by Sonita Reese | Oct 11, 2019 | 2019, Marketing

by Scott Gillum

Estimated read time: 4 minutes

Over the last few months, I have had the opportunity to attend industry events, review new research on buyers and sellers, work with clients on very difficult challenges and observe the behavior of sales and marketing teams working together… and I’m worried.

I’m worried because of the following. Albeit a small sample size, I am seeing the issues below across organizations of various industries, big and small.

– Confusing Activity for Performance, Again

Despite our ability to measure more than ever I have observed organizations rushing campaigns out the door without proper performance metrics defined and/or proper mechanisms in place to capture performance data. And when flagged, the client took a pass on putting them into place because it would take “too much time.” The behavior of go, go, go is pervasive.

– Overreaching Procurement and IT

This observation is unique. It’s the first time I’ve ever seen the procurement and IT group change the requirements on making a purchase decision. The group changed the client sponsor’s key decision criteria to bring in their preferred vendor costing more than $100,000 above the next highest bid. The owner of the work did not get what they wanted and the organization ended up paying more for it. Someone has too much budget.

– Basic Building Blocks are Missing or Skipped

Database quality is owned by everyone, and no one, customer profiles lacking basic information (like emails), performance metrics are missing or not being tracked, process metrics are in place but not used, call list are not being bounced up against do not call list, agencies lacking knowledge on their clients customers and products, and on and on and on.

– Lack of Accountability

Large chunks of money being dropped on media without accountability on the performance of the spend, and sales comp not aligned to organizational revenue objectives and goals. Also see bullet above.

– Silver Bullet

Related to bullet #3, over reliance on the MarTech stack to fix basic problems that they were not intended to fix. The ramping up of Data Science departments to run sophisticated analysis on data that they may, or may not, realize is compromised. Marketing investment decisions being made using outdated marketing optimization models that only output “spend more” recommendations.

– Status Quo

Lack of courage or motivation to make difficult decisions that would impact performance for fear of being disruptive. Control issues that prevent real change from being made by team members who see opportunities to improve performance but may be perceived as threatening to others. “Things are good, don’t rock the boat.”

– Doing the Dirty Work

This is the most disappointing of all of the things I’ve observed. Good marketing is hard work. It requires research to understand buyers, products and competitors. And guess what, it takes time. Recently, I was in a meeting about a new positioning for the organization. Everyone was excited by the idea but the marketing team lost it’s enthusiasm when they heard the amount of work needed to take to bring the idea to life in a campaign. Breakthrough work requires ergs of effort to make it great. It’s the price you pay…get over it.

Much of what I have observed are symptoms of good economic times. Organizations flush with budgets, high demand for products and services, and growing profits are causing organizations to operate inefficiently. The reason this is so concerning is because we’ve seen this movie before, most recently in 2008.

Things are in motion. The trade war, the presidential election, candidates promising to come after industries and corporate profits, big tech getting squeezed by governments over their size and privacy issues.

For the past five years we’ve been able to get away with average efforts. Strong economies and demand bring about waste. “Doing” became more rewarding than “thinking.” Put more in the top and even more comes out the bottom. But those days are numbered.

Being smart about what you do and why, will become a necessity again. Doing more with less will become the reality. So as you do you 2020 planning, have a mindset that a recession is coming. Try taking an approach that assumes you have 20% less budget than last year. Here are 10 things to consider.

- What would you cut to reach a 20% reduction, and why? Lay out 3-4 different scenarios.

- What would you invest in in Q4 2019 to set you up to be more efficient in 2020?

- If you had to turn off 2-3 tools what would they be, and why?

- If you had to shut something down to reinvest to get a better return what would it be and where would you put the money?

- Could you move something off of your budget line and onto someone else?

- Are you paying for something that you shouldn’t or it benefits some other group?

- Could you centralize something and get greater efficiencies?

- Could you consolidate vendors to be more efficient?

- Could you do less and produce better results by sticking to a limited set of priorities?

- Could you have one centralized campaign and tie it to several products/markets or goals?

The goal is to become 20% more efficient. Even if the recession doesn’t come next year you’ll be able to clean up some of the sloppiness that comes with good economic times.

Subscribe Here for thoughtful content on how to ‘think differently’ on marketing, business, and work.

by scott.gillum | Nov 7, 2014 | 2014, Marketing

The 2015 planning season is upon us. It’s the time of year when the C-Suite is busy sharpening their elbows to ready themselves for the budget brawl. To help arm marketers for this blood bath, I’ve pulled together benchmarks and/or research needed to defend and win marketing dollars. Here are some answers, and sources, for your five toughest budget questions.

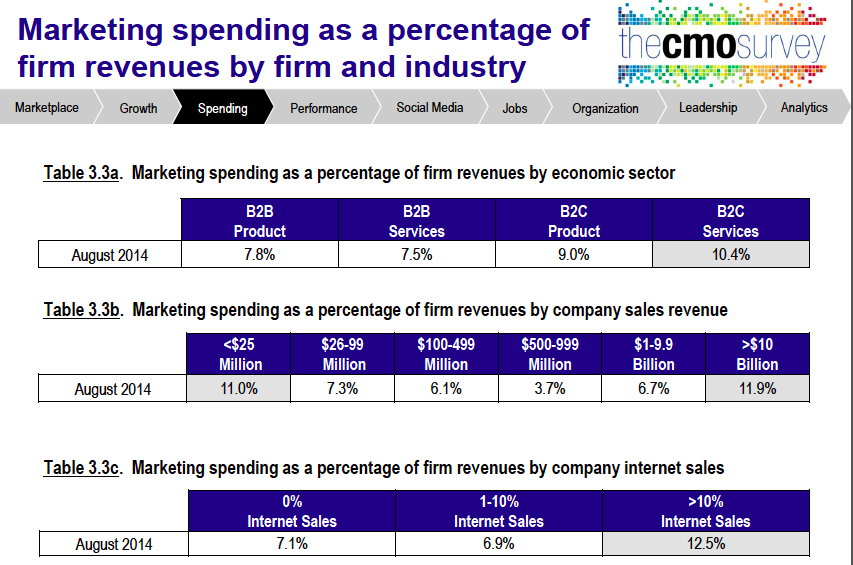

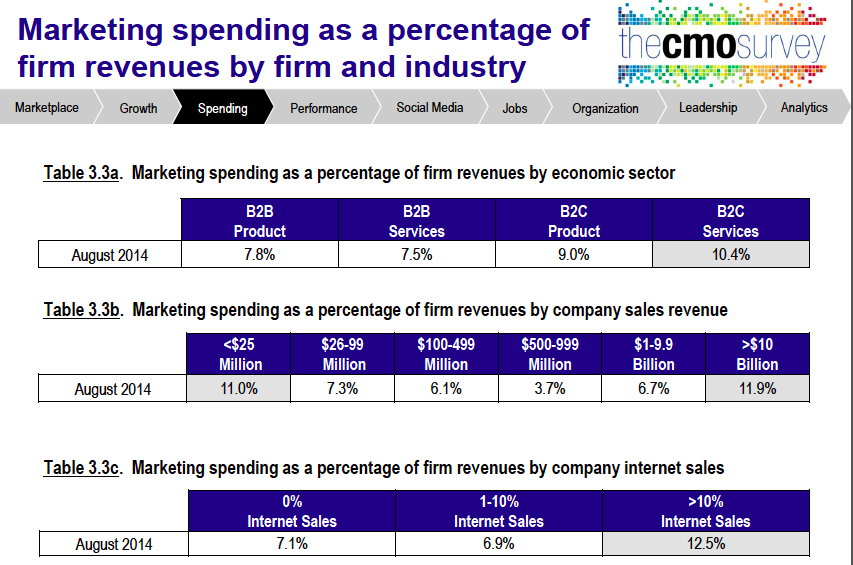

- How much should we be spending on marketing? It’s a classic question and a favorite of CEO’s everywhere. The mere mention of it is enough to stop marketers in their tracks. Fortunately, the AMA, McKinsey and the Duke Fuqua School of Business have got your back with their 2014 CMO Survey. Section 3 of the report contains data from 350 marketers on their spending from digital to people and programs. The research even breaks spending out by size of company, type of company (B2B or B2C, and B2B products or services). The report is packed with valuable information — it’s a “must have” for any marketer this year.

- What should the mix between people and programs? This question comes shortly, if not immediately, after the question above. Ten years ago the general benchmark ratio was 40/60, forty percent of the budget went to staff and the remaining to program spending. Now it’s the reverse, 60/40 people to program spending, for a number of reasons. The biggest factor has been the need for specific skill sets that are in high demand relating to analytics, social media and content marketing have driven up staff cost. Need more information, here’s a useful infographic on the real cost of social media, including salary cost for staff.

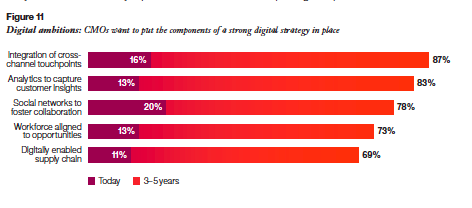

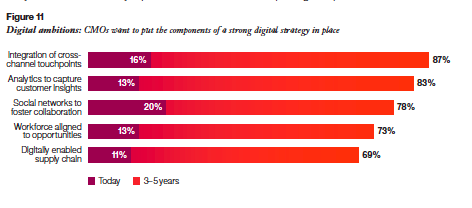

- Where should we invest? Typically, this is a teaser question, and could also be asked as; “if you had an incremental $1 (or $10K, $100K, etc.) where would you invest it?” Keep in mind that just because the CEO is asking the question doesn’t necessarily mean you’ll get the incremental funding, but you better be able to answer the question. To do that see IBM’s C-Suite Priorities report entitled The Customer-activate Enterprise. The research, collected from face to face interviews with over 4000 senior executives, provides insights into the priorities of each member of the C-Suite. The top priority in the report is Digital. Including everything from increasing responsiveness to customers, to making the organization more agile and responsive. Specific priorities for CMO’s, it’s about capturing; analyzing and using customer data across touch points.

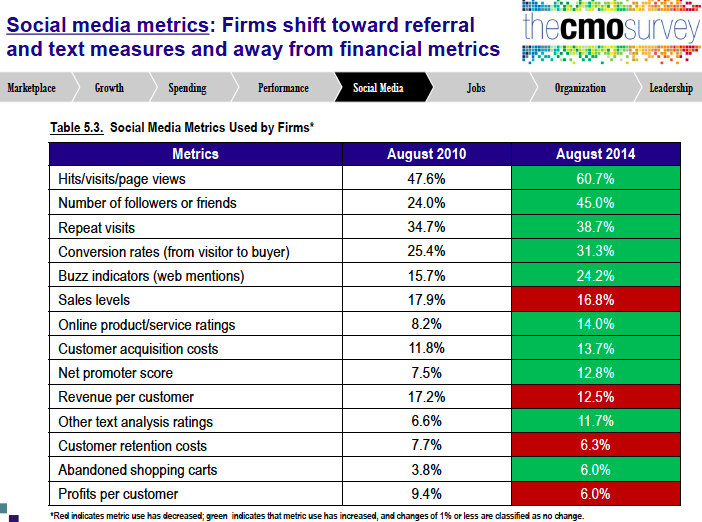

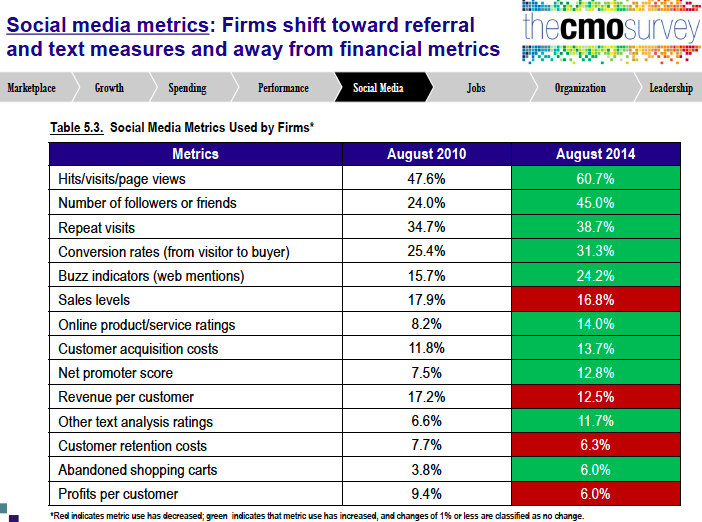

- What’s the payoff/return/business impact of Social Media? There are a number of sources that you could tab into to help develop a response. I’ve always been a fan of HubSpot’s State-of-Inbound. Additionally, if you have downloaded the CMO Study mentioned in bullet #1, there is a whole section on Social Media (see graphic). Interestingly enough after four years “Visits” and “Followers/Friends” are still the leading social media metrics today. Personally, I’m not a fan, try using measurements related to engagement. Note the gains being made in “Conversion Rates” and “Buzz Indicators” over that last four years. This is the result of the development of better measurement tools. Here’s a great cheat sheet from SocialMediaToday on the Top 50 Tools. For digital and mobile benchmarks download Adobe Digital Index’s Best of the Best Report.

- What return should we expect from our marketing investments? This is a loaded question. Recognize that what the executive really wants to know is: “What will marketing do for me and/or my group?” As a result, answer the question based on their area of interest, and in their language. If it’s a sales executive, talk in terms of new leads, customers and pipeline value. If it’s the CEO, talk about brand value, revenue growth or customer retention or loyalty. Rarely is this question asked on behalf of the organization as a whole. Even more rare, is the executive that believes the numbers you’ve quantitatively derived for a ROI.

Lastly, go in strong and ask for a bigger budget. Here’s a report to keep in your back pocket in case you need it, Gartner’s CMO Spend 2015: Eye on the Buyer. The report will support your request for an increase, and maybe help the “powers that be” understand that if you’re not getting a bigger budget, your key competitors probably are…now go get ‘em!

by scott.gillum | Feb 19, 2013 | 2013, Marketing

You know the question is coming, because it comes every year. You know who is going to ask it, because they ask it every year. It’s just a matter of when, perhaps at the end of a difficult quarter, or during a mid-year review meeting. As budgets are being discussed it comes; “What are we getting from our marketing dollars?”

It’s a fair question to ask, and given the size of some marketing budgets, marketers should be asking the same question. To answer the sales executive (usually the one asking the question) you must first recognize what they are really asking, which is; “what is the value of marketing to them?” Specifically, they want to know the impact marketing is having on sales performance, beyond leads.

A few years ago, we did some interesting research for a medical equipment manufacturer. Their analysis showed that they were missing opportunities but they couldn’t agree on why – was it a sales or marketing issue?

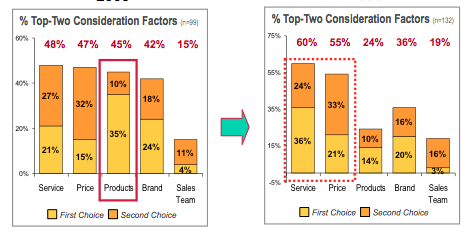

To uncover the answer we interviewed hundreds of buyers (customers and prospects) in order to rate the performance of the company compared to three competitors, at four stages of the pipeline, product awareness (unaided), consideration, proposal and win. We then constructed a quantitative model to reflect the impact of changes in performance. Two years later, we were given a unique opportunity to measure the impact of recommendations and investments.

The research yielded three key insights on the importance of marketing and how it was impacting their sales success:

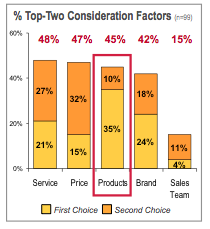

1. Increasing Opportunities – without marketing support sales cannot move consideration rates. The company’s unaided product awareness rate was 62%, compared to 88% for the market share leader. The consideration rate was even worse at 46% compared to 86% for the leading competitor.

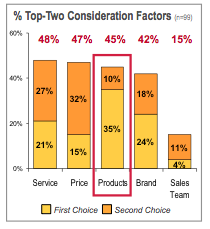

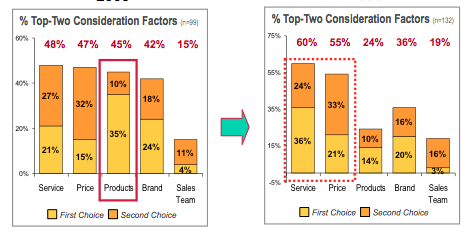

The organization had a strong sales culture. So to demonstrate the need to increase marketing activity, and not just sales coverage, we included “relationship with the sales team” as a key consideration drive, along with typical drivers such as; price, brand, and service.

The research showed that the relationship with the sales team was not an important consideration driver. In fact, the data revealed that reps could do very little to change buyers’ perceptions relating to products and service. It also revealed a new buyer that was not being reached by the sales force.

The company increased the marketing budget and reallocated funds from events into digital marketing. They ramped up webcast, videos and built a microsite specifically for this new buyer. As a result, Awareness rose 17 percentage points to 79%, and Consideration, originally at 46% rose to 62%. The model showed that an incremental 1% change in consideration rates yielded 20 new opportunities, and almost four new wins with a value of almost $2M.

2. Sales Coverage – increased marketing activity can create the perception of greater sales coverage. Buyers were asked how often they saw a sales person within a 90 day period. They mentioned seeing the company reps on average of 0.8 times, basically once a quarter, while reporting rep visits from the leading competitor at 2.5 times, almost once a month. Two years later, buyers stated seeing the company’s reps 2.4 times per quarter, on par with competitors. As a result of the ramped up marketing efforts, buyers perceived an increase in visits despite the fact that the number of reps in the segment remained the same over the two year period.

3. Sales Enablement – marketing can identify shifts in buying behavior. The company’s performance had increased in all stages of the funnel except for one, existing accounts Reps had mentioned that customers had become more “price sensitive” and competitors were undercutting them. The company was the product leader in the industry and the senior management team still believed that technology innovation was the key consideration driver.

The follow up research found that the sales force was indeed right. Buyers had shifted their priorities. With changes in reimbursement, healthcare reform, and an effective competitor campaign against overbuying technology, buyers had indeed changed, much faster than anyone suspected.

As a result, sales material and value proposition had to be updated quickly. Instead of espousing the virtues of innovation, it now needed to help buyers justify the investment. Leading to a shift from “bells and whistles” to “ROI models and product configurators.”

So, how do you communicate the impact marketing has on sales performance? Tell the sales folks that marketing can identify new buyers and influencers, increase the number of opportunities reps see, improve a buyers perception of sales coverage, and enable them with the right value proposition at the right time to win the deal. Of course, you’ll need the data to prove it.

In this case, the increased marketing investment and activities yielded $50 million in new sales over the two-year period…just as the model predicted.