by scott.gillum | Jul 19, 2012 | 2009, Marketing

My inbox is full of resumes of good marketers that I’ve been fortunate to come to know or work with over the years. Solid people, with great experience who are now having a challenging time finding new opportunities in this incredibly difficult economic environment. Many of these people could have had their pick of jobs as recently as last year. Given the situation, I thought I’d try to help by providing a viewpoint on what skills set, background and experience companies will be seeking once they start hiring again. I’ll use two data sources to make the case.

A few years ago, we teamed up with a professor (

John Josephs)at

Kellogg on a couple of research projects aimed at getting a better understand of what creates a high performance marketing organizations. Internally, we thought of it as the “head” and “body” studies because we first studied the marketing organization (

the body) and then the follow year CMO’s (

the head).

We surveyed not only CMO’s and marketers, but also CEO’s, about their views on what makes marketing effective. The research was then published by the

CMO Council. Here are a few things we discovered along the way.

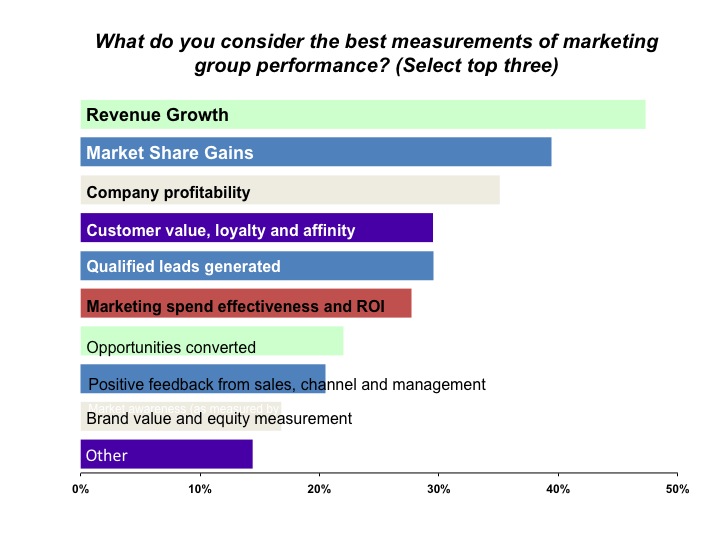

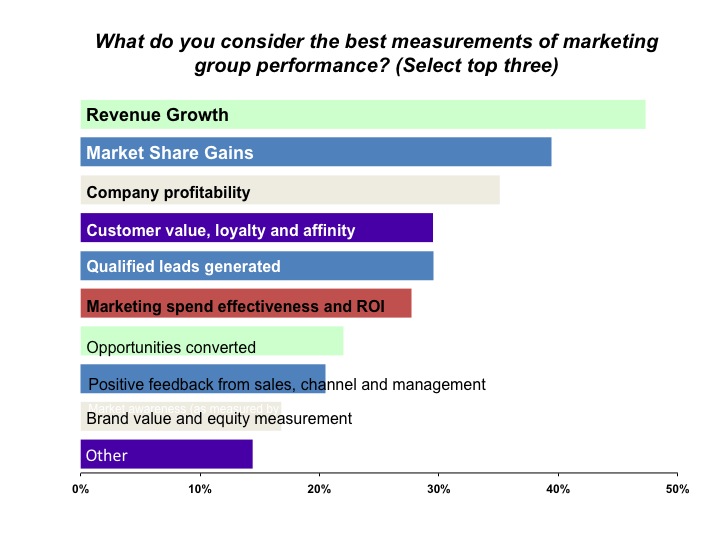

CEO’s view on how to measure marketings performance

How CEO View Marketing Value and Performance

This information is a few years old now, but I can tell you that based on client work that the down turn has done nothing to change this, if anything, it has placed greater importance on the top 3-4 responses. Keep the top responses on these charts in mind as we move to the next section.

Last month, I was given access to a database of senior level marketers (SVP and up) to do some analysis for the organization that owns it. We looked at the background and experience of over 800 marketers with the following titles:

- 50% were CMO’s

- 32% EVP’s of Marketing

- 8% SVP’s of Marketing

- And interestingly enough 10% had CEO titles but had recently been the head of marketing

They came from large, medium and small companies including start ups:

- 25% – Large (over $500M)

- 32% – Medium ($100-$500M)

- 23% – Small ($50-$100M)

- 22% – Start up or under $50K

We were interested in assessing their area of expertise, experience and tenure.

Although executives with Product Management and Sales Enablement/Demand Gen experience represent only 27% of the total group, they represented a disproportionate amount of executives with the longest tenure. In fact, they were twice as likely (as a representative percentage) to be in the 2-5 years tenure category than those with Brand, Advertising and Corp Comm backgrounds. And they made up half of the individuals in the more than 5 year category.

Another interesting thing we picked up is that markerters in the NYC area were more likely to be new in role versus other regions (higher than average churn…probably attributed to a higher supply of talent).

Spencer Stuart has for many years reported CMO tenure rates (less than the life of a gold fish) but I’ve never seen them look at tenure by background…which makes a difference based on our assessment.

Finally, let’s look at Supply & Demand.

The Top 20 Advertisers in the US have been decimated. Think about…half of the Top 10 advertisers in 2007 were automobile manufactures. As a result, agencies have put hordes of people on the street.GDP in Q4 2008 is estimated to have declined by 6.2% from Q3 that declined by 0.5%. Revenues are down on average of 30-40% from the prior year in most firms (at least the ones we work with).

As a result, there are a slew of marketers with advertising, branding, and corporate comm backgrounds (73% of the database that we analyzed) in the market.

Let’s put it all together:

- CEO’s measure marketing effectiveness by revenue growth and market share

- CMO’s see the greatest need for new talent being driven by the integration of sales & marketing

- A large supply of “above the line” marketers exist in the marketplace

Conclusion– potentially high demand and a low supply of marketers who can drive revenue. The marketers that will be in the highest demand coming out of the recession will be the ones who have been aligned or have had direct responsibility for growing revenue. Marketers that can speak the language of sales. Unfortunately, it will be a slow process for folks with a Brand PR and Corp Comm or the Ex-Agency/Media guys.Marketers with backgrounds in Product Management/Marketing who have owned a P&L, folks with sales backgrounds and/or marketers who can show that they can drive revenue/growth will be in demand first.

The challenge for the other groups is that of supply. It’s not to say that good Brand and Agency folks won’t find positions it’s that it’s going to be hard. Expect that you will be competiting with many other qualified candidates and it may be difficult to differentiate yourself.

by scott.gillum | Jul 14, 2012 | 2007, Marketing

Original Post Date April 23, 2007

The Define & Align the CMO report is avaliable to today after 2 years in the making. The report actually turned out to be more interesting than we orignal thought based on our working hypothesis.

The year-long research by the CMO Council and MarketBridge encompassed qualitative and quantitative interviews with CMOs, CEOs, board members, senior marketers and executive recruiters throughout North America. The 80-page report, priced at $295, along with a complimentary executive abstract, is available for download at http://www.cmocouncil.org/.

Here’s a teaser of some the insights coming out of the research:

- Confusion over the role – the casualty rate of Chief Marketing Officers can be reduced if CEOs and boards better understood the role, requirements and value of a CMO and empowered the right individuals to architect all aspects of a company’s operations around the customer experience.

- “A Fixer Upper” – the report points out that title inflation, unrealistic expectations, flawed hiring practices, talent deficiencies, and lack of requisite business and strategic leadership skills are big contributors to the limited shelf life of CMOs. The research also points to the fact that 50 percent of executive searches are to replace incumbent CMOs who are primarily hired to fix broken marketing organizations, not drive business value.

- R-E-S-P-E-C-T – the study uncovers startling contradictions in upper management: most executives consider the CMO a valued member of the executive team, yet they also believe many CMOs lack the background and skills needed to be a top managementplayer – a challenge numerous senior marketers share with their CIO counterparts at many companies. Additionally, in a sharp commentary on the connection between strategic value and performance, most CMOs involved in top-level decision-making get high marks from their CEOs for their overall performance, while those CMOs who remain in tactical mode get significantly lower grades.

- Show me the Money! – nearly three-quarters of the C-suite executives surveyed consider the marketing organization “highly influential and strategic in the enterprise.” At the same time, nearly two-thirds also say their top marketers don’t provide adequate evidence of ROI with which to gauge marketing’s true performance.

- Getting a Grade – In a clear sign of the strategic role played by marketing executives, nearly 70% of the CMO respondents to this study report directly to their CEO. However, only 40% of that number get an A grade for their performance from the CEO…most likely the ones who could demonstrate their value! For the most part, CMOs get more respect from the boardroom than from the CEO. Most of the board members surveyed, over 80%, believe that within the next two years, the CMO position will gain greater credibility with the rest of the management team. But in another reality check, less than 20 percent also say that an increasing number of CMOs will rise to the CEO position.

- Longer Tenure – A majority of the recruiters surveyed believe that CMOs have a shorter shelf life than other C-level executives. The average tenure of CMO respondents to this study was 38 months. (In a past report, the search firm Stuart Spencer pegged the number at 23 months). We had a professor from a top business school involved in our research…he’s a data/analytics guru. He was also familiar with the Stuart Spencer report, here’s a dirty little secret…CMO’s your tenure is longer than what SS reports. Don’t believe the hype…they are an executive placement firm.

The research concluded that the most successful CMOs are aggressively instituting rigorous performance measurement and analytics in every aspect of their organizations, and tying those metrics to revenue and profit growth.

by scott.gillum | Jul 12, 2012 | 2006, Marketing

The promise of a “performance-based” contract or a “risk sharing” agreement sounds so appealing on the surface but does it really live up to its lofty billing? Do customers really only “pay for performance”? And/or get what they are paying and if so, what does it take to make that contract work?

The Promise

The concept has been around for many years and has been used successfully in the Public Sector and Health Care industries. Additionally, it has also been a very successful way to sell certain commodity products. More recently it has caught on with companies providing web and tele services.

Research on the prevalence of this pricing model shows that in marketing, online marketing services are dominated by “pay for performance,” especially in the area of search and advertising.

This trend is also carrying over to non-web based lead generation services like teleprospecting. With companies offering performance-based or risk sharing models, it seems like a good business decision when spending precise and sometimes hard to track marketing dollars.

But not so quick! It does sound good on the surface but read on to find out how it can go wrong.

“At Risk” Contracts

I recently had the opportunity to assess an outsourced lead generation program for a Fortune 500 company. The CMO of the organization was frustrated with the performance of the vendor and was close to terminating what had been a relatively successful 5 year relationship. Before that occurred, she asked me to assess the operation and the performance of the vendor, including the new Performance-Based Contract with an “At Risk” clause… recently forced on the vendor.

After visiting the operation and evaluating the program I concluded that:

- the vendor was actually performing exceptionally well given the situation

- the performance-based clause in the contract was causing counter productive business practices,

- the reason the vendor was not hitting their lead targets was actually the client’s fault and not the vendors.

The interesting part of the story that the CMO didn’t realize was that the vendor had 5 years of response data (by campaign, tactic and channel) including lead conversion rates by campaign type. The vendor also had very precise and predictable conversion rates for each stage of the pipeline. It was only a matter of flowing the right volume of responses from campaign activities into the top of the pipeline to create the number of leads needed to meet the target. All very predictable and a perfect set up for a performance-based contract, right?

Except there was one major problem…guess who was supposed to create the responses? That’s right, the CMO’s marketing team.

This tele-qualification program was an inbound group that qualified responses coming from the client’s marketing efforts. Unfortunately, the client was not producing enough response for many reasons: under performing campaigns, inconsistent campaign activity with some months being totally dark, etc.

What is a vendor to do?

They start running their own campaigns to fill the gap because they don’t want to see their fees get hit. Here’s the not so funny part — their marketing campaigns start outperforming those of the client. Ha, Ha …the client is paying the vendor to follow up on their campaigns’, the only problem is that when they do the vendor loses productivity.

The vendor now doesn’t want to follow up on certain campaigns that it knows will be produce less than 10% response rates (because its own programs are producing 14%). Keep in mind the vendor owns 5 years of campaign response rate data it also can predict the lead yield from the client’s campaigns and so it begin to decline to participate in certain campaigns.

The vendor has now turned the tables on the client and is actually holding the client to its own version of a “performance-based” metric for campaigns, except it doesn’t tell the client that and it appears to the client that the vendor is now not only underperforming but also hard to work with because it doesn’t want to do certain things it knows are of low value.

Are you starting to see the mess?

Making it Work

First, create a real partnership with your vendor. Don’t put them in a situation where the performance clause of risking fees is used as a threat. A true “At Risk” model can be very appealing to senior management but may make the day-to-day vendor managers life a living nightmare.

If you decide to create an “At Risk” clause, be willing to add the “At Reward” clause as well. I’ve seen plenty of companies go for the fees at risk but balk at paying for performance that exceed targets. If you’re not willing to pay for the upside then don’t bother with the downside.

Finally, performance-based contracts can be a win for everyone just know that a vendor can’t do it all by themselves. It takes two to dance “the high performance dance” and if you’re not willing to do the “Tango” the dance can turn ugly. You start stepping on toes, tripping over each other and dancing to a different tune. I’m talking real ugly…think Jerry Springer on Dancing with the Stars.

by scott.gillum | Jul 12, 2012 | 2006, Marketing

Once upon a time there was a Prince named CMO and he lived in the magic kingdom of Marketing. The kingdom of Marketing was under attack from the kingdoms of Sales & Finance. The kingdoms were fighting over the “holy grail” of performance and ROI. So the Prince decided that he would build a Marketing Dashboard that would lead him to the Holy Grail.

The Prince commissioned a band of Knights called Consultants to lead the crusade and help him search the world for information. This journey was difficult and exhausted much of the Prince’s fortune but finally, the Knights built the Prince a magnificent and magical Dashboard…and the Prince was happy.

The Prince showed the Kingdoms of Sales & Finance his Dashboard and they were impressed. He told them that he was close to discovering where the Holy Gail of performance and ROI was hidden. Every month the Prince met with his people to talk about the Dashboard, and ogle at its magnificence but then, one day, something happened. The Dashboard started to lose its magic. The Prince and his people could not make it better and it steadily got worse; the Prince and the Kingdom of Marketing were very concerned and unhappy.

The Prince of Sales started to question the magnificence of the Dashboard and the power of Prince CMO. Prince Finance believed that the magic Dashboard was showing him how Prince CMO was squandering the wealth of his people. The Prince was under attack and eventually lost his kingdom.

The moral of the story is that a Dashboard is not the “holy grail” of performance and ROI. CMO’s are under a tremendous amount of pressure to show the organization how they are providing value and producing a positive return on what can be very sizeable investments (3-6% of revenues). CMO’s believe that they need to have the data to prove their case…and they are right. The difficult part is knowing what to do with the data once they have it, and how to move the numbers in the right direction. Although the story above is written as a fairy tale, it is based on a true story.

The most important thing that a CMO can do to improve the performance of marketing is teach/train country marketing managers the basics of pipeline management because it is their results that show up on the Dashboard. Effective pipeline management is built on four key principals:

- Volume – the flow of incoming response, leads, opportunity coming into the pipeline

- Conversion – the percent of opportunity that makes its way from one stage to another

- Cycle Time – the average time it takes for opportunity to move from one stage to the next

- Transaction Size – the average order size of the opportunity closed

If CMO’s can effectively coach their teams on how to manage by these prinicipals then they will have achieve the “Holy Grail”…and they will get to keep their kingdoms.