by scott.gillum | Sep 21, 2012 | 2011, Marketing

This post was originally posted on July 8, 2011. It also appeared on Forbes.com

Here’s a hypothesis: Given the greater focus on ROI, marketing automation tools, and enhanced tracking of results, marketing is more of a science than ever. Therefore, marketers’ ability to defend and validate their value among peers should be easier than ever before.

So why does a recent study by Fournaise show that CMOs still lack credibility with CEOs?

The study points to several deficiencies with an emphasis on communication – are you sensing the irony? Further, marketers tend to sabotage themselves in everyday interactions with the larger executive team, and in many cases, have no idea they are doing it.

Here are five common mistakes among marketers:

- Stumble explaining the value of marketing. Asked almost daily, and rarely answered properly. The key is to understand how the inquirer perceives the role of marketing. The question behind the question is “what is the value of marketing … to me?” According to the study, it most often relates to “revenue, sales, EBITA or even market valuation.”

- Limited product, service, and customer knowledge. Even the savviest marketer will arrive DOA in the credibility department if they fall short on this one. And it is not about feature or functionality, but rather customer use and application that matter most and those factors vary by industry and size. Leave “speeds and feeds” to the product organization. Marketing’s job is to differentiate and develop compelling value propositions that sell. If products are built “inside-out,” then bring the “outside-in” perspective.

- Can’t Dance. Marketing comes with highly visible risk and things are going to go wrong. When they do, marketing needs to learn how to dance. Handling these situations will define how marketing is viewed. Keep best and worse case scenarios in mind when briefing the executive team. Truth is, if marketing isn’t making a few strategic and tactical mistakes, it’s not moving fast enough. As a former IBM client told me, “If you fail, and you will, fail fast.”

- Isolation. A favorite question from sales: What have you done for me lately? And the product team can be equally demanding. However, marketing has to build, nurture, and maintain strong relationships with these groups. For Sales, it is helpful to establish an integrated sales pipeline and hold weekly pipeline meetings; this will build rapport and create a common sense of purpose. It’s also an opportunity to put marketing metrics in a sales context. The key to a successful relationship with sales is about communication and performance. For the product group, marketing needs to clearly define points of integration for research, content, and value proposition development. The key to a successful relationship with the product team is about process and integration.

- Where to invest – or cut – an incremental dollar. This question is posed by the CFO at the end of the quarter when numbers are off, and by the CEO who wants to redirect budget. It’s also used as a test. As a holder of discretionary dollars, marketing has to be prepared to answer “where” and “why” along with stating the business impact. In talking about CMOs, 72% of CEOs say, “[marketers] are always asking for more money, but can rarely explain how much incremental business this money will generate.”

To call out the sense of irony, most of these issues are communication related. The same rigor brought to external communication needs to be applied internally:

- Know the audience

- Understand their needs

- Communicate to them in their language.

While the Fournaise study states that executives think in terms of “revenue, sales, and EBITA,” most make judgments based on their emotions. Marketers are advised to use their creativity in delivering the message.

Friedrich Nietzsche said it: “All credibility, all good conscience, all evidence of truth come only from the senses.”

by scott.gillum | Aug 28, 2012 | 2010, Sales

Originally posted on August 11, 2010

Social Relationship Management and Social CRM are terms that are now being thrown around for new technology platforms that are enabling multichannel execution. Companies like Lithium Technologies have created platforms that allow companies to run hosted communities, listen across a variety of social media channels, and manage content to and from social networks in one integrate tool.

While marketing has steadily evolved from “one to many”, to “one to one“, Social CRM is now creating the opportunity for “many to one.” For example, a customer tweets a question about a product (e.g. is it worth the money) on Twitter, a customer advocate brings that comment into the company’s online forum. Customers response to the question by sharing their experiences with the product, those comments (most likely only the positive ones) are then tweeted by the company to promote the product.

The promise of Web 2.0 has always been about customers selling to customers. New Social CRM tools are now enabling that by consolidating platforms. But this has the potential to raise issues over who gets credit for the sale. If the true ROI on social media is revenue, which many research studies are now suggesting, then who should gets credit for a sale closed by a customer advocate?

Customer references and testimonials have always been critical for closing deals. What happens when customer advocates volunteer their support for the brand and/or endorsement of a product? Does marketing get credit for providing platforms for enabling customer advocates? And what about the customer/s who’s comments help push the prospect over the goal line…do they need to be rewarded, and if so?

One thing is certain: social media is blurring the line between sales and marketing interactions and dialogues. Given that, we may have to rethink our traditional views of customer coverage and relationship management. Perhaps in the future, marketing will be responsible for managing customers online relationships, and sales for the offline experience.

Someone call HR and give them the heads up. Territory planning, revenue crediting, roles and responsibilities might need a refresh soon.

by scott.gillum | Aug 7, 2012 | 2010

Original post date August 27, 2010

The amount of “lameness” on the part of some sales people (and some marketers) has now come to a point that I think a public flogging is in order. To those Michael Scott’s of the world (and I like Michael), know that we are on to you. The following tactics have never, and will never, produce a lead.

1. Filling out a company’s contact form on the website with ”contact me if you need…” Yep, I’ll get right on that. (Click on the image below, it may take a moment to build).

Mike, for example, was able to jam an entire spam email onto our company contact me form, impressive. Sure, I will take the time to read the entire message box and get back to you.

But wait, sensing that I might not take him seriously, he submits the form again 2 minutes later.

2. Sending an email blast with the generic intro of “Dear Sir.” Forget everything you’ve learned about 1 to 1 marketing, personalization, relevancy, this just might work. Just get a list, and go.

3. Even better, the telemarketing of version of the “no effort” approach. Cold calling and asking; “can you please tell me who handles…” Instead of you doing your job, you’re now asking me to do it for you — beautiful.

4. Some telemarketers have taken it to a whole new level. Love the folks who leave a message without saying why they are calling, but then ask you to call them back. And my personal favorite — the rep who invented the “I’m returning your call…” It’s like the guy you knew in college that spent hours figuring out how to cheat for a test, instead of using the time to study.

5. Advertising your services in the comment section of a blog. Let’s take Jeff D, he didn’t even try to hide it in a link. He went straight for the kill.

It’s not all bad because he does give me “props” at the end of the ad…”I like your information it is helpful to me.” Mmm, is it helpful because it gives you an opportunity to display spam? Apparently so, because Jeff D comes back 6 days later, this time pimping new services, Website design and development. Notice I get no “props” this time. Pretty tricky changing the name of the company, almost didn’t catch him.

To Jeff D, and all the other spammers, know that bloggers decide whether or not to post your comments. The comments above never made it public, I saved them for my own personal enjoyment, and this blog post. Also, know that Blogspot, as well as other platforms, now have enable spam filters. Good luck on future postings.

6. Posting a discussion within a Linked-in group that isn’t a discussion, but rather, an advertisement for your company…it’s not a discussion; it’s spam, and it’s annoying.

Take Mr. Gupta for example, at Web Box Office. He’s advertising “Learn the secrets to success with attendee-funded webinars.” Sounds good, huh. Guess who’s paying for the webinar…you are, Mr. attendee, if you register.

7. Using the yellow pages as your prospect database. I’m not kidding, people are still using it. Just wait until they find out about the internet.

8. Offering something FREE, unless it is truly FREE. Taking a credit card number so you can start billing a customer after a “free” trial is not free. This is not selling, it’s scamming. There are rules, some people call them laws, governing this practice. See

FreeCredit Report.com for an example of how not to do it.

9. Any email coming from Nigeria, or any other country, offering a fortune if you could just help them by giving them your social security number, bank account number, etc. To good to be true, something for nothing? Any of this ringing a bell? Ok, maybe I’m a little bitter because I’m still waiting for my $1M from the

British Lottery Authority.

10. Actually, couldn’t think of a 10th, but I’m sure there’s one or more out there. I’d love to hear your experiences. Add your “Top 10” story in the comment section, but please easy on the spam. Jeff D takes up a lot of my time.

I know that times are tough, but with the amount of information now available in the public domain, there is just no excuse for these tactics other than…just plain laziness. C’mon guys, kick it up a notch! If not, I’ll be out with the Top 10 sequel or maybe a FREE webinar.

by scott.gillum | Jul 20, 2012 | 2009, Sales

Original post date March 24, 2009

In August 1999, Selling Power magazine ran an article featuring our firm and the work we’ve done helping clients, like IBM, build new sales channels and increase sales productivity. A few months later, we received a call from the head of a division within NCR asking us to meet with them to see if we could help them with something similar.

The senior executive with whom we met said if we could help IBM we should be able to do this project for them. Excited about the prospect of helping them build a new channel, we agreed and they laid out the challenge:

- A well-known consulting firm had been previously engaged but had failed

- …which left only 41 working days to get the new sales channel up and running

- An internal NCR tele organization was competing for this…which, we would later learn, tried to sabotage the effort…and us

- And finally, we were entering the holiday season…good luck

After collecting the previous project work we quickly went to work on assessing what had gone wrong. It took us a while, but we finally discovered “IT”. Once found, this insight became the key to unlocking success.

Almost ten years later I’ve seen this scenario play out over and over in B2B companies. This is what we discovered.

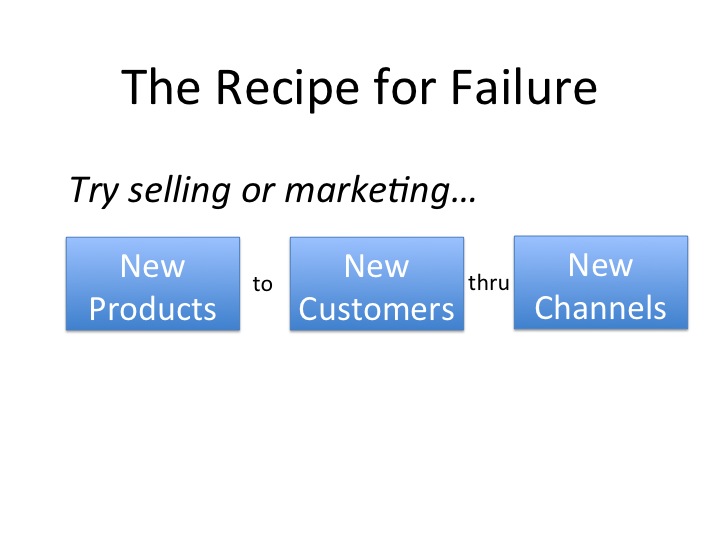

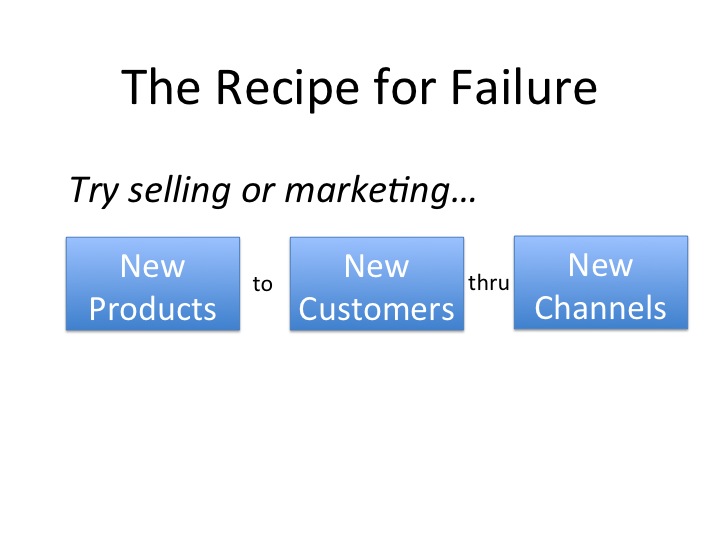

The secret recipe for failure

This simple equation is just as true today as it was a decade ago when we discovered it. Oh, you may find one or two exceptions but the majority of the time when we do post mordem on failed programs you find this equation is at the heart of the problem. When combined with a few related pieces, like a lack of time in the market and/or funding, the initiative is doomed. The degree of “newness” in these three areas will directly impact the likelihood of success or failure.

Sales Channels

- Why they fail – new sales channels fail because companies aim new channels at the wrong targets — new customers/markets. An investment in a new sales channel means that it is competing with existing channels for funding. If it does not hit expectations/goals quickly, it will be robbed of the necessary funding and/or resources needed to make it successful.

- How to improve the chances for success – The most successful way to build a new sale channel is to do exactly the opposite of what is described above. Shift coverage of existing customers or products to the new channel and use your existing channels to go after the “new.” Shift dormant or flat growth customers to the new channel to give it revenue immediately and free up your existing most knowledgeable, best trained sales folks to go after new opportunity.

Marketing Campaigns

- Why they fail – new marketing campaigns promoting new products aimed at new customers typically fail because of reasons listed above…they take too long to produce and/or aren’t given the time. Here’s another common problem, agencies will tell you the problem is the “creative” or “value prop”…maybe, but they also could telling you this because they make money on creative and production. “New” works with their business model.

- How to improve the chances for success – build less individual campaigns and invest more in one or two long term programs with many integrated tactics. Keep the programs in the market longer, closely monitor them and modify tactics based on performance. You don’t need a new campaign every month, you need a program that produces…and with tight budgets this will help you be cost effective/efficient. Years ago we did an assessment of campaign performance at IBM. We found that the highest performing campaigns had at least 7 integrated tactics and stayed in the market for at least 6 months. Use this as a starting point to design your campaigns and programs.

- New to New thru New – level set expectations and invest for the long haul. You will need time and commitment to make it successful. Companies have short-term horizons that are getting shorter every day. If you’re going to lead this effort get everyone to agree on what defines success and stick with your timeline.

- New Product/Service/Solution – try to leverage existing channels, customers or both to start…then migrate to new. This way you can learn if you have the right value prop, messaging, pricing, etc. We like to take existing reps, for example, and use them to help launch a new sales channel, like Tele. We like to use existing customers to test new products, etc.

We got the NCR teleaccount program up and running in 41 days. We transitioned existing field account managers to TeleAccount managers and built their territories around their customers. We then began to backfill them with new lower cost resources over time. You’ll be happy to now that the manager of the group that tried to sabotage the effort got fired.

The program hit our first year sales targets, reduced the expense to revenue ratio from 13% to 6% and grew sales productivity from $1.7M to $3.1M per rep. As a result, NCR then built a full-scale tele channel with close to 80 reps.

Then they killed it. It’s a long story but the bottom line was the company has a strong field sales tradition and culture. Mark Hurd, now CEO of HP, became the CEO of NCR, and decided to shut the channel down, redirecting the resources to the field.

Remember my comment about competing for resources. Mark’s an operations guy and a fan of face to face selling.

Culture runs deep, and can also kill channels and programs. Maybe I should update the “recipe” to include the forth “New”…new leadership.

by scott.gillum | Jul 19, 2012 | 2009, Marketing

My inbox is full of resumes of good marketers that I’ve been fortunate to come to know or work with over the years. Solid people, with great experience who are now having a challenging time finding new opportunities in this incredibly difficult economic environment. Many of these people could have had their pick of jobs as recently as last year. Given the situation, I thought I’d try to help by providing a viewpoint on what skills set, background and experience companies will be seeking once they start hiring again. I’ll use two data sources to make the case.

A few years ago, we teamed up with a professor (

John Josephs)at

Kellogg on a couple of research projects aimed at getting a better understand of what creates a high performance marketing organizations. Internally, we thought of it as the “head” and “body” studies because we first studied the marketing organization (

the body) and then the follow year CMO’s (

the head).

We surveyed not only CMO’s and marketers, but also CEO’s, about their views on what makes marketing effective. The research was then published by the

CMO Council. Here are a few things we discovered along the way.

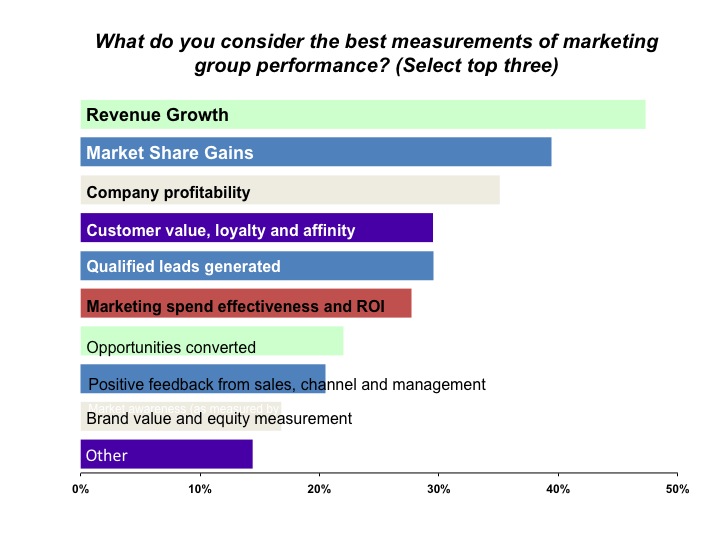

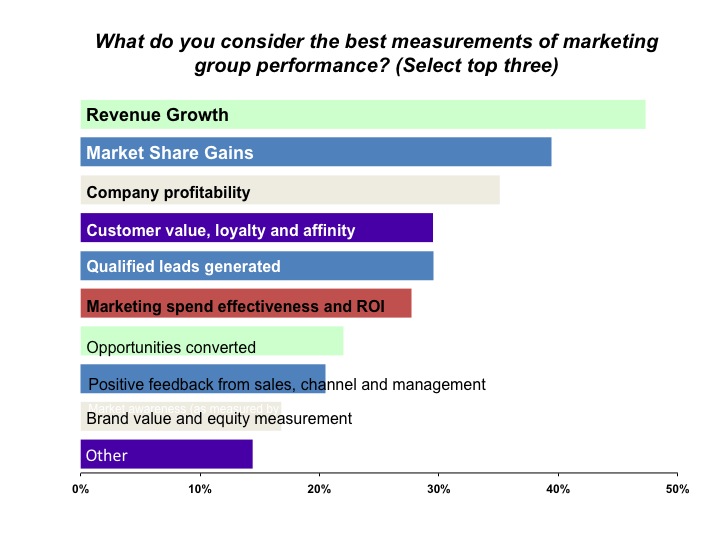

CEO’s view on how to measure marketings performance

How CEO View Marketing Value and Performance

This information is a few years old now, but I can tell you that based on client work that the down turn has done nothing to change this, if anything, it has placed greater importance on the top 3-4 responses. Keep the top responses on these charts in mind as we move to the next section.

Last month, I was given access to a database of senior level marketers (SVP and up) to do some analysis for the organization that owns it. We looked at the background and experience of over 800 marketers with the following titles:

- 50% were CMO’s

- 32% EVP’s of Marketing

- 8% SVP’s of Marketing

- And interestingly enough 10% had CEO titles but had recently been the head of marketing

They came from large, medium and small companies including start ups:

- 25% – Large (over $500M)

- 32% – Medium ($100-$500M)

- 23% – Small ($50-$100M)

- 22% – Start up or under $50K

We were interested in assessing their area of expertise, experience and tenure.

Although executives with Product Management and Sales Enablement/Demand Gen experience represent only 27% of the total group, they represented a disproportionate amount of executives with the longest tenure. In fact, they were twice as likely (as a representative percentage) to be in the 2-5 years tenure category than those with Brand, Advertising and Corp Comm backgrounds. And they made up half of the individuals in the more than 5 year category.

Another interesting thing we picked up is that markerters in the NYC area were more likely to be new in role versus other regions (higher than average churn…probably attributed to a higher supply of talent).

Spencer Stuart has for many years reported CMO tenure rates (less than the life of a gold fish) but I’ve never seen them look at tenure by background…which makes a difference based on our assessment.

Finally, let’s look at Supply & Demand.

The Top 20 Advertisers in the US have been decimated. Think about…half of the Top 10 advertisers in 2007 were automobile manufactures. As a result, agencies have put hordes of people on the street.GDP in Q4 2008 is estimated to have declined by 6.2% from Q3 that declined by 0.5%. Revenues are down on average of 30-40% from the prior year in most firms (at least the ones we work with).

As a result, there are a slew of marketers with advertising, branding, and corporate comm backgrounds (73% of the database that we analyzed) in the market.

Let’s put it all together:

- CEO’s measure marketing effectiveness by revenue growth and market share

- CMO’s see the greatest need for new talent being driven by the integration of sales & marketing

- A large supply of “above the line” marketers exist in the marketplace

Conclusion– potentially high demand and a low supply of marketers who can drive revenue. The marketers that will be in the highest demand coming out of the recession will be the ones who have been aligned or have had direct responsibility for growing revenue. Marketers that can speak the language of sales. Unfortunately, it will be a slow process for folks with a Brand PR and Corp Comm or the Ex-Agency/Media guys.Marketers with backgrounds in Product Management/Marketing who have owned a P&L, folks with sales backgrounds and/or marketers who can show that they can drive revenue/growth will be in demand first.

The challenge for the other groups is that of supply. It’s not to say that good Brand and Agency folks won’t find positions it’s that it’s going to be hard. Expect that you will be competiting with many other qualified candidates and it may be difficult to differentiate yourself.