by scott.gillum | Jul 27, 2016 | 2016, Marketing

A few weeks ago, I participated in an interview with CEB‘s new Marketing Solutions group. The focus of the article, as they described it, was to “understand what it takes to have a healthy client-agency relationship.”

The article was published in their July monthly newsletter to members. CEB was kind enough to allow me to share an excerpt of the article with my readers (see below).

We asked agency leaders from key partners in CEB’s recently launched Marketing Solutions* effort to answer the question “What key relationship-building steps do clients most often overlook?” Below you’ll find our curated list of top overlooked steps:

- Make Sure They “Get It”: No matter how well the agency knows your industry, there needs to be discipline on both sides, ensuring the agency invests time getting to know your business, customers, brand, and the expectations of key stakeholders.

- Keep the Creative Spark Alive: Saying “no” too many times or being too directive can kill a client/agency relationship. You’re looking for a fresh perspective, not a passive, tactical partner. Challenge your agency to do at least one wildly strategic or creative thing for you each year, something that might even make you a bit nervous.

- Be Constructive: Creative teams invest time in understanding a clients’ issues/objective and then brainstorm on possible solutions. Keep in mind that it’s not what you say, because agencies need your input, it’s how you say it. First be complimentary, what you like, and then give notes.

- Don’t Miss the Magic: Too often RFP’s are focused only on qualifications and price. The real magic in an agency relationship is how well you work together. Be mindful of the way your teams will work together—and bring out the best in each other—that will really make a difference.

- Understand Limitations: A good creative campaign can change perceptions about your brand, products, and even service capabilities. However, it is the burden of the organization to deliver on the “promise” being communicated. Be realistic of what your agency partners can and cannot solve for.

- Agency’s Ability to Help You Bust Internal Silos: Assess agency candidates for their understanding of key partner functions (like sales, service or operations) and their ability to help you bring those other partners into creating seamless customer experiences.

- Agency’s Ability to Disrupt Your Customers: Winning marketing efforts disrupt what customers think, believe, and assume about themselves (not about you). Bottom line: pressure test your agency’s empathy—the ability to go deep into how customers think about themselves and their own world.

Additionally. CEB is now providing execution support on B2B go-to-market messaging and content creation. They’ve partnered with select agencies, like gyro, to offer engagements that help create messaging and content that reflect the latest insights from CEB’s B2B buyer and best practice research If you’re interested in learning more, send me a note.

by scott.gillum | Aug 1, 2012 | 2010, Marketing

Original post date December 15, 2010

Last month I had the chance to be a panelist at a forum hosted by Wolfgang Jank and the Robert H. Smith School of Business at the University of Maryland. The topic was on Informatics – Data Driven Decision Making in Marketing.

Agreeing to participate without knowing what I would discuss, I searched my files reviewing old project work. Not only did I find a relevant effort, I also realized that I had spent two years working on building and implementing an insights program at a major Financial Services firm.

What’s interesting about the topic is that everyone will agree that they should be more data driven, or fact based, with their decision-making. Heads will nod when it’s discussed, it’s intuitive, and so the question…and the problem, is why doesn’t it happen?

The company I was working with had an abundance of data but were faced with two consistent problems related to the use of it:

- Reps wanted better insight

- Customers wanted a POV

The first issue we probably spent a good six months on defining what an ‘insight” was, how to create it, and who was responsible for doing it. The second issue was more complicated, and took much longer to resolve.

Over that two-year period, I learned how challenging it is for an organization to use one source of data effectively across the enterprise. Some of the challenges we uncovered were typical such as lack of resources, process, and funding. Others were more challenging: People funded their own resources and research to support their strategy, budget or group.

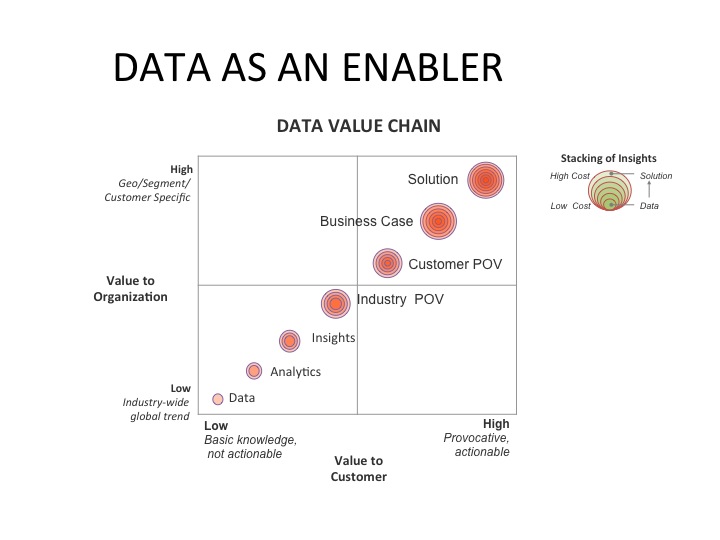

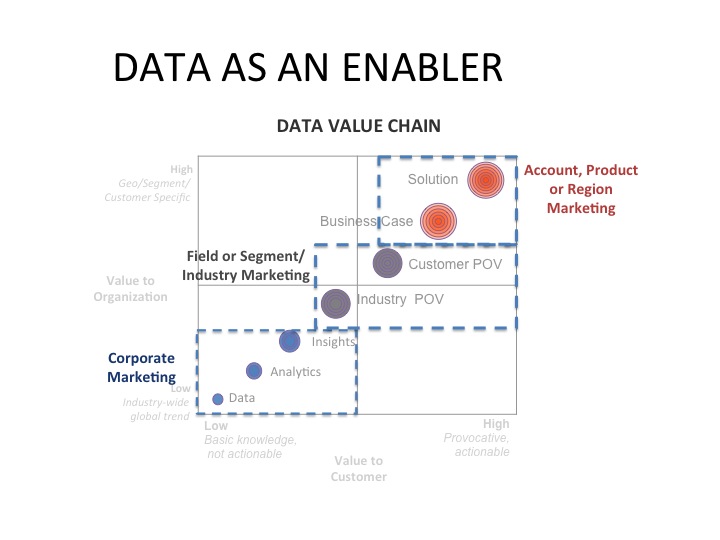

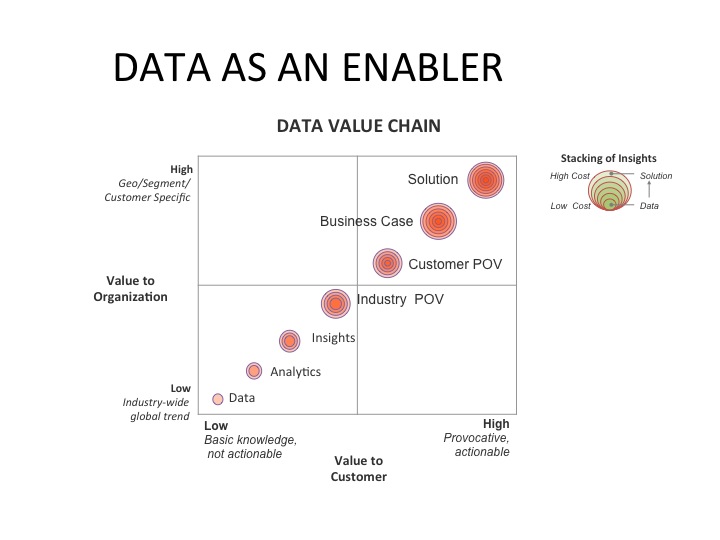

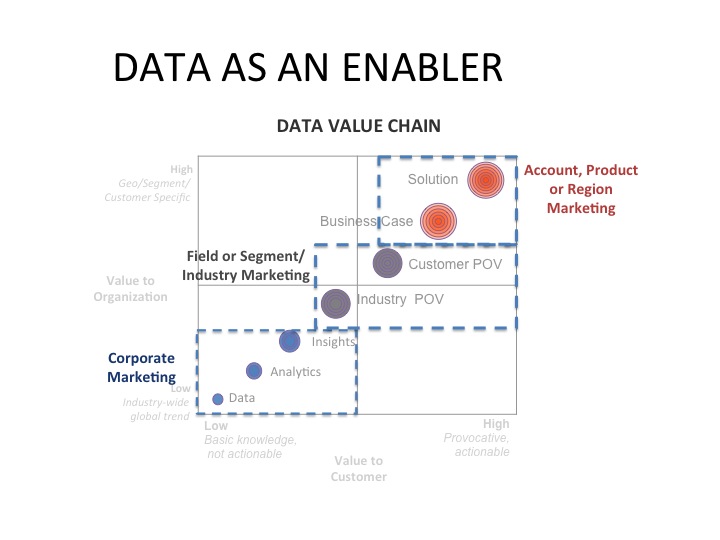

To begin to solve this complex problem we created a “data value chain” (see below). The starting point was having one centralized source for data. As we discovered, as data flows from across the organization to the customer, enhancements were needed to make it more valuable, like growth rings on a tree.

As data became more customized, and localized, it grew more valuable. This helped to identify why, for example, research that was being produced at corporate was not often used by the sales teams…it lacked relevancy, especially in regions outside of the US.

Once we got everyone on the same page the next challenge was to align the various groups in the organization across the value chain. We learned there could be as many as five different groups involved in handoffs as the data moved across the value chain. This help to explain why product groups were developing solutions without market insights, and regions were not leveraging corporate insights for business development.

Handoff points in an organization

As a result, we had to design process maps, hand-off points, engagement process, etc. The elephant in the room, and one of the biggest challenges was wrestling with the budget. The solution for that last huddle was turned out to be pretty simple.

The corporate “insights” team would work with those regions that wanted to work with corporate. Those regions had to be willing to fund resources to finish the “last mile”…building a solution or a customer business cases with a defined solution in mind. Even though everyone wanted more relevant insight, and more defined points of view, not all regions were willing to pay for it. Finally, to secure the funding to make the fixes we had to be able to answer a very simple question; “how does being more data driven provide value to the organization?”

The answer was getting the data closer to revenue or a sale….”turning data into dollars.” The epiphany wasn’t that the value was found at the end of the chain but the number of groups, and the coordination needed to be involved to reach that destination.

by scott.gillum | Jul 17, 2012 | 2008, Sales

Given our average deal size we used to think we needed to have a scaled down offer to get a foot in the door. Once in, we could then grow the account. We were wrong.

Considering the current economic situation, I know that many companies may be tempted to come up with a “door opener.” A subscale and/or entry level product/service intended to get a foot in the door with a new client and/or a new business division.

You’re also probably thinking about going down market into smaller accounts. Although this shift may help satisfy short term revenue needs it will do little to nothing in helping grow your business. Most likely those accounts will not expand and/or even be retained next year.

Here’s how I know. Looking back at the new accounts acquired over the last four years we found some interesting trends and confirmed some things that we knew intuitively (click on the image). When we measured the value of customers in their first year against the average time spent engaged with the client a few key insights emerged.

First, three “clusters” of accounts emerged;

- Customer that grew to beyond $800K in their first year

- Customer who had first year revenues between $350-$600K

- Customers who represented under $250K in total billings from the year.

Let’s start with the bottom and work our way up. Customers in cluster 3 had an average value of $150K. Accounts on the lowest end of the spectrum in the “One and Done” zone” (under $10K for example) were “workshop”…our “foot in the door” offer. Guess what, of the 8 that fit that description zero, zippy, nada, grew beyond the initial workshop. The other bad news…only 2 accounts led to follow on work and no company in that grouping was retained the following year.

I was speaking with Larry Emond, CMO of the Gallup Organization the other day and he mentioned that they saw a similar trend; “We found that only 4% of customers who were acquired under a certain price point grew to be substantial customers.”On the other end of the spectrum are the occasional customers who are big right out of the gate. The “Rare Birds” zone in cluster 1 includes those few customers who start big and for the most part remain large customers YOY. The key to success with this cluster is that they had/have a tendency to have a need for multiple service lines and/or desire a complex solution. This group was looking for a strategic partner versus a vendor for an immediate need. Year over year retention was also good at over 50% and if they used multiple services lines it was almost a sure thing they be retained….and grow.

As Larry also mentioned; “Our big customers today came in as big customers…”. We’ve had the same experience and have grown our top 5 largest accounts by an average of 90% over the last two years.

Customers in cluster 2, the “Sweet Spot” represented the best of both worlds. Although their value was not as high as the “Rare Birds” they were more plentiful. They also had higher price points, high percent of follow on work and YOY retention than the “One & Dones.” Retention rates although not as high as the “Rare Birds” was good (a little over 33%). Bottom line – they represent the model that we need to build our coverage and services bundle against. We have also realigned our resources to help account development/retention activities against this group.

Why do low price point and short engagement acquisitions perform so poorly?

We discovered five main reasons for this:

- Length of the engagement – too short to learn business/issues/meet folks/create a relationship, etc.

- They get the “B” team – the “A” team is on existing accounts, as a professional services firm that measure FTE productivity this will always be the case.

- Short term need vs long term problem – we were successful in building a relationship with target buyers within targeted accounts. So much so that they decided to “give us a try.” The problem with that is that it was usually a piece of work that wasn’t strategic.

- Size matters – our win rate and retention rate dropped dramatically on companies that had under $1B in revenues. The only exceptions were situations we were able to sell a solution as the first engagement.

- Culture/Attitude – some companies just don’t have a culture of working with outsiders. This very difficult to know until you’re in the door.

So as you are thinking about 2009 focus on aligning resources and efforts on;

- Retaining and expanding your biggest customers with new lines of business.

- Find your “sweetspot” based on this type of analysis…what is the right mix of services and price.

- Targeting big companies with big needs…there are many out there now just make sure you have the right offer.

Because at the end of the first engagement…a foot in the door just isn’t enough.