by scott.gillum | Jun 18, 2018 | 2018, Opinion

The experience of selling our house has been a good reminder of the importance of goodwill in the negotiating process.

We were fortunate to get a couple of offers on our home. Hearing feedback from our neighbors and realtors, we learned that one couple with young children really loved our home, especially the trampoline in the backyard!

As we responded to the offers we made it clear to the realtor of a family with the young children that we really wanted them to have the house. Our children, now in college, were a similar age when we first bought the house. The neighborhood was a great place to raise kids and we thought it would be nice to “complete the circle.”

And that’s when the trouble started. Our counteroffer made it clear that we were negotiating in good faith trying to meet the couple in the “middle.” Except they didn’t. They stood their ground forgoing the traditional comprise an approach to pursuing a “we win, you lose” stance. As an emotionally charged seller, I can confirm that this tactic did not go over well.

The disconnect was that we were selling a home full of memories which we wanted to pass along to another young family. As the buyers, they were just making a purchase decision at the best price as possible. It was a transaction for them. And with that, they took out all of the goodwill.

For example, the family was moving to the area from out of town. We’ve lived in the area for thirty years, 14 years in our current location. There are things that would have been helpful to know about our home, our neighborhood and our community. Our children attended the school their children will mostly attend. Played on the soccer fields, and in the school gyms where their kids will play. Insights from a resident on teachers, coaches, neighbors are usually helpful to someone new to an area.

Because they changed the rules of the game none of that conveyed. The relationship had been killed. Think about that when you’re negotiating a business deal. Deals are made between humans so emotions are involved. In the end, you may get your price but at what cost? What goodwill may have been lost? What could the seller tell you that could help with implementation, use of the product/service, etc.

The secret to a good deal is that both parties feel like they gave up something but that they also got something in return. You may feel good about the short-term gain — but by making the other party the “loser” it might cost you in long run.

by scott.gillum | Nov 21, 2016 | 2016, Sales

Last week Tibor Shanto from Renbor Sales Solutions mentioned in his post that I questioned the value of the sales organization. Given the information shared with us at the CEB Sales and Marketing Roundtable meeting we attended, the question was relevant. He goes on to state that what I was really asking is why are so many sales reps struggling and what could marketing do to help them succeed. If the sales organization struggles, most likely marketers will struggle, and they may be the ones who will get the blame.

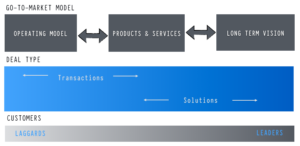

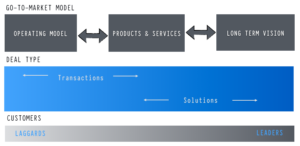

The more I thought about it the more convinced I became that the issue goes beyond sales and marketing, and their ability to correct it. I don’t think marketing can fix what ails sales, and vise versa. To illustrate the issue, I have created a framework that oversimplifies an organization go-to-market model. The core of the GTM model is the operating model, the product and services group and the organizations long-term vision.

Each part of the model plays an important role in determining the success of an organization. Additional detail on each group is contained below.

- Operational Model – the core of the business, how it delivers value to customers. It is also focused on driving efficiency and effectiveness in the delivery model.

- Product/Services – the physical manifestation of the value.

- Vision – how the company articulates their view of the world, now and in the future based on consumer/customer, competitor and market trends and needs.

Marketing develops and articulates the organization’s vision. It should be forward looking (at least three years), and challenge the product organization to “catch up.” It should enable the sales force to sell new solutions, enter new markets and differentiate the organization against competitors.

The product group builds, tests and perfects products, services and solutions that meet the needs of buyers today, and in the future. It should be able to define the market opportunity and the best route to capture it.

The “operating model” should be constantly evaluating those products and services most strategic to the organization (revenue, profit, etc.) and how to scale them. In some of the best organizations I’ve seen, this group enable the “visionary” solution sales reps to sell whatever they want early in a “wave,” as it works to pair down offerings to the few that are the most desired (market demand and/or profitability) As a result, choice, selection and pricing are simplified which helps them scale and enables the sales force to sell efficiently.

Aligning The Sales Organization

Solution Sales team – the solution selling team should be aligned to the front end of the go-to-market model. They have the capability, experience and navigation skills to configure and sell the vision and complex solution, both to internal and external audiences.

Product Specialist and Account Management teams – AM’s or PS’s are aligned to existing accounts and/or products and may be aligned by industry or type of solution. Their goal is to keep and expand the account. Reps that excel in this role are adept at understanding how to navigate the internal workings of the client — how to work the procurement process, position their products/organization against competitors, gain access to new buyers/opportunities, and how to anticipate future needs.

Telesales and Online Portals – the back end of the go-to-market framework where the “operating model” has shifted low margin “simple” products, to align with knowledgeable buyers. Allowing them to make a purchase transaction at the lowest cost and in the most convenient way possible. Sales reps may also dealing with “laggard” first time buyers who come late to a product or solution and have simple requirements.

Marketing’s role across this continuum varies. For the solution sellers, content marketing is critical and as Tibor states “insights built around business objectives.” Marketing has to help the sales organization articulate the organization’s vision (“air cover”) and the value of the product to the buyer, professionally and personally.

So what’s different about the sales model I laid out? Nothing. Does sales need a new model? Maybe, maybe not, but what it needs right now is the organizations commitment to executing the model that I just described. It isn’t throwing more resources and technology at sales, as the CEB research points out. Almost all (98%) of the sales leaders surveyed by CEB had added resources for sales support over the last four years, yet 76% of sales reps said that they have experienced an increase in the complexity of the support they are receiving.

Organizations have to commit to being good at all parts of the go-to-market model. Many of the organizations shortcomings and/or dysfunctional behavior become sales inhibitors. For example, organizations that are operationally efficient often lack the ability to articulate a long-term vision. On the other end, companies that have their heads in the future often miss simple things like scaling down the number of products sold, or simplifying financing terms or compensation plans.

What I took away from the meeting is, in today’s complex business environment, those organization that can simplify buying will win. The problem is that it’s easier to add and feel like you’re making a difference than it is to subtract or reduce and know that you making progress. It’s time to stop feeling like you’re making a difference and start putting a shoulder to making it happen.

by scott.gillum | Feb 28, 2016 | 2016, Marketing

Having a hard time convincing “the powers that be” to invest in the brand? Ever wonder why it’s so hard, why all they want from marketing is leads? Let me explain.

Having a hard time convincing “the powers that be” to invest in the brand? Ever wonder why it’s so hard, why all they want from marketing is leads? Let me explain.

In organically grown companies, an organization develops a product or service and goes to market through a sale channel, either owned or via a partner. At this point, the organization is focused on acquiring customers and generating revenue. With low market awareness the organization typically has more sales capacity than demand for its products or services.

If marketing exists, it’s in its infancy, and plays a tactical role developing sales material, supporting business development activities, and it may have a small social media presence.

To fuel the company’s growth, the management team begins to realize in order to make sales and revenue objectives it has to be able to create demand beyond what the sales channels can generate on its own. As a result, marketing expands beyond its most basic sales enablement role into being responsible for generating leads.

When growth slows and/or begins to plateau, the executive management team will (or should) begin to explore the value of “strategic” marketing. Unfortunately, these strategic marketing activities and investments aimed at broadening awareness of the brand are often misunderstood and/or dismissed all together. Here’s why they shouldn’t be, and why they are critical to unlocking a company’s next phase of growth.

Why it’s so hard getting to “Yes”

The challenge in convincing the organization that marketing can be a strategic growth level is one of perception. Because marketing evolves “bottom up” as I just described, the common perception among executives is that marketing is a “tactical support” function.

The second issue is the messenger. The staffing needs of marketing in its infancy are simple, and usually satisfied by an entry-level hire or someone without a marketing background. Rarely, will this person rise to a senior management level. Achieving senior executive “gravitas” is critical for changing perception among the senior management team, especially if the company has a strong sales and/or product culture.

How to win the battle

To convince executives, you have to tie brand investments back to something “tangible.” Your argument has to show a direct connection to an organizations performance, be it sales, profit or the customer. And, if you can improve your message, you will also improve how your executives view the messenger. Here are three areas to explore.

- A strong/valued brand lifts price point. Are reps constantly complaining about being beaten up on regarding cost/price? A company that has a strong brand can command a price premium. Years ago, I did some work with competitor of Cisco and found that the Cisco brand had a price premium of 7% over the competitors. Why? B2B purchases are high risk, and as a result, are emotionally charged. Buyers that connect personally to brands are willing to pay more for their product if they believe it will reduce the risk of a bad decision. Need proof, click here.

- Improving top of the funnel performance improves the performance of the entire pipeline. Need to increase leads? You have two choices, expand the top of the funnel, or increase conversation rates. The best solution is to do both. By expanding the number of prospects aware of your product you increase the number who will also consider it, which increases the number of opportunities, leads and wins. If you only focus on increasing leads, you’re stuck with improving conversion rates, which may be much more difficult and/or costly.

- Brand building doesn’t mean you need a big budget. The fact is you’re doing it everyday, for better or worse. Every conversation a sales rep has with a prospect creates a brand impression, every unresolved service call to the contact center has the potential to damage the brand. You can make great strides by clearly and consistently communicating what the brand stands for both internally and externally. Once defined, put it into the language of your audience in the simplest terms possible. Complex, “consultant like” words and terms are meaningless. The really smart folks simplify the complex.

Now that you’ve made the argument, it’s time to close the deal. When an executive evaluates a proposal from your company against other competitors, do you know what tips the scale in your favor? No, it’s not price, or the “relationship,” it’s your reputation, your brand. It’s how they feel about your company…and that’s not in your proposal.

by scott.gillum | Oct 29, 2015 | 2015, Sales

My first job out of college was selling office equipment. The first thing I ever learned about selling (from my very Southern sales manger) was that “Telling ain’t selling.” In layman terms, stop telling customers why they need your product and start listening to their needs.

For years this simple phase remained in my memory. It guided me as a way to engage prospects in advisory-like sales dialogue, probing for a need to sell to. But, after attending CEB’s Sales & Marketing Summit last week, where new research highlighted the increased complexity in reaching a purchase decision, I’m now considering rethinking my whole approach.

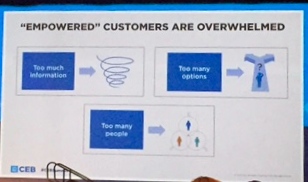

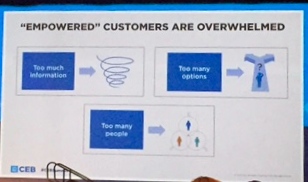

Why? Because buyers have become overwhelmed by the potential choices,  and the involvement of other decision makers in the process, according to Brent Adamson, co-author of The Challenger Customer. Too much information, too many options and too many people involved in the process are making it more difficult than ever to reach a consensus, let alone a purchase decision. Given the complexity, stalled deals are no longer a sales issue; they’re a buying problem.

and the involvement of other decision makers in the process, according to Brent Adamson, co-author of The Challenger Customer. Too much information, too many options and too many people involved in the process are making it more difficult than ever to reach a consensus, let alone a purchase decision. Given the complexity, stalled deals are no longer a sales issue; they’re a buying problem.

The question is: Are marketers contributing to that problem? Is it possible our content marketing efforts, aimed at helping buyers make an informed choice, are becoming part of the “too much” problem? According to Psychologist Barry Schwartz, author of The Paradox of Choice, too much choice often results in no choice at all.

Dr. Schwartz’s research has shown that limiting choice is often necessary to reach a decision, and/or to speed up the buying process. As he said, “When you make choice easier, or more simple, you will sell more.”

For business-to-business sales and marketers, the key is to become “prescriptive,” according to Adamson. Customers need a “trusted advisor” to help guide them through the complexity of the decision making process, in particular in driving a consistent point of view on the problem, and the best solution. Schwartz suggests focusing on the following three areas:

- Be the “expert” or “simplifier.” Help reduce the complexity of the problem, process and/or solution. Smart content should help to explain and simplify solutions to complex problems.

- Create an “anchor.” Help customers understand how to assess the value you offer. Buyers may have a hard time assessing the true value of a new purchase or a new vendor. Help them by giving them context. Find a relatable anchor comparison. Think: ”Platinum service at a standard price.”

- Understand the impact of “no decision.” If no decision is the right decision, then find a way to make it the default answer. This approach is commonly seen in software or subscription-based services where membership/licensing automatically renews.

Do we now dictate to customers/prospects? Not according to Schwartz. Asking probing questions that lead customers to convince themselves that they need your product is the path to goal attainment. Help them understand how your product/service uniquely solves their problem by guiding their path to purchase.

The words of wisdom given to me years ago were right, but given today’s increased complexity it needs an updated “Telling ain’t selling…until it is.”

by scott.gillum | Jan 4, 2015 | 2015

It’s the time of the year to look back over the last 12 months and create a “best of” list. This year I’ve pulled the most popular posts from five different sites; Adage, Business2Community, Forbes, Fortune and LinkedIn. In addition, I’ve thrown in a few other noteworthy nuggets from the year at the end of the post.

Adage – Why Apple Pay Could be Huge, And It’s Not What You Think explored the potential upside of Apple Pay as an advertising platform. It sparked the most conversation, and debate, on Twitter. Time will tell if they this strategy will come to fruition.

Business2Community – 5 Key Tips and Da ta Points to Defend You 2015 Marketing Budget. The last post of the year required the most man hours, and it was the most reposted story of the year. It offers marketers help with their 2015 planning activities in the form of free research and benchmark data.

ta Points to Defend You 2015 Marketing Budget. The last post of the year required the most man hours, and it was the most reposted story of the year. It offers marketers help with their 2015 planning activities in the form of free research and benchmark data.

Forbes -the most popular and shared post of the year, Could Falling Test Scores Be a Good Thing for the US? explores the link between test scores and success in business. It also highlights the risk associated with over emphasizing left brain analytic skill development, outlined by Sir Ken Robinson in his Ted Talk video Do Schools Kill Creativity? The endorsement of Marc Andreessen certainly played a big role in the popularity of the post.

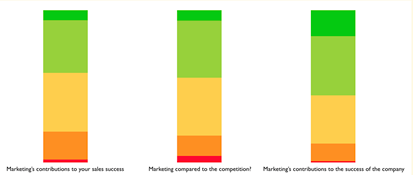

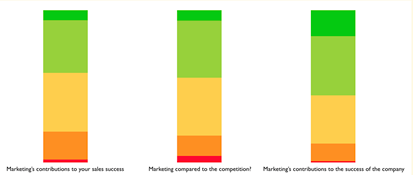

Fortune – Are Marketers Measuring the Right Things was the first post I wrote for our new partnership with Fortune. It profiles the efforts of Ciena, a networking company, to elevate marketings role, and importance, within the organization. The post highlights an unique survey tool used to gather feedback from the sales organization on the performance of marketing (see the dashboard below).

LInkedIn – 2014 marked my first year publishing on LinkedIn. Based on my experience so far, I’m not convince it will viable platform for content unless it becomes better policed. Too much promotional material seems is making its way on to it. At this point, I’m not sure I’ll continue to post.

That said, the most popular post on LinkedIn was also one of the most popular on Adage. The Keys to Differentiating Your Company From Others provides tips on how marketers can humanize their corporate brand to better resonate with audiences. It also identifies one of the common flaws of B2B communication – thinking that what you sell…is who you are. Hopefully, it also helped generated a new client for a follower.

Bonus Stuff

A couple of other noteworthy happenings from the year.

Moving on up.

The Next Generation of Apps Will Be All About You post that ran on Advertising Age was reprinted in the Sept/Oct version of The Portal magazine, a bi-monthly publication produced by the International Association of Movers.

Taking Center Stage

Taking Center Stage

Karen Walker, SVP at Cisco, highlighted my post Everything We Thought We Knew About B2B Marketing is Wrong in her presentation at this year BMA member meeting in Chicago. The post now has close to 70,000 views.

Happy New Year! Here’s to an exciting year to come.

and the involvement of other decision makers in the process, according to

and the involvement of other decision makers in the process, according to  ta Points to Defend You 2015 Marketing Budget

ta Points to Defend You 2015 Marketing Budget