such as Bizo enable us to know who the audience is at the first interaction. We also know where they’ve been for 30 days (who they’ve been dating, so to speak) before the conversion point, via Google Analytics’ new Multichannel Funnels.

We can serve up custom content through retargeting based on audience profiles, adapt for whatever device they are using, and deepen engagement by providing specific product or brand messages that align with their journey.

We can serve up custom content through retargeting based on audience profiles, adapt for whatever device they are using, and deepen engagement by providing specific product or brand messages that align with their journey.

95% of prospects on your website are not yet ready to talk with a sales rep.” Source: 2011 MECLABS research

We no longer have to interrupt a buyer’s journey to gauge the interest level. We no longer have to call a prospect to qualify him or her. When a company offers something of value (i.e., relevant and personal), buyers are more likely to share their interests, desires and needs, but only if we listen, nurture and respect the relationship. According to Forrester, this intimate information is critical to creating real opportunity (leads) for the sales force.

In the Technology Buyer Insight Study, Forrester found that although tech has done a good job of equipping its sales force to discuss company products, it had failed to provide reps with insight into the buyer’s roles and responsibilities. Only 29 percent of CIOs said that sales reps could “relate to their role”; less than a quarter (24 percent) of business leaders said that reps were “knowledgeable about their business.”

Still too touchy-feely for you? Consider Harte Hanks’ report, Mapping the Technology Buyer’s Journey, which states that the relationship with the vendor is still a top five consideration driver. The first and second most important drivers are what you’d expect: (1) Meets all needs and (2) cost.

Competitors can match your price, but they can’t necessarily match your understanding of the buyer’s need or the relationship developed through that journey.