Data Driven Insight

Original post date December 15, 2010

Last month I had the chance to be a panelist at a forum hosted by Wolfgang Jank and the Robert H. Smith School of Business at the University of Maryland. The topic was on Informatics – Data Driven Decision Making in Marketing.

Agreeing to participate without knowing what I would discuss, I searched my files reviewing old project work. Not only did I find a relevant effort, I also realized that I had spent two years working on building and implementing an insights program at a major Financial Services firm.

What’s interesting about the topic is that everyone will agree that they should be more data driven, or fact based, with their decision-making. Heads will nod when it’s discussed, it’s intuitive, and so the question…and the problem, is why doesn’t it happen?

The company I was working with had an abundance of data but were faced with two consistent problems related to the use of it:

- Reps wanted better insight

- Customers wanted a POV

The first issue we probably spent a good six months on defining what an ‘insight” was, how to create it, and who was responsible for doing it. The second issue was more complicated, and took much longer to resolve.

Over that two-year period, I learned how challenging it is for an organization to use one source of data effectively across the enterprise. Some of the challenges we uncovered were typical such as lack of resources, process, and funding. Others were more challenging: People funded their own resources and research to support their strategy, budget or group.

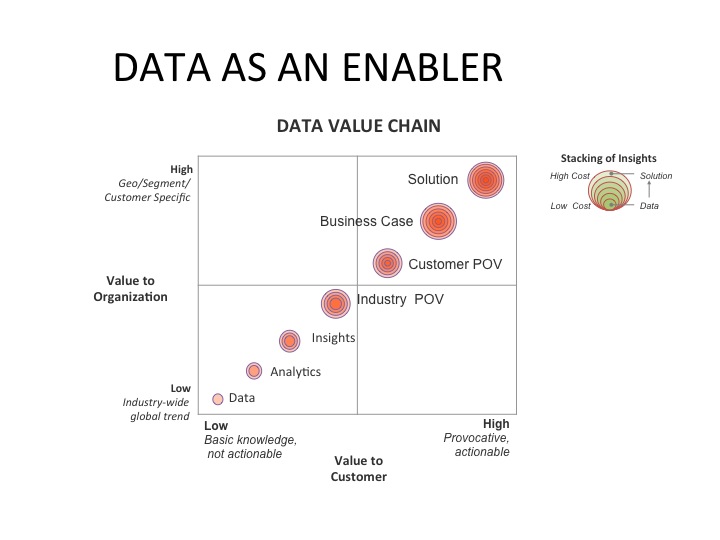

To begin to solve this complex problem we created a “data value chain” (see below). The starting point was having one centralized source for data. As we discovered, as data flows from across the organization to the customer, enhancements were needed to make it more valuable, like growth rings on a tree.

As data became more customized, and localized, it grew more valuable. This helped to identify why, for example, research that was being produced at corporate was not often used by the sales teams…it lacked relevancy, especially in regions outside of the US.

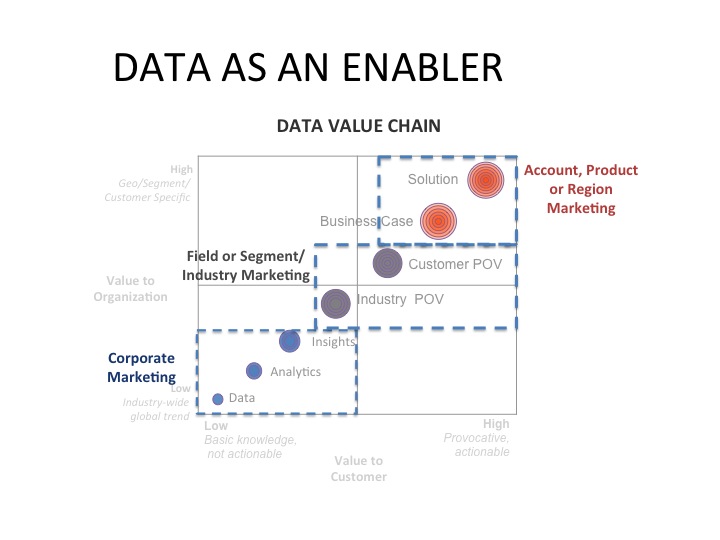

Once we got everyone on the same page the next challenge was to align the various groups in the organization across the value chain. We learned there could be as many as five different groups involved in handoffs as the data moved across the value chain. This help to explain why product groups were developing solutions without market insights, and regions were not leveraging corporate insights for business development.

As a result, we had to design process maps, hand-off points, engagement process, etc. The elephant in the room, and one of the biggest challenges was wrestling with the budget. The solution for that last huddle was turned out to be pretty simple.

The corporate “insights” team would work with those regions that wanted to work with corporate. Those regions had to be willing to fund resources to finish the “last mile”…building a solution or a customer business cases with a defined solution in mind. Even though everyone wanted more relevant insight, and more defined points of view, not all regions were willing to pay for it. Finally, to secure the funding to make the fixes we had to be able to answer a very simple question; “how does being more data driven provide value to the organization?”

The answer was getting the data closer to revenue or a sale….”turning data into dollars.” The epiphany wasn’t that the value was found at the end of the chain but the number of groups, and the coordination needed to be involved to reach that destination.