by scott.gillum | Dec 20, 2019 | 2019

by Scott Gillum

Estimated read time: 5 minutes

People, we have a people problem. The US unemployment rate once again hit a 50 year low at 3.5 percent this month. But that’s not the big story. Something more menacing is at work. The US crossed “peak employment” earlier this year — the number of job openings now exceeds the number of available workers.

This “crossing” has created a problem that now threatens to make buyers unreachable. It also changes the relationship between employee and employer. And it’s not just “skilled labor” (which gets most of the press) that is in rare supply it’s ALL labor.

Right now there are 400,000 entry-level sales positions on LinkedIn. According to CSO Insights, it takes 4 months to recruit a one and 9 months to make them productive. New hires who are mismatched for the role or company (15% according to CSO) turnover within the first 90 days. The time to recruit them could actually be longer than the time they spent with your organization.

With an average tenure of only 1.5 years and plentiful job opportunities, reps could and do leave before ever becoming productive. (To keep a revenue-producing position filled for at least 3 years you’re looking at least 2 hires, for 5 years at least 3 hires). And, you’re swimming in a very shallow talent pool, it’s become a decision of hiring a “warm body” versus an “able body.”

This is the reason sales organizations have become obsessed with hiring for the last few years. Crossing the “peak employment” threshold has only compounded the problem. Once demand exceeds supply, employees gain leverage. Add that to a generation, like Millennials, and you have a recipe for a whole new set of expectations that comes along with hiring. If you’re not providing a clear career path, advancement opportunities, upskilling/training, a vacation policy, etc that aligns with their expectations, they’re gone.

This “people problem” has unleashed machines to fill the void. Robo dialers are now making hundreds of dials a day, at a rate of 33 calls per connection (a dramatic increase from 3 calls to connect 15 years ago). AI has now made its way into ABM tools to try to help inexperienced reps be more productive and that’s about to create another problem.

We are now caught in a cycle of what Hank Barnes of Gartner termed “The Machine of More.” With Robo dialers now pounding the phones, sales has set its sight on outmarketing marketing — sales now sends more emails than marketing. This is all ending up on the doorstep of buyers, who according to Hank and Gartner, are now only spending 17% of their time during the buying process speaking with reps.

How did we get here?

Good economic times have created a mentality that there is a linear correlation between hiring and revenue — more reps equal more revenue. As if the number of deals and buyers are keeping pace with this expansion. It’s a number game, namely volume. Cast a wider net and bring back more fish…except that’s not happening.

CSO Insights’ annual Buyer Preference Study finds that only about half (53%) of sales representatives are achieving quota. So what are smart sales managers doing? Knowing that about half of the sales force is ineffective, they’re hiring (or trying to) more reps to make their numbers.

How do we get out of this mess?

Here’s a handful of ideas to consider for 2020.

- Long term focus on new hires – according to Seleste Lunsford of CSO Insights, who spoke last month at the University of Texas Dallas Sales Summit, 60% of the sales organizations surveyed are not providing sales coaching. Let that sink in. We’re hiring entry-level positions, who might not be a good fit for the role, and we’re providing little to no coaching. Finding, training, coaching and retaining salespeople has to be a focus. Focus on hiring half as many reps and make them twice as productive.

- Focus on conversion, productivity, and profitability – this “mentality of more” is not confined to sales. Investors, you’re complicit in this as well. If you’re working at a SaaS company with investors on the board, you have probably been given the mandate to work the numbers — X in the top produces Y out the bottom. That’s incorrect and it’s creating the wrong behaviors. To be rewarded in today’s market a startup has to focus on driving profitability. The easiest way to do that is to narrow your focus and double down on conversion rates. Do more with less, and do it better.

- Watch for sales creeping further into marketing – as I mentioned earlier, ABM tools are using AI in the goal of helping reps become more productive. Here are two areas to watch that are dangerous. The first is DISC personality profiling. Scraping the digital domain, AI tools can build individual buyer profiles in about 2 seconds. In a sense, sellers can now create “one to one” personas that do not align with typical marketing created “one to few” personas. This conflict will cause mixed messages to be sent to an audience who is increasingly becoming tone-deaf. The second challenge is curation tools which allow sales reps to send what they believe to be relevant content to buyers in hopes of being “value-added.” It’s instant ammo in their email spam gun. It’s also a missed chance to use the information to generate more engaging thought leadership content.

- Enable buyers – this is the key to changing the tide. Allow buyers to go as far into the sales process as they want and let them choose how and when they want to engage reps. Remove all barriers to information they might need to make an informed purchase decision. Provide digital guidance on how to find the right content specific to their needs on your site or other sites (this will require improvements in UX). Become the source of the most credible information available. According to Gartner, buyers don’t trust reps to provide ALL the information needed. Let buyers do the curation, and you facilitate the process of helping them find it.

Finally, If you take anything from this post, remember these two numbers. First, only about half of sales reps are making their quota, (a decline for five straight years according to the CSO Insight report). Second, 17% of the buying process is spent speaking with sales reps (down from 19% the previous year).

These are two lights flashing something is wrong. Buyers are signaling to stop, but instead of picking up that signal we are ignoring it and the machines are throwing more at them.

The reality that we face today is that the supply of sales reps now has exceeded the demand from buyers for them. We have reached “peak sales hiring.”

At the Sales Summit, I asked the audience how many of their organizations have asked customers what they want, how buyers wanted to be sold to, a grand total of zero hands went up. If you want to create a sustainable competitive advantage, especially if demand slows, find out how buyers want to buy. We have to stop shouting at them and start listening. The machine has to stop.

For more tips on marketing, business, and thinking differently delivered directly to your inbox, subscribe to our newsletter at www.carbondesign.com/subscribe.

by scott.gillum | Sep 14, 2016 | 2016, Marketing

By Scott Gillum and Paige DiPrete

Modern marketers are “technology crazy,” constantly searching for the latest innovation to help them optimize the customer lifecycle and gain a completive advantage. For better or worse, marketers have plenty of options to play with, according to Scott Brinker the MarTech landscapes is enormous with 3,874 ISV’s and growing everyday.

In the past, Larry Ellison would of referred to the maturing MarTech space as a “killer field.” With the “Big 5” (Oracle, IBM, Salesforce.com, Adobe and SAP) swooping in like birds of prey picking off niche providers to fill out their product portfolio.

Marketers in the past would have been content with letting the industry leaders pick the winners and losers from this vast field of options. Preferring to consolidate their technology needs with one or two vendors making it easy to have “one throat to choke.” Companies like Oracle, have invested in making acquisition to fill solution gaps in functional areas as they have built their Marketing Cloud.

Unfortunately for Oracle and others, Millennia’s are not behaving the way traditional software buyers have in the past. In fact, there is growing evidence that they are pursuing a “best of bred” approach aimed at stitching together multiple platforms that follows the customer journey. Marketers are arranging their “stacks” either in a linked multi-platform approach, or with a spine in tag management products that hook up to an assortment of specific platforms and ISVs.

These new customer-centric clouds cut through traditional inefficiencies to motivate purchase intent. They are woven on the idea that consumers search for and choose customer-oriented brands, so marketing technology should reflect and enhance this in the evolving digital world. Most clouds only offer targeted suites in functional areas, which create both customer and internal silos. But these hybrid clouds humanize the digital experience and bridge integration seamlessly across all channels and touch points. All customer-facing departments are poised to address the public with a single strategy organized into one set of solutions.

A growing leader in the experience cloud space is Sprinklr, recently valued at $1.8 billion. Sprinklr has a focused acquisition strategy that concentrates on integration and is unlike any other in the business. First off, it doesn’t sweep up tools simply to increase their client base or rapidly grow, but it instead targets how well each can augment the customer’s experience. Sprinklr then completely rebuilds their software onto its own platform to ensure seamless integration.

And this could present a major challenge for the Big 5, as Oracle’s president Mark Hurd calls the idea of perfect integration between its products impossible, adding that, “There will never be a day where the depth of integration, unless it was all built from the bottom ground up, will be as integrated as any of us would like.”

When Sprinklr made its initial acquisition in 2014 of the Dachis Group, it was able to launch the first end-to-end operating system for brand marketing that enhanced customer relationships through multiple channels and touch points. Since then, its business ventures have made it a pioneer in converged media, advocacy, social communities, content management, audience segmentation, and social visualization – all to enrich its clients’ understanding of and engagement with customers.

Even though Sprinklr may be the fastest and most effective solution so far, it’s not alone in the move to deliver this new breed of experience clouds. In 2014, Gartner predicted that 89% of companies would be competing mostly based on customer experience by today, versus the 36% four years ago. The leading cloud giants like Oracle, IBM, Salesforce, and Adobe are starting to recognize this new wave and have shifted their strategies accordingly to offer their own experience clouds but integration remains a challenge.

Salesforce recently acquired Demandware as an integral part of its Customer Success Platform, but it yields weak integration between its various clouds. Similarly, Oracle and IBM are especially vocal about their experience cloud offerings and each present a large number of comprehensive solutions, but they are also limited on the integration front, both internally and with third party plug-ins.

It’s still debatable if there will eventually be “one cloud to real them all” but for now, the successful platforms will be those that can serve as a solid backbone through internal as well as external integration. Or as Sprinklr Founder, and CEO Ragy Thomas states it “Sprinkle, don’t shout. It’s not about who yells the loudest. It’s about who offers the most value in a relevant, nurturing way.”

by scott.gillum | Jul 20, 2012 | 2009, Sales

Original post date March 24, 2009

In August 1999, Selling Power magazine ran an article featuring our firm and the work we’ve done helping clients, like IBM, build new sales channels and increase sales productivity. A few months later, we received a call from the head of a division within NCR asking us to meet with them to see if we could help them with something similar.

The senior executive with whom we met said if we could help IBM we should be able to do this project for them. Excited about the prospect of helping them build a new channel, we agreed and they laid out the challenge:

- A well-known consulting firm had been previously engaged but had failed

- …which left only 41 working days to get the new sales channel up and running

- An internal NCR tele organization was competing for this…which, we would later learn, tried to sabotage the effort…and us

- And finally, we were entering the holiday season…good luck

After collecting the previous project work we quickly went to work on assessing what had gone wrong. It took us a while, but we finally discovered “IT”. Once found, this insight became the key to unlocking success.

Almost ten years later I’ve seen this scenario play out over and over in B2B companies. This is what we discovered.

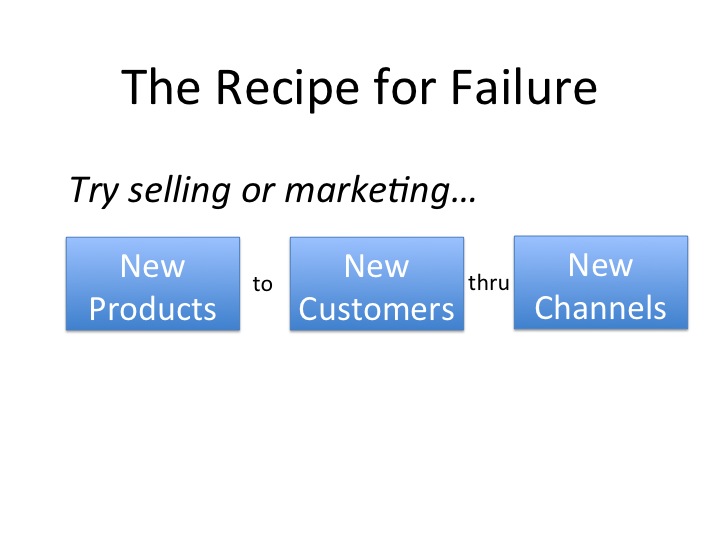

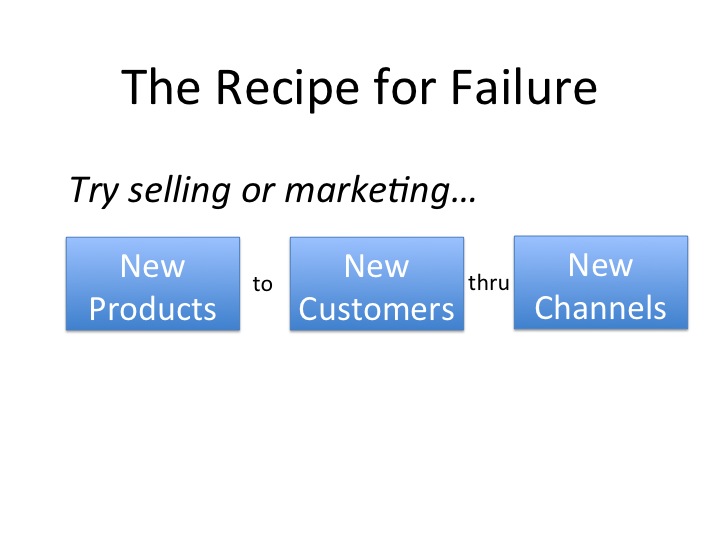

The secret recipe for failure

This simple equation is just as true today as it was a decade ago when we discovered it. Oh, you may find one or two exceptions but the majority of the time when we do post mordem on failed programs you find this equation is at the heart of the problem. When combined with a few related pieces, like a lack of time in the market and/or funding, the initiative is doomed. The degree of “newness” in these three areas will directly impact the likelihood of success or failure.

Sales Channels

- Why they fail – new sales channels fail because companies aim new channels at the wrong targets — new customers/markets. An investment in a new sales channel means that it is competing with existing channels for funding. If it does not hit expectations/goals quickly, it will be robbed of the necessary funding and/or resources needed to make it successful.

- How to improve the chances for success – The most successful way to build a new sale channel is to do exactly the opposite of what is described above. Shift coverage of existing customers or products to the new channel and use your existing channels to go after the “new.” Shift dormant or flat growth customers to the new channel to give it revenue immediately and free up your existing most knowledgeable, best trained sales folks to go after new opportunity.

Marketing Campaigns

- Why they fail – new marketing campaigns promoting new products aimed at new customers typically fail because of reasons listed above…they take too long to produce and/or aren’t given the time. Here’s another common problem, agencies will tell you the problem is the “creative” or “value prop”…maybe, but they also could telling you this because they make money on creative and production. “New” works with their business model.

- How to improve the chances for success – build less individual campaigns and invest more in one or two long term programs with many integrated tactics. Keep the programs in the market longer, closely monitor them and modify tactics based on performance. You don’t need a new campaign every month, you need a program that produces…and with tight budgets this will help you be cost effective/efficient. Years ago we did an assessment of campaign performance at IBM. We found that the highest performing campaigns had at least 7 integrated tactics and stayed in the market for at least 6 months. Use this as a starting point to design your campaigns and programs.

- New to New thru New – level set expectations and invest for the long haul. You will need time and commitment to make it successful. Companies have short-term horizons that are getting shorter every day. If you’re going to lead this effort get everyone to agree on what defines success and stick with your timeline.

- New Product/Service/Solution – try to leverage existing channels, customers or both to start…then migrate to new. This way you can learn if you have the right value prop, messaging, pricing, etc. We like to take existing reps, for example, and use them to help launch a new sales channel, like Tele. We like to use existing customers to test new products, etc.

We got the NCR teleaccount program up and running in 41 days. We transitioned existing field account managers to TeleAccount managers and built their territories around their customers. We then began to backfill them with new lower cost resources over time. You’ll be happy to now that the manager of the group that tried to sabotage the effort got fired.

The program hit our first year sales targets, reduced the expense to revenue ratio from 13% to 6% and grew sales productivity from $1.7M to $3.1M per rep. As a result, NCR then built a full-scale tele channel with close to 80 reps.

Then they killed it. It’s a long story but the bottom line was the company has a strong field sales tradition and culture. Mark Hurd, now CEO of HP, became the CEO of NCR, and decided to shut the channel down, redirecting the resources to the field.

Remember my comment about competing for resources. Mark’s an operations guy and a fan of face to face selling.

Culture runs deep, and can also kill channels and programs. Maybe I should update the “recipe” to include the forth “New”…new leadership.

by scott.gillum | Jul 12, 2012 | 2006, Opinion

Original post date November 15, 2006

Over the last 25 years, I’ve had the opportunity to work with well over 100 companies. Some of them recognized as “best in class” while others brought up the rear…so to speak. What has been interesting is the consistent themes, trends, and/or characteristics that determine where they land on that list.

Below are what I’ve observed to be the “Top 10 Truisms” of business behavior.

The TOP 10

- Corporate Culture – is directly related to the CEO. He or she sets the tone that everyone else emulates.

- Trust – is the difference between a dysfunctional and a high performance team. If you can not trust the people you work with and/or who work for you, you can not perform at the highest level.

- 80/20 Rule – the Pareto Principal always, ALWAYS applies, whether it is revenue, profit, sales, people, etc.

- No New Customers – if you are an established company that has been in business for 10 years or more, you can achieve revenue and profit objectives solely based on doing a better job of capturing the opportunity in existing accounts (see the 80/20 rule).

- Marketing Contribution – 10-15% of Revenues– if you are in a mature marketplace and you have to use marketing to acquire new customers, sell new products, etc., know that it will not product more than 10-15% of your total revenues. The other 85-90% will come from the sales channels.

- The Rule of 70% – given the speed of today’s market, competitors, and customers, getting a product and/or marketing campaign/program 70% complete and out the door is good “enough.” Let customers/prospects complete the rest of the 30% for you. Less internal debate and more customer feedback makes for successful programs and products.

- NEW does not mean BETTER – everyone loves something new but it is the last thing that any company should focus on. Building/ selling/thinking NEW takes too long, cost too much and will have the lowest ROI. Focus first on getting more out of existing…and then invest in new (see 80/20 rule..again).

- Elephant in the Room syndrome – there are big problems impacting performance in every organization that everyone knows about but no one talks about or attempts to fix. They will treat the symptoms but not the core problem…call it career preservation. High performing companies (and leaders) create a culture that is open to addressing difficult issues.

- Risk Tolerance – fast growing and “best in class” companies have a culture of tolerating risk and/or failure. It is a HIGHLY valuable and a very real competitive advantage.

- Performance Dashboards – we recently completed a research study with the CMO Council that surveyed over 400 CMO’s in companies over $500 Million in revenue. 50% of the responders said that they have a Dashboard and 38% said that they were working on one. Here’s the truth…they don’t have a dashboard; they have an excel based “Report Card” of what they did, where they spent marketing dollars and what they got in return (hopefully). The reality is that a real Dashboard has real time information and can allow you to forecast at least 30 days forward. Don’t show everyone in the organization your “numbers” until you know how to move them in the right direction.

Since this posting, I’ve recognized two other “Truisms.”

- Sales Force Behavior – is consistent regardless of what they are selling, who they are selling it to, or the industry they work in. As a result, it’s somewhat easy to predict how they will react in certain situations and/or to certain changes or challenges. Good insight for marketers to know.

- Smart companies can’t tell you what they do – professional services firms are terrible at creating the “elevator” speech. The reason is that they view the company as a reflection of the work they do with clients. Each client and project being different, they form different opinions as to the organization’s value.

Please add your “Truism” in the comment section below.